First Half (1H) 2020 investment volume 45% lower than 1H 2019 shows Cushman & Wakefield research

- Some opportunistic buys expected in the second half of 2020 may boost investment volume says report.

The 1H 2020 preliminary investment volume amounted to $6.13 billion, 45 per cent lower than the 1H 2019’s volume of $11.24 billion. The second quarter (2Q) 2020 preliminary investment volume amounted to S$3.06 billion, remaining stable from 1Q 2020’s volume of S$3.07 billion. 2Q 2020 saw the return of big ticket commercial deals, resulting in the quarter’s commercial volume surging to S$2.02 billion, more than 10 times that of S$183.4 million in 1Q 2020. This led to the commercial sector accounting for 66 per cent of 2Q’s total volume.

The largest deal of the quarter was Chinese e-commerce giant Alibaba Group buying a 50 per cent stake in AXA Tower in a deal that values the property at S$1.68 billion. Also, Perennial divested its 30 per cent stake in TripleOne Somerset to Shun Tak Holdings for S$155.1 million. Another major commercial deal involved Olayan Group purchasing the retail and banking units of 30 Raffles Place (former Chevron House) for S$315.0 million.

A significant chunk of the 2Q 2020 investment sales was attributed to the merger between Frasers Logistics Trust and Frasers Commercial Trust (via Frasers Logistics Trust acquiring Frasers Commercial Trust), which accounted for S$1.25 billion, or around 41 per cent of the 2Q 2020 total volume.

The hospitality sector remained quiet with no deals, as buyers waited on the side-lines for prices to be revised further downwards. As there is uncertainty over the duration of the crisis and when tourism will return to the prepandemic levels, a significant proportion of hospitality asset owners could be seeking to exit the sector in favour of more stable asset classes, which could lead to some deals in future quarters.

Shaun Poh, Executive Director, Capital Markets, Cushman & Wakefield said “In this post circuit breaker period with the resulting recession, some owners are expected to put up their assets for sale to free up liquidity. Funds with a fixed fund life will also be planning their exits. As past recessions have shown, there are gains to be reaped when investors enter during the period when the market is going through a repricing to find its balance. We are starting to see some market activity around investors sniffing out these opportunities and these might potentially be inked in the later part of the year.”

2Q 2020 & 1H 2020 Preliminary Investment Volume

| Sector | 2Q Volume

(S$ billions) |

1H 2020 Volume

(S$ billions) |

| Residential | 0.31 | 2.33 |

| Commercial | 2.02 | 2.20 |

| Industrial | 0.70 | 1.36 |

| Hospitality | 0.00 | 0.00 |

| Others/Mixed | 0.03 | 0.24 |

| TOTAL | 3.06 | 6.13 |

Source: Cushman & Wakefield Research

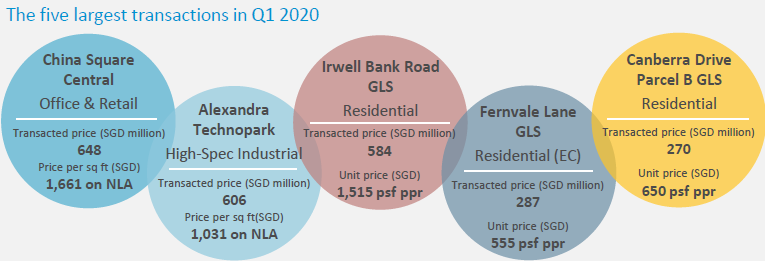

The S$1.25 billion comprised of China Square Central (commercial) at a valuation of S$648.0 million and Alexandra Technopark (industrial) at a valuation of S$606.0 million. This led to the 2Q 2020 industrial volume remaining stable at S$701.3 million, as compared to the Q1 volume of S$661.4 million. Without Alexandra Technopark, the industrial volume would have been just S$95.3 million this quarter.

Due to the absence of government land sales (GLS) sites this quarter, activity in the residential sector was muted with a volume of S$305.4 million, significantly down from S$2.02 billion in the preceding quarter.

Christine Li, Head of Research, Singapore and Southeast Asia said “In the absence of a catalyst, the sluggish market sentiment is expected to continue, with volume in the second half of the year unlikely to increase significantly. The full-year volume is expected to be in the range of S$12-$15 billion. If the merger between CapitaLand Commercial Trust and CapitaLand Mall Trust is approved by unit holders, this would add an additional S$10 billion to the investment tally, raising the full-year volume to a range of S$22-25 billion.”

Another report by Colliers International released in April pointed out that Singapore remains an attractive top investment destination in the longer term. The report said Singapore remains an attractive top investment destination with investment volume growing at an average growth of 5% per annum in over 2019-2024, not withstanding an expected decline in 2020.

Colliers Research projects that Singapore investment volume will grow on average by 5% per annum in longer-term, over 2019-2024 despite a 24% forecasted drop year-on-year (YOY) in 2020 as Singapore’s strong policy response to the coronavirus (COVID-19) pandemic is reinforcing its safe haven status.

Jerome Wright, Senior Director of Capital Markets at Colliers International, said, “The global disruption to economic activity caused by COVID-19 will mean challenging times in the short-term. However, the longer-term fundamentals of the Singapore real estate market remain strong and intact, and we can expect the market to recover as the successful control measures are lifted and industries regain full momentum.”

In the short-term, based on advance estimates from the Ministry of Trade and Industry (MTI), Singapore’s Q1 GDP contracted by -2.2% YOY, and Singapore is experiencing the worst decline since the global financial crisis.

In addition, according to Oxford Economics, as of 24 March 2020, the Singapore economy is forecast to head into its first recession in two decades, putting 2020 growth in the range of -4% to -1%.

Colliers Research also reports some of the largest residential deals were closed during Q1 including five residential public land sales totaling S$1.4 (US$ 1.0) billion and two properties transferred during the Frasers Logistics and Industrial Trust (FLT) – Frasers Commercial Trust (FCOT) merger –China Square Central for S$648 million and Alexandra Technopark for S$606 million.

Tricia Song, Head of Research for Singapore at Colliers International, said, “In the absence of big-tickets deals, the residential sector led the quarter’s total investment volume for the first time since Q3 2018 at 51%. Developers’ sentiment is still cautious, judging from the relatively robust number of bidders but subdued bid prices during the land tenders.”