Prompt loan payments in the construction sector recorded the highest quarter-on-quarter increase in slow payments according to Singapore Commercial Credit Bureau

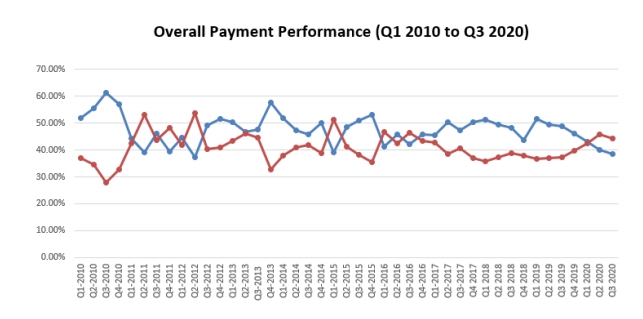

Local payment performance has deteriorated further in Q3 2020 although some slight improvements were seen across certain sectors. According to Singapore Commercial Credit Bureau (SCCB), prompt payment accounted for less than two-fifths of total payment transactions while slow payment accounted for more than two-fifths of total payment transactions.

Established in 2005, Singapore Commercial Credit Bureau (SCCB) operates a database of local enterprises and their credit history to provide clients with the insight needed to build trust and improve the quality of business relationships with their customers, suppliers and business partners. SCCB operates under D&B Singapore.

D&B Singapore compiled the figures for its report by monitoring more than 1.6 million payment transactions of firms operating through its Singapore Commercial Credit Bureau (SCCB). Payment data is contributed to the Bureau by local firms. Prompt payment refers to when 90% or more of total bills are paid within the agreed payment terms.

Slow payments refers to when less than 50% of total bills are paid within the agreed terms. Partial payment refers to when between 50% and 90% of total bills are paid within the agreed payment terms.

On a quarter-on-quarter (q-o-q) basis, prompt loan payments have declined to a new low, down by 1.70 percentage points from 40.09 per cent in Q2 2020 to 38.39 per cent in Q3 2020.

Year-on-year (y-o-y), prompt loan payments dropped significantly by 10.42 percentage points from 48.81 per cent in Q3 2019 to 38.39 per cent in Q3 2020.

Slow payments dipped slightly by 1.62 percentage points, from 45.78 per cent in Q2 2020 to 44.16 per cent in Q3 2020. Y-o-y, slow payments climbed by 6.87 percentage points from 45.78 per cent in Q2 2020 to 44.16 per cent in Q3 2020.

Meanwhile, partial payments increased moderately by 3.32 percentage points from 14.13 per cent in Q2 2020 to 17.45 per cent in Q3 2020. Y-o-y, partial payments jumped by 3.54 percentage points from 13.91 per cent in Q3 2019 to 17.45 per cent in Q3 2020.

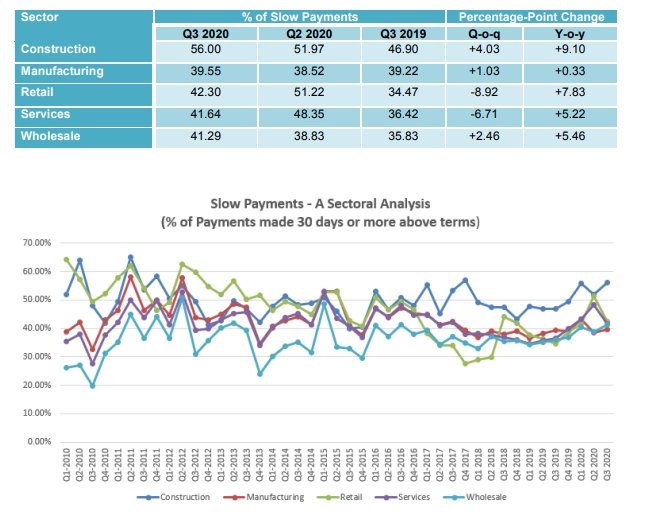

From a sectoral perspective, q-o-q slow payments have deteriorated across 3 out of five industries. The construction sector saw the largest q-o-q increase in payment delays.

Construction

Payment delays within the construction sector jumped visibly in Q3 2020 accounting for more than half of total payment transactions.

- Q-o-q slow payments rose by 4.03 percentage points from 51.97 per cent in Q2 2020 to 56.0 per cent in Q3 2020.

- Special trade contractors saw the largest increase in slow payments, up by 7.50 percentage points from 48.65 per cent in Q2 2020 to 56.15 per cent in Q3 2020. Slow payments within the building construction sector inched upwards by 1.11 percentage points, from 55.54 per cent in Q2 2020 to 56.65 per cent in Q3 2020. Payment delays within the heavy construction sector rose by 2.29 percentage points, up from 52.91 per cent in Q2 2020 to 55.20 per cent in Q3 2020.

