With the additional buyer stamp duties (ABSD) for developers and purchasers of investment properties introduced last year, the Singapore Government has kept the local property market on a leash says a recent UBS Research

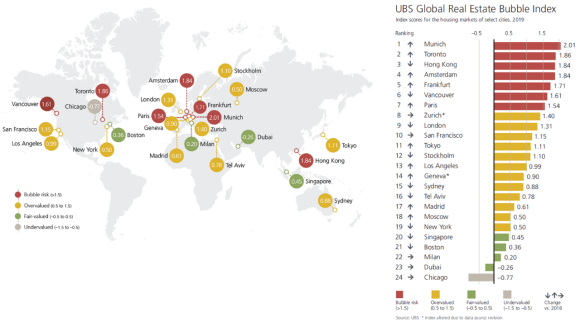

- The UBS Global Real Estate Bubble Index 2019 analyzes residential property prices in 24 major cities around the world.

- The local property market is stable again after prices stagnated with the number of transactions falling.

- The risk of a price correction in the local property market is limited by sound market fundamentals.

The UBS Global Real Estate Bubble Index 2019, a yearly study by UBS Global Wealth Management’s Chief Investment Office, indicates bubble risk or a significant overvaluation of housing markets in half of all evaluated cities.

The report said that over the last four quarters, imbalances have soared particularly in the Eurozone, with Frankfurt and Paris the two most prominent new additions to the bubble risk zone when compared with last year. By contrast, valuations in Vancouver, San Francisco, Stockholm and Sydney have fallen sharply.

London’s property market has cooled down considerably, moving the financial hub out of bubble risk territory for the first time in four years. On the other hand, index scores in New York and Los Angeles are slightly lower than last year while Tokyo and Singapore remain almost unchanged.

The report pointed out that the brief housing boom in the local property market between mid-2017 and mid-2018 is over.

“Prices have stagnated since and the number of transactions fallen. The UBS Global Real Estate Bubble Index score for Singapore remains in the fair-valued zone. The market slowdown is attributable to several factors.

The government is keeping the market on a leash. The additional buyer stamp duties (ABSD) for developers and purchasers of investment properties introduced last year have put a lid on the price upside and curbed speculative demand. Population growth has also declined notably in the past two years. Finally, economic momentum is expected to deteriorate, limiting the willingness to pay. Overall, we expect prices to remain at current levels over the coming few quarters.

However, while regulatory measures still cap price growth expectations, the risk of a price correction is limited by sound market fundamentals, including a declining vacancy rate, good affordability, and a healthy employment market.”

The local property market is one the few among those UBS cover in which private housing affordability has improved in the last 10 years. Current prices are similar to those in 2008 while household incomes have climbed by 20%. Nonetheless, affordability is still stretched. The report noted that it takes 12 annual incomes to buy a 60m2 (650 sqft) apartment on the private market.

<Whether you are looking for a new commercial loan or to refinance and existing one, our brokers can help you get everything right from calculating mortgage repayments, comparing interest rates, all through to securing the final loan. And the good thing is that all our services are free of charge.>

Claudio Saputelli, Head of Real Estate at UBS Global Wealth Management, said: “The worldwide collapse in interest rates will not come to the housing markets’ rescue. Mortgage interest rates in many cities aren’t the major challenge for house buyers anymore. Many households simply lack the funds required to meet the banks’ financing criteria, which we believe poses one of the biggest risks to property values in urban centers.”

Matthias Holzhey, lead author of the study and Head of Swiss Real Estate Investments at UBS Global Wealth Management, said: “Investors should remain cautious when considering housing markets in bubble risk territory. Regulatory measures to curb further appreciation have already triggered market corrections in some of the most overheated cities. Real prices in all four top-ranking cities in the 2016 edition of the UBS Global Real Estate Bubble Index have fallen, for instance. On average they are down by 10% from their respective peaks and we don’t see this trend reversing.”

Owning residential property in global cities has been a sure road to wealth accumulation. However, the absence of economic viability leads to a deterioration in many cities’ attractiveness and favors a shift in jobs to the suburbs. Even though, the underlying factors favoring city properties, including urbanization, the digital revolution and artificial supply constraints, still hold good, real price appreciation can no longer be taken for granted.

<If you are you planning to purchase a residential property but unsure of funding, contact iCompareLoan mortgage brokers as we can set you up on a path that can get you a commercial loan in a quick and seamless manner>

The report noted that in the Asia Pacific Region, the momentum in Hong Kong’s red-hot property market has stalled. The weaker economic outlook has cooled residential buyer sentiment. However, the market remains firmly in bubble risk territory. By the end of the first quarter of 2019, prices in Sydney were 15% lower than at the peak, and credit growth for housing had reached an all-time low. Singapore’s brief housing boom between mid-2017 and mid-2018 is over. Regulatory measures cap price growth expectations and keep the market in fair-valued territory.

In the United States of America, index scores have not risen in any of the cities in the UBS study for the first time since 2011. Regulatory changes and affordability issues have caused home prices in New York to lag the countrywide average. Similarly, affordability issues, trade tensions and diminishing foreign demand have capped price growth in San Francisco and Los Angeles for now. Boston is still in fair value territory and benefits from the appeal of the region for businesses and high income earners. Chicago is undervalued but continues to lag far behind given its increasing fiscal challenges.