With property cooling measures in Singapore, many property buyers are looking elsewhere outside of Singapore. As we have seen from anecdotal evidence, the presence of many overseas investment property shows that Singaporeans and Singapore based investors buying into overseas property projects.

Some of these property projects offer rental guarantee whilst others are deemed easy to rent out with strong rental demand.

Why are these properties attractive to Singapore based investors?

Table of Contents

Some of the reasons are: –

- Lower price quantum

- Lower regulatory hurdles

- Higher yield

However, are these so called higher yield worth it’s weight in gold?

Let us examine some of these markets. Say for example Thailand, the typical rental yield is about 5% to 6% yield. Many Singapore based investors are attracted by this higher yield compared to their home market.

Now, would you say that let’s all go and invest in thailand? Is this yield good or no good?

As you prepare to buy your first overseas property and start to look for financing options, then you come across various options: –

- Full cash purchase

- Borrow in Singapore for the overseas property

- Borrow locally

The 1st option of Full cash purchase is of course the simplest, but requires people with deep pockets.

Borrowing in Singapore for overseas property would be possible, but the borrowed amount is usually in Singapore dollar equivalent of the required foreign currency borrowing. In other words, you owe the money in Singapore dollars and continue to repay the loan in Singapore dollars. At the same time, you will be subject to Singapore borrowing regulatory regime. Also, you are subjected to currency fluctuation risks.

The last option is to borrow from local banks. This would then be subject to whether the local bank is able to recognise your foreign (Singapore income) as proof of your servicing ability, and how much loan to valuation they are able to loan to you (if at all they can lend you).

How then do you know if these are good investments or not?

For investments, we need to compare apples-to-apples. So for instance if you are investing in Thailand, then you need to consider the rental yield and the borrowing cost in Thailand as if you are based in thailand, versus other investment destinations and potential local cost of borrowing. Hence, it is important to calculate based on Return of invested capital and compare the various investment markets.

For the case of thailand, the gross rental yield is 5.25% to 6.6% (Source: Globalpropertyguide, Dec 2013), but the borrowing cost is 6.51% for the 1st year and even higher on subsequent years (Source: Kasikornbank, Dec 2013).

What does this mean?

For simplicity, let’s say rental yield is 6% on average and borrowing effective interest rates is 6.5%.

This means that, had you borrowed in Thailand for this property, the rental is not even enough to service the interest cost component of your installment.

Illustration of a property investment in Thailand: –

- Property price equivalent to : S$500,000

- Assume 100% borrowing : S$500,000

- Interest rate : 6.5%

- Gross Rental Yield : 6%

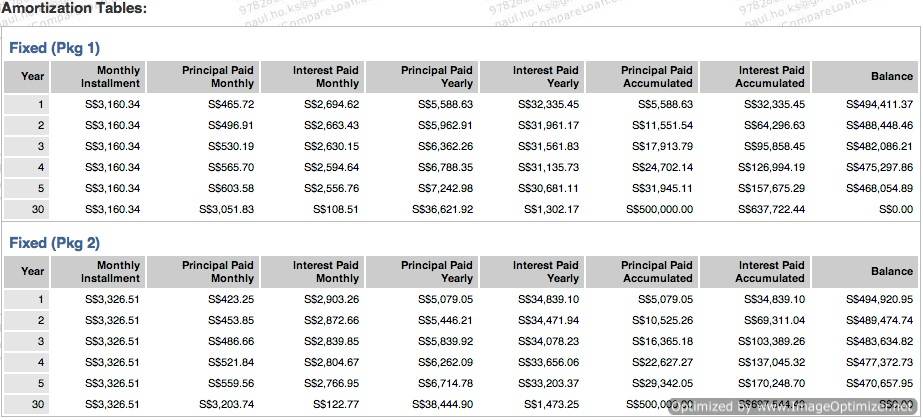

Figure 1: Amortization Table pkg1 = 6.5%, pkg2 = 7%

Source: www.iCompareLoan.com/consultant

Based on a gross rental yield of 6% on $500,000, you would obtain $30,000 annual rental income or $2,500 a month. This gross rental income of $2,500 is not even sufficient to cover the interest cost component of the installment at $2,694.62, let alone covering the entire installment amount.

In other words, your Return on invested Capital (based on 100% borrowing) would yield a negative return. However if you had invested 100% cash (zero borrowings), your return on invested capital would be 6%.

What this means is, based on these average figures, many properties in thailand has no investment appeal if you were to borrow in thailand to invest in such properties for rental yield.

Is it good then to invest in Thailand properties?

This does not mean that it’s not good to invest in thailand, as many people still do so for different reasons. However these property buyers do so using largely cash and some token borrowings.

With bank deposit interest rates so low in Singapore, these investors are participating in exchanging Singapore currency to thai currency and using this thai currency to purchase an asset that yields a thai currency gross return on asset of 6% and a gross return of 6% (if they use 100% cash and zero financing) in thai baht terms. As a reference, Thai deposit savings rates yields about 3.25% as at Dec 2013.

For those with ample cash, this is a form of asset diversification.

In Summary

Hence, as an investor, it is important for you to assess the returns not only based on yield versus yield (across different countries) as they are different and have different base cost of funds conditions. Perhaps you could also consider local borrowing costs. In this case, on the surface, Thailand properties may seem overpriced as there is inadequate rental income to cover even the interest costs of borrowing, or conversely, it could also be that rental rates are currently too low and is lagging the property prices.

Investing away from one’s base country is also a great form of asset diversification.

For advice on a new home loan.

For refinancing advice.

Download this article here.