- On a y-o-y basis, slow payments rose significantly by 9.10 percentage points from 46.90 per cent in Q3 2019 to 56.0 per cent in Q3 2020.

Manufacturing

Slow payments within the manufacturing sector increased slightly due to a fall in payment delays by manufacturers of textiles, petroleum and coal as well as rubber and plastic products.

- Slow payments inched upwards by 1.03 percentage points from 38.52 per cent in Q2 2020 to 39.55 per cent in Q3 2020.

- Payment delays by manufacturers of textile mill products dropped significantly, down by 10.33 percentage points from 43.59 per cent in Q2 2020 to 33.26 per cent in Q3 2020. This is followed by manufacturers of petroleum and coal, which saw a strong decline by 9.70 percentage points from 39.60 per cent in Q1 2020 to 29.90 per cent in Q2 2020. Payment delays by manufacturers of rubber and plastic products fell by 7.71 percentage points from 37.76 per cent in Q2 2020 to 30.05 per cent in Q3 2020.

- On a y-o-y basis, slow payments increased marginally by 0.33 percentage points from 39.22 per cent in Q3 2019 to 39.55 per cent in Q3 2020.

Retail

The retail sector saw a visible improvement in slow payments compared to the previous quarter. This is largely due to a fall in slow payments by retailers of general merchandise, food and beverage as well apparels and accessories.

- Slow payments fell by 8.92 percentage points from 51.22 per cent in Q2 2020 to 42.30 per cent in Q3 2020.

- Retailers of general merchandise experienced the largest drop in slow payments, down by 9.44 percentage points from 56.94 per cent in Q2 2020 to 47.50 per cent in Q3 2020. This is followed by retailers of food and beverage, down by 7.37 percentage points from 53.17 per cent in Q2 2020 to 45.80 per cent in Q3 2020. Retailers of apparel and accessories saw the third largest decrease in slow payments, down by 5.66 percentage points from 49.46 per cent in Q2 2020 to 43.80 per cent in Q3 2020.

- On a y-o-y basis, slow payments climbed significantly by 7.83 percentage points from 34.47 per cent in Q3 2019 to 42.30 per cent in Q3 2020.

Services

Slow payments within the services sector has also seen improvements due to a fall in payment delays by personal services, educational services and health services.

- Q-o-q slow payments fell by 6.71 percentage points from 48.35 per cent in Q2 2020 to 41.64 per cent in Q3 2020.

- The personal services sub-sector saw the largest decline in payment delays, down by 16.44 percentage points from 46.65 per cent in Q2 2020 to 30.21 per cent in Q3 2020. This is followed by educational services, down by 6.45 percentage points from 54.16 per cent in Q3 2020 to 47.71 per cent in Q4 2020. The health services sub-sector saw the third largest decrease in slow payments, down by 5.43 percentage points from 48.76 per cent in Q2 2020 to 43.33 per cent in Q3 2020.

- On a y-o-y basis, slow payments rose by 5.22 percentage points from 36.42 per cent in Q3 2019 to 41.64 per cent in Q3 2020.

Wholesale Trade

The wholesale trade sector saw a slight increase in payment delays primarily due to a jump in slow payments by wholesalers of both durable and non-durable goods.

- Q-o-q payment delays rose by 2.46 percentage points from 38.83 per cent in Q2 2020 to 41.29 per cent in Q3 2020.

- Slow payments by wholesalers of durable goods rose visibly by 3.02 percentage points from 38.78 per cent in Q2 2020 to 41.80 per cent in Q3 2020 while payment delays by wholesalers of non-durable goods climbed by 1.88 percentage points from 38.90 per cent in Q2 2020 to 40.78 per cent in Q3 2020.

- On a y-o-y basis, slow payments jumped by 5.46 percentage points from 35.83 per cent in Q2 2020 to 41.29 per cent in Q3 2020.

Commenting on the slow payments hitting several sectors Ms Audrey Chia, D&B Singapore’s Chief Executive Officer., said: “On the overall, the full impact of payment delays is more greatly felt in Q3 compared to the previous quarter as businesses continue to face cashflow woes. The construction sector in particular has seen a significant deterioration due to a temporary halt and series of delays in project completion.”

Partial payments sees increase as prompt loan payments hit all time low

She added, “However, we are seeing more businesses making concerted efforts to fulfill their debt obligations partially. While prompt payments have hit an all-time low, we have also seen an increase in partial payments being made by businesses over the previous quarter. We would expect this trend of staggered payment plans to continue in the coming months.”