Basic Mortgage Loan Facts You Must Know

By iCompareLoan Editorial Team

If you are a complete greenhorn to Singapore home loans, this article hopes to educate you about some basic facts you should know before shopping for a loan.

Interest rate

Table of Contents

Two terminology that you may come across when interest rates are mentioned are the 1) X-month before SIBOR or SOR, and 2) Spread.

1. X-month before SIBOR or SOR

SIBOR (Singapore Interbank Offered Rate) and SOR (Singapore Swap Offer Rate) come in 1-month, 3-month, 6-month, 9-month and 12- month tenure. These represent the tenure in which banks borrow from each another or the tenure of borrowing S$ via a swap out of US$.

2. Spread

The margin that the financing institutions adds to the loan is the spread. In an interest rate, you see this as the percentage points added to SIBOR or SOR. For example, for an interest rate of 3-month SIBOR + 1%, the +1% is the spread.

Fixed-rate versus variable (floating)-rate loan

Among the different types of home loans available, fixed-rate and variable (floating)-rate loans are the two most widely used ones. To read more about the others, go here.

Fixed-rate loans only have its interest rates fixed for the first 3 to 5 years of the loan tenure. There are no perpetual fixed-rate packages available in Singapore.

So this makes the HDB (Housing Development Board) concessionary loan the few housing loans which rates can be fixed for long periods because it is pegged to the rate of of the CPF Ordinary Account. From time to time, some banks may also introduce packages with interest rates bench-marked against the rate of the CPF Ordinary Account, making interest rates on such mortgages stable. You can read more about the pros and cons of HDB loans in “Explaining the Advantages of HDB Loans versus Bank Loans” and “A Quick Look at the Drawbacks of HDB Loans”.

In contrast, variable (floating)-rate loans have interest rates that fluctuate during the entire loan duration. The fluctuations are due to the changes in the Board Rate, SIBOR or SOR, which the interest rates are pegged to.

Generally, people opt for fixed- rate loans because of the monthly repayment stability which the package offers during the fixed period. This facilitates their cash flow management.

However, there is no free lunch.

This certainty comes at a higher cost in the form of higher interest compared to a variable-rate loan.This is because banks need to be compensated for keeping borrowing costs (ie. Interest rate) unchanged when overall borrowing may have become more costly.

SIBOR versus SOR

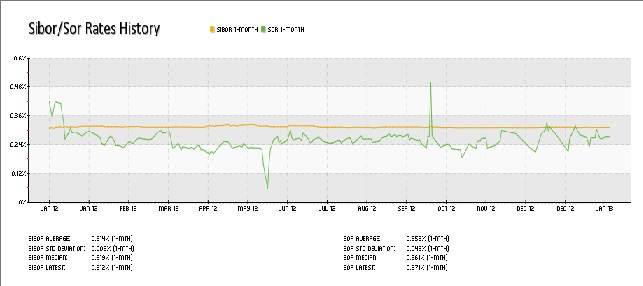

SOR is more volatile than SIBOR. As evident from Figure 1.

Figure 1: 3-Month SIBOR and SOR for Jan 2007- Jan 2013

Source: www.iCompareLoan.com

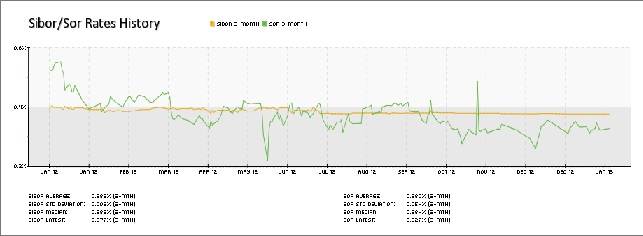

But the fluctuation of SOR can be above or below SIBOR. SOR does not always move above (below) SIBOR during a high (low) interest rate environment. This is seen in Figure 2 and Figure 3.

Figure 2: 1-Month SIBOR and SOR for Jan 2012- Jan 2013

Source: www.iCompareLoan.com

Figure 3: 3-Month SIBOR and SOR for Jan 2012- Jan 2013

Source: www.iCompareLoan.com

Thus it is difficult to predict whether you will enjoy lower interest with a SIBOR or SOR- pegged loan. It may well be wiser to focus on the spread instead.

However, a SIBOR-pegged loan will be more suited to the risk-averse borrower as it provides greater stability.

The relation between interest rate level and stability is also determined by the tenure of the SIBOR or SOR.

Generally, the longer the tenure of the SIBOR or SOR the higher it is, but it remains unchanged during the tenure.

For instance, a 1-month and 12-month SIBOR can be 0.3% and 0.5% respectively; but the former is revised every 1 or 3 months (varies with each bank), whereas the latter is the same for 12 months.

Due to the interplay of factors and trade-offs, the choice between a SIBOR or SOR-pegged loan becomes complex, it may be more straightforward to just seek the advice of mortgage consultants, like those at www.iCompareLoan.com. Simply contact us at loans@PropertyBuyer.com.sg (or here), for a FREE consultation.

Or if you prefer to be independent, you can refer to our other article: “Understanding SIBOR and SOR Based Home Loans in Singapore”.

Credit cards and borrowing quantum

That supposedly innocuous plastic that you carry around -which is meant to facilitate payment and ease your cash-flow – can well cause you dear when you apply for a housing loan. This is because having credit cards reduce your overall loan borrowing quantum even if you do not owe a single cent on them. To gain a clearer picture of the factors that can affect the approval for your loan, have a look at “Tips to Make Your Mortgage Financing a Breeze”.

Lawyers or bankers recommended by property agents

Be aware that some agents earn a commission when they refer you to lawyers or bankers. Therefore, these professionals may not be the best persons to meet your needs. It is possible too that the lawyer may overcharge you to make up for the commission he has to pay the agent. The recommended banker also may not carry the loan package most suited to your financial risk profile.

For advice on a new home loan.

For refinancing advice.

Download this article here.