The Minister for National Development has clarified that the HDB occupancy cap for renting out flats does not apply to family members live in the same HDB unit. The Minister said this in responding to a parliamentary question of whether there is a limit to the number of occupants for HDB’s rental flats; and if the Ministry has plans to introduce basic occupancy standards for these rental flats.

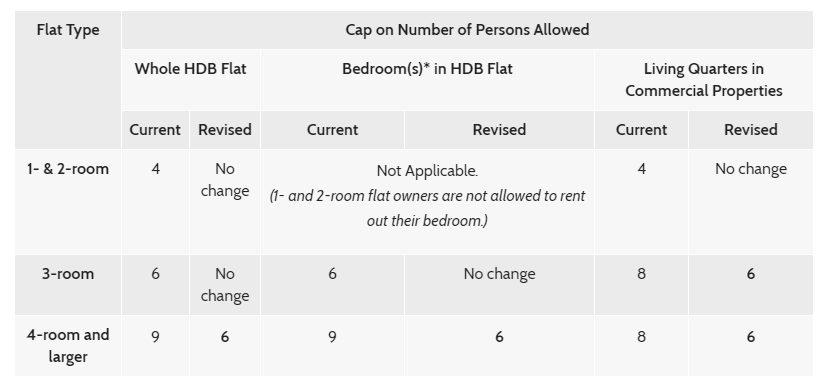

In February 2018, the Housing and Development Board (HDB) announced that from 1 May 2018, the occupancy cap for 4-room and larger HDB flats being rented out will be reduced to six persons, from the current maximum of nine persons.

The HDB occupancy cap for 3-room and smaller flats remains unchanged at 6 persons and 4 persons respectively.

Table of Contents

All flat owners must also obtain HDB’s prior approval before renting out their flats or bedrooms. HDB said that the changes seek to minimise disamenities caused by overcrowding, and to maintain a conducive living environment in our public housing estates.

HDB justified that this was in line with URA’s cap of six persons for private residential properties which are rented out. HDB flat owners renting out their flats or bedrooms to unrelated persons (who are not from the same family unit) will need to adhere to the new occupancy cap of six.

This HDB occupancy cap will also apply to all living quarters of commercial properties that are being rented out. The cap will take effect for all new and renewal applications submitted from 1 May 2018.

* Occupancy includes the flat owners and the occupiers, as well as the tenants

For cases approved before 1 May 2018, the revised HDB occupancy cap will apply upon renewal of the arrangement to rent out or when there are changes in the occupants. New occupants cannot be included if the HDB occupancy cap has been reached.

Currently, flat owners who intend to rent out their flat are required to seek HDB’s approval before the commencement of the tenancy. Flat owners and rental commercial property tenants who intend to rent out their bedroom(s) and living quarters need to register within seven days from the start date of the tenancy. Owners of HDB commercial properties are not required to do so.

https://www.icompareloan.com/resources/new-hdb-flat-buyers-save-money/

From 1 May 2018, all flat owners, as well as all commercial property owners and tenants, will be required to seek HDB’s approval before the commencement of the tenancy. This measure will help ensure that the eligibility conditions are met before the tenancy commences, said HDB.

In responding to the parliamentary question on August 6, the Minister said: “there are no plans to impose a limit on the number of family members who can live in a rental flat or to impose occupancy standards for such flats. We take a similar approach for flats which are sold or rented in the open market, because in the same manner, there is no limit on the number of related persons who can stay together as a family in these units.”

The Minister also answered other questions related to public rental flats and said:

“Public housing first started with HDB blocks comprising 1-, 2-, and 3-room rental flats. Subsequently, as part of the Government’s overall move to encourage Singaporeans towards homeownership, HDB sold existing 3-room rental flats to the sitting tenants, and closed the 3-room rental register in 1982. Hence, when HDB resumed the rental building programme in 2007, only 1- and 2-room flats were built.

The rental rates for these 1- and 2-room public rental flats are heavily subsidised so that they remain accessible to the lower-income households. More than 90% of households in these public rental flats have 4 or fewer persons living together. Larger families who form 2 separate family nucleus, such as grandparents living with parents and children, and need more space may also apply for two separate rental flats.”

In responding to a question of what are the main reasons for the rejection of applications for HDB rental flats; and what are HDB’s projections for new rental flats in the next decade, the Minister added:

“HDB’s public rental flats, which are heavily subsidised, cater to needy citizen households who have no other viable housing options or family support.

The most common reasons for rejecting requests for HDB public rental flats are that applicants have the ability to buy a flat, have family support, or are unable to meet the citizenship requirement. For households who do not meet the eligibility criteria, HDB exercises flexibility based on their individual needs and circumstances.

There are about 60,000 existing HDB rental flats, with another 3,000 units under construction. HDB will continue to monitor the net demand for rental flats, as more rental families have become homeowners, and make adjustments to our rental flat supply as required.”

Public housing first started with HDB blocks comprising 1-, 2-, and 3-room rental flats. Subsequently, as part of the Government’s overall move to encourage Singaporeans towards homeownership, HDB sold existing 3-room rental flats to the sitting tenants, and closed the 3-room rental register in 1982. Hence, when HDB resumed the rental building programme in 2007, only 1- and 2-room flats were built.

https://www.icompareloan.com/resources/sell-hdb-buy-condo-costly-mistakes/

The Minister added: “The rental rates for these 1- and 2-room public rental flats are heavily subsidised so that they remain accessible to the lower-income households. More than 90 per cent of households in these public rental flats have 4 or fewer persons living together. Larger families who form 2 separate family nucleus, such as grandparents living with parents and children, and need more space may also apply for two separate rental flats.”

The Minister further promised to continue to review how best to meet the needs of public rental households, including larger families, as part of the Government’s broader effort to support vulnerable families.

How to Secure a Home Loan Quickly

Are you planning to purchase a HDB flat but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.