The many stories of scams we hear, both in the news and from our friends, about dishonest renovation schemes and less than unscrupulous renovation contractors makes us wary of even those who do an honest business.

By: Hitesh Khan/

Home renovation is one of the larger expense items incurred by consumers with the payment of large deposits required even before a project is completed. Yet, unscrupulous contractors who hatch dishonest renovation schemes often get away in Singapore because there is no official regulation for renovation contractors or interior designers here.

What we have in place of proper safeguards from dishonest renovation schemes for home owners is a joint-accreditation scheme for renovation contractors by Consumers Association of Singapore (CASE) and Singapore Renovation Contractors and Material Suppliers Association (RCMA). The joint scheme tries to ensure that consumers are protected against the closure, winding up and/or liquidation of the renovation business through a deposit performance bond that safeguards their deposit payments”.

The threshold to entry to become a renovation contractor is also very low. This means that anyone can register a company (or business), claim to be an interior designer, take up renovation projects, all with the only aim of perpetuating dishonest renovation schemes.

Table of Contents

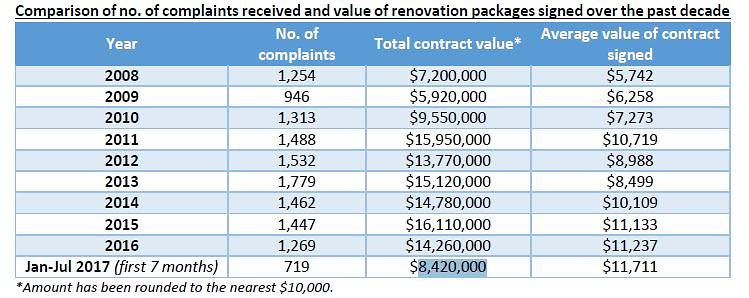

Against this backdrop, home owners are spending more and more on renovating their homes in recent years. Statistics show that over a 10-year period, the total renovation contract value has doubled – from $7,200 in 2008 to over $14,000 in 2017. Many are also paying a larger deposit or full upfront payment, which leaves them vulnerable to dishonest renovation schemes and disputes with contractors.

CASE said that the renovation contractor industry has been in the consumer watchdog’s top 10 list of industries with the highest number of complaints for the past decade.

But all’s not bleak for the homeowners who need renovation works. They can better protect themselves from shady renovation contractors if they follow these tips.

The joint CASE-RCMA accredited scheme is the minimal protection for homeowners who need renovation. The joint scheme requires an accredited renovation contractor to protect a customer’s deposit payment through purchase of a deposit performance bond. This bond will safeguard deposits against closure, winding up and/or liquidation.

The joint scheme will also use a CaseTrust Standard Renovation Contract which will ensure cost transparency and accountability for listed deliverables in a renovation project. This, in most cases, will meet the demands of a modern discerning consumer.

Renovation contractors who qualify to obtain this accreditation will be able to display a CaseTrust-RCMA logo on their shop fronts and marketing materials as an outward sign of their commitment to fair trading.

2. ALWAYS GET A FEW QUOTATIONS TO COMPARE

Even if it is a referral from a family or friend, always double check and request to see other renovation works or ongoing projects of the contractor. And never ever go with the first or only quotation you get for your renovation works. Always get at least 3 quotations from different renovation contractors to check if you are getting the best deal.

The saying, “if it is too good to be true, it probably is” is befitting especially for dishonest renovation schemes by unscrupulous contractors.

Some contractors may not always include items like cost of electrical works, bathroom accessories, curtains, air-conditioners, window-grilles, lighting fixtures, haulage, painting, cement screeding and disposal in the renovation quotation. Some contractors assume that these costs should be covered separately. Others may deliberately leave these items out to make the quotation look cheaper.

Always ask the renovation contractor to make the quotation as comprehensive as possible so that you are comparing ‘apples-to-apples’ with the different quotations you have, and so that you can award the renovation works to the right contractor.

https://www.icompareloan.com/resources/property-valuation-singapore/

3. NEVER PAY THE FULL AMOUNT UPFRONT

Case executive director Loy York Jiun, for example, advocates that consumers should “always negotiate for progressive payment as the work commences, instead of paying in full up front”. A reputable renovation contractor will always provide options for progressive payments for homeowners. If anyone asks you for upfront full payment, even before the commencement of any works and regardless of the size of the works, it should make you very suspicious. It is better that you err on the side of caution with such contractors, no matter how attractive their proposal looks to you.

The following is a good guide for progressive payment to your renovation contractor:

10% – Deposit on signing of renovation contract;

40% – 1st balance payment upon commencement of renovation works;

40% – 2nd balance payment upon completion of 70% of renovation works; and

10% – Last payment should be issued 2 weeks after satisfactory completion of ALL works.

https://www.icompareloan.com/resources/new-hdb-flat-buyers-save-money/

4. NEVER ASK YOUR BANK TO CUT JUST ONE CHEQUE

Most banks and financial institutions in Singapore do offer renovation loan packages and almost all of them will make cheques payable to the renovation firm or contractors as this is a renovation loan. But homeowners should note that terms of conditions differ from bank to bank. It may be time consuming and difficult to compare all the renovation loan packages which are out there. The worst mistake an uninformed homeowner could do is to go with the first loan that is offered.

The best advice for homeowners who need to take loans for their renovation works would be to engage a loans specialist. The loan specialist would be able to match the best renovation loan package that meets the homeowners’ unique financial situation.

Even after you have found a bank which satisfactorily meets your needs for renovation, you should never instruct your bank to cut just one cheque for the renovation works. You should ask them to issue several cheques for progressive disbursement, according to your renovation timetable.

Do you know enough about how property valuation is done in Singapore?

Knowing how to calculate the property valuation is of paramount importance to a home owner. It can help you determine whether you are overpaying for a home, or whether you have gotten yourself a real bargain. Paying the right price is just one way you can avoid overspending on your property.

Another smart way to avoid overspending on your property is to get the right loan. Getting the right loan can be a much simpler task, but only if you get the right person to it for you. Get in touch with iCompareLoan’s loan consultant to help you get the best loan deal at the right price.

The iCompareLoan mortgage brokers can set you up on a path that can get you a home loan in a quick and seamless manner. We are the experts who do the work for you for free, while you lean back, rest and rely on our professionalism at absolutely no cost to you.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.