90% Car Loan in Singapore – How it works?

Table of Contents

Paul HO (iCompareLoan.com)

In May 26, 2016, MAS relaxes car loan regulations. Car borrowers are now able to borrow up to a higher amount: –

- 60% of Car Price if OMV is above $20,000; up to 7 years.

- 70% of Car Price if OMV is below $20,000; up to 7 years.

This is the traditional car loan scheme from Singapore banks for individuals. However another scheme has appeared at the side where financing is more than the 60% or 70% financing is possible.

Traditional Car Loan: –

- Banks lend you money, you buy car.

- Bank lends you 60% for cars with OMV above $20,000 and up to 7 years, or 70% for cars with OMV less than $20,000 and up to 7 years of loan.

With private hire car scheme: –

- You set up a Private Hire car company

- Banks lend your company money to buy car.

- Company owns the car.

- You are the driver of your company’s car.

Info-graphics 1: Comparing Traditional Car Loan and Private Hire Car Scheme, iCompareLoan.com

Clipart Credits: Openclipart.org

How does private hire Car Financing scheme work?

This is called the Private Hire Car purchasing scheme. Some dealers and financing company out there are offering up to 90% loan up to 10 years tenure for new cars.

What is Private Hire Car Scheme?

It is when a car is used for “private hire” to be used for limousine services to ferry passengers. These passengers must be pre-booked. Private hire car companies and their drivers are not allowed to pick up passengers on the road. So this is the main differentiator between Taxi and Private Hire. You can hail down a Taxi, but you cannot hail down a “Private Hire” car as LTA forbids it.

How to qualify as a Private Hire Car Driver?

To be a qualified Private Hire Car driver, you will first need to be covered by insurance. There are insurance companies that requires 2 years of driving experience and minimum age of 26. Of course the requirement varies from insurer to insurer, some are less strict and allows 1 year of driving and 22 years old.

Get a Car Insurance Quote here.

Generally the stricter requirements are: –

- Minimum age 26.

- Must have class 3/3A Singapore driving license with a minimum of 2 years of driving experience.

- Singaporean or Singapore PR only

- Applicant must be Sole-proprietor of a business with activitity code 49219 (Private cars for hire with operator)

- Vehicle must be classified under Z10 or Z11 (Private hire chauffeur motor car). Z10 refers to saloon cars and Z11 normally refers to station wagon, jeep and land rovers.

Subjected to the following; –

- No street pick-ups allowed

- Background checks

- Medical examination

- Undergo and pass a 10-hour course with a 3-hour refresher every 6 years.

- Demerit points system

- Display of a “Tamper-evident” decal issued by the Land Transport authority.

(Reference 1: New Regulations for Private Hire Car Drivers and vehicles to better protect commuter interests, LTA)

What are the steps to become a Private Hire Vehicle Driver?

- Step 1 – Qualify as a Private Hire car driver

- Step 2 – Register a business with ACRA as a Sole Proprietor using your SINGPASS with business activity 49219.

- Step 3 – Get a Loan with a Bank or in-house finance.

- Step 4 – Register the car under Z10 for cars and Z11 for station wagon, jeeps and land rover.

- Z10 and Z11 is the category of cars for provision of private hire chauffeur service.

- If the Car is previously in a different category, you need to submit a request using your company letter-head, sign and have the company stamp ready.

- Step 5 – Buy a Commercial Insurance. To protect both the passengers and driver should there be any accidents.

- Step 6 – Pay Road Tax. There is no difference in Road tax for vehicles registered under Z10 and Z11 compared to P10 and P11.

That is all, you have registered yourself as a private hire vehicle driver and have set up your own one-man limousine car company.

Steps 4, 5 and 6 are done by car loan company.

Can your family members use the car?

Yes, your family members must also meet the criteria for private hire car drivers (see above). You must also include their name as drivers in the commercial policy, depending on insurer conditions.

There may be differences across different insurer, if in doubt, please check with them.

Can I convert my car to Private Hire Car Scheme?

If you already own a car, you can still convert your car under a Private Hire Car Scheme. However if your car still has outstanding loan, you may need to settle your outstanding car loan before you get a new loan under the sole proprietor company name.

Is this 90% car loan financing under Private Hire Car Scheme legal?

90% car loan financing manages to skirt around the MAS’ car loan rules of 60% loan-to-value for cars with OMV above $20,000 and 70% loan-to-value for cars with OMV below $20,000.

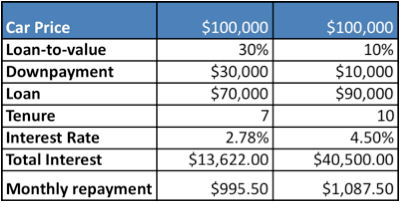

Table 1: 70% Loan versus 90% Loan

For a 70% loan of $70,000 over 7 years, you pay about $995.50 and if you borrow 90% loan of $90,000 over 10 years, you pay about $1087.50 per month.

However not everybody who could not obtain a 70% loan will be having a field day with 80% or 90% loan.

In-house loan companies are very cautious in who they will be granting loans to as they underwrite the risks. So do not expect your loan to be approved by in-house financing just because a bank rejected your application.

Who MUST avoid 90% Car Loan

If you are looking to buy a car that you liked for ages and you cannot afford the down-payment, then you should NOT consider 90% Car Loans. The 90% private hire car loan scheme is not meant to bypass the 60% and 70% car loan rules by the MAS, as they are a different scheme meant for different purposes.

The private car hire scheme is not for encouraging consumption and induce people to take risks to own a car with little down-payment and little installment by stretching your loan up to 10 years. If you are using this scheme just to own a car and do not intend to be in the business of chauffeur-driven cars, you should not get 90% car loan.

Some of you who are looking to do some chauffeured services along with personal use to help pay for the car. If you are not disciplined in your time, you should avoid 90% car loan. You will need to spend considerable time on the road and you may neglect your main job.

Who Can consider 90% Car Loan

If you are looking to start a limousine service as a driver using applications such as Uber, Grab and the rest, then since you are using it as a business, you could consider this type of loan as you are using this car to generate income.

However, you still have to do the sums whether it is worth it to do so.

Who can Consider Converting current Car to Private Hire Scheme?

If you often drive to work and park your car there all the time and only leave when it’s time to knock off. And provided you have parents who are retired, in their 50s or early 60s and do not mind roaming around.

Your parents can do a bit of private hire chauffeured services while you are at work, earn some money, increase their mobility and you can save on parking fees. Afterall, COE runs out whether you use your car a little or a lot.

Find out how to buy a car DIY.

Obtain a car loan to buy your dream car.

References

1: New Regulations for Private Hire Car Drivers and vehicles to better protect commuter interests, LTA)

- lta.gov.sg/apps/news/page.aspx?c=2&id=59c466e2-8eff-46bc-8d60-f13bb00de4b2