Colliers assesses the APAC region and reveals an optimism for a property market rebound in 2021, with 98% of investors planning to expand their portfolios

Key findings from APAC investors surveyed include:

- Property market rebound may see Sydney as the no. 1 location to invest in during 2021

- With property market rebound 74% of investors believe ESG will be a strong factor in their investment decisions in 2021

- Property market rebound will see Office, Logistic/Industrial and Data Centres emerging as the top 3 assets investors are most likely to invest in during 2021

- With property market rebound 55% of investors expect to be net buyers in 2021

- Property market rebound will see 41% of investors expect to be stable in 2021

Colliers International said according to its new Global Capital Markets 2021 Investor Outlook, investors are largely optimistic about a market rebound in 2021. Colliers anticipates a 50 per cent surge in investment activity in the second half of 2021, pointing to a broad-based renewal of confidence in the property market as a result of recent vaccine developments and continued government stimulus.

Colliers International (‘Colliers’) 2021 Global Investor Outlook is an in-depth exploration of investor sentiment, strategies and the forces set to shape global real estate markets. The report draws on two main sources: a comprehensive global survey of real estate investors, and interviews with Colliers Capital Market leaders.

The survey was conducted across the regions of the Americas, EMEA and APAC in November and December 2020, and drew close to 300 respondents. This includes major institutional investors, listed property companies, sovereign wealth funds, private equity funds, family offices and third-party money managers. Interviews with senior Colliers executives were conducted to add context to survey findings and insights based on their interactions with investors on the ground.

Tony Horrell, Head of Global Capital Markets & CEO UK & Ireland, said: “As the new year develops, news around the world of vaccination approvals and roll outs provides hope that control of the COVID-19 pandemic remains in sight. The resilience of our industry is strong, reflected in the fact that global volumes for standing real estate assets expanded by 40% in the latter half of 2020 under very trying circumstances. As we continue to tackle this challenge together, I would like to take this opportunity to remind you that our Capital Markets teams are there for you – to advise, guide and assist you in refining and implementing your real estate strategies for 2021 and beyond.”

Terence Tang, Managing Director, Capital Markets & Investment Services of Asia, said: “Based on our global analysis, which gives us a bird’s-eye view of investors’ interests and expected appetite, longer-term tailwinds in the property sector remain intact. With a massive volume of equity raised globally and the need for real assets, investors are eager to deploy pent-up capital and pursue opportunities during the year,” said Tony Horrell, Head of Capital Markets | Global at Colliers International. “We expect to see movement up the risk curve this year, with investors exploring all types of assets from senior care homes to public infrastructure projects.”

“Grade A offices in gateway cities like Sydney, Melbourne, Singapore and Hong Kong SAR are a key area of focus for regional investors, with COVID-19 seen as likely to accelerate a shift towards higher-quality assets that meet rising demand for health and sustainability. Due to the growth of tech companies and start-ups in the region, there is also a high demand for technology-related real estate including business parks.”

“In Australia, with a superannuation fund scheme that needs to be invested, the market is not big enough, so some of that money will go overseas, while we also get a lot of attention from global investors because of our stability and handling of COVID-19,” said John Marasco, Managing Director, Capital Markets & Investment Services | Australia & New Zealand. “We are seeing more movement into alternatives, and more co-investment, where foreign investors are partnering with local managers.”

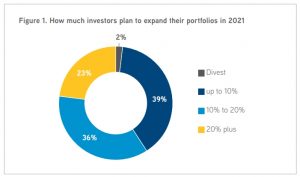

The report, which drew nearly 300 respondents including major institutional investors, listed property companies, sovereign wealth funds, private equity funds, family offices and third-party money managers, indicates 98 per cent of investors across all regions aim to expand their portfolios, with approximately 60 per cent looking to expand by more than 10 per cent.

With investors sitting on substantial amounts of dry powder and looking to make up for lost ground, Colliers expects total investment activity to increase by up to 50% in 2021. Our Global Investor survey results highlight that 98% of investors across all regions aim to expand their portfolios this year, with around 60% looking to expand by more than 10%, including 23% who want to expand by 20% or more

With investors sitting on substantial amounts of dry powder and looking to make up for lost ground, Colliers expects total investment activity to increase by up to 50% in 2021. Our Global Investor survey results highlight that 98% of investors across all regions aim to expand their portfolios this year, with around 60% looking to expand by more than 10%, including 23% who want to expand by 20% or more

Additional key takeaways from the Colliers Global Capital Markets 2021 Investor Outlook report include:

- Top-tier city offices remain a primary asset target. Investors with international capital find the scale and liquidity of the office sector in major commercial hubs such as New York, London and Sydney appealing. Having office assets that meet health, sustainability and technical benchmarks is important to investors.

- Logistics and residential sectors are thriving. Both sectors were among investors’ top three choices across all regions. Intense demand for these assets will require investors to broaden their geographic focus and build portfolios through joint venture platforms and local partnerships.

- Opportunities to repurpose discounted retail and hospitality assets. Investors are expecting to see pricing discounts of over 20 per cent in these sectors. They represent a rare opportunity to acquire distressed assets for ambitious repurposing initiatives.

- Alternatives, platforms and partnerships are playing a bigger part. Rising demand for alternative real estate such as data centres, senior living and life science assets reflects broader structural shifts amplified by COVID-19.