The Farrer Park Company partners UOB on Singapore’s first green loan for a healthcare facility

- Issued under the UOB Real Estate Sustainable Finance Framework, the S$120 million green loan is a first for The Farrer Park Company

The Farrer Park Company Pte Ltd has obtained a S$120 million green loan from United Overseas Bank Limited (UOB), the first such loan for a healthcare facility in Singapore. The loan is issued under the UOB Real Estate Sustainable Finance Framework and will be used to re-finance Connexion, Singapore’s first integrated healthcare and hospitality complex which houses the Farrer Park Medical Centre, Farrer Park Hospital and One Farrer Hotel.

The Farrer Park Company is a Singapore-based company headquartered at Connexion, an integrated building that houses Farrer Park Hospital, Farrer Park Medical Centre and One Farrer Hotel.

Table of Contents

It was founded in 2011 by a group of medical and hospitality specialists. The Company’s healthcare arm, Farrer Park Hospital and Farrer Park Medical Centre, is home to suites of specialist clinics with over 200 medical specialists and medical technology such as nuclear medicine and radiology services to support a wide range of surgical specialties in cardiology, astroenterology, oncology and orthopedic.

Designed by healthcare professionals and built above an underground train station for the convenience of their patients and visitors, the hospital’s carefully created environment is here to enable a modern yet holistic care for all its patients. The hospital shares numerous calming gardens and inspiring art works with One Farrer Hotel. Synergies between the hospital and hotel provide families and visitors with enhanced experiences in food and beverage, choices of accommodation, lifestyle programs and conference facilities.

The Connexion building has been awarded Green Mark Platinum since 2011, a testament of the Company’s commitment to making a positive difference in the environment through eco-friendly energy and water management system.

The loan supports The Farrer Park Company’s continued efforts in ensuring that it is environmentally responsible in its operations. One of the features already implemented in Connexion’s design is the use of lowemissivity glass to reflect heat and to keep cool air within its premises for more efficient energy consumption. Connexion’s management also actively monitors energy and water consumption and pursues opportunities to lower its carbon footprint.

Connexion has been certified as a Green Mark Platinum building by the Singapore Building and Construction Authority (BCA) since 2011, the highest distinction in the green building rating system. To be recognised and re-certified as a Green Mark Platinum building, Connexion needs to meet a list of performance metrics, including achieving at least 30 per cent in energy savings as compared with developments of a similar size.

Dr Peng Chung Mien, Chief Executive Officer of The Farrer Park Company, said, “Environmental sustainability has been in our DNA since our inception. Our goal to make a positive difference in the environment and society remains unchanged today. Becoming the first healthcare building to receive the green loan underscores our commitment to reduce our carbon footprint and prove how sustainability can go hand in hand with design, quality and service.”

Mr Leong Yung Chee, Head of Corporate Banking Singapore, UOB, said, “To help more of our clients access green financing as part of their sustainability goals, we launched the UOB Real Estate Sustainable Finance Framework in October last year. This is the first lending framework for the sector established by a Singapore bank and makes it easier for companies to apply for sustainability-linked or green loans as they do not need to come up with their own sustainable finance framework.

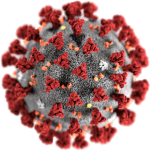

“Through our collaboration with The Farrer Park Company on Singapore’s first green loan for a healthcare facility, we hope to lead the way for more healthcare companies to consider the use of green financing in their sustainability efforts. This will not only support our collective efforts in transitioning towards a lower carbon economy but also encourages companies to consider their environmental, social and governance risks, particularly against the backdrop of the COVID-19 pandemic.”

Green loans such as the first healthcare green loan obtained by Farrer Park Company are aimed at advancing environmental sustainability and until quite recently came under the umbrella of Green Bond Principles.

They now have their own guidelines known as Green Loan Principles (GLP). The green loan market aims to facilitate and support environmentally sustainable economic activity. GLP have been developed by an experienced working party, consisting of representatives from leading financial institutions active in the syndicated loan market, and with a view to promoting the development and integrity of the green loan product.

The green loan market aims to facilitate and support environmentally sustainable economic activity. The Green Loan Principles have been developed by an experienced working party, consisting of representatives from leading financial institutions active in the syndicated loan market, with a view to promoting the development and integrity of the green loan product.

Their aim is to create a high-level framework of market standards and guidelines, providing a consistent methodology for use across the green loan market, whilst allowing the loan product to retain its flexibility, and preserving the integrity of the green loan market while it develops.

The GLP comprise voluntary recommended guidelines, to be applied by market participants on a deal-by-deal basis depending on the underlying characteristics of the transaction, that seek to promote integrity in the development of the green loan market by clarifying the instances in which a loan may be categorised as “green”.