Singapore mid sized corporates prioritise value-added solutions and operational agility in post COVID-19 world

- Survey of more than 200 corporate leaders in Asia reveal impact of global pandemic

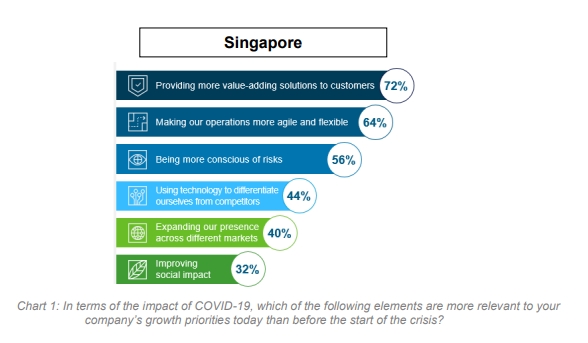

Standard Chartered’s mid-sized corporates pulse survey revealed that medium enterprises in Singapore today prioritise providing value-added solutions to customers (72 per cent), making their operations more agile and flexible (64 per cent), and the need to be more risk-conscious (56 per cent), compared to before the COVID-19 pandemic.

The survey results were released in July. 205 mid sized corporates with an annual revenue USD100m-500m and based in Singapore, Mainland China, Hong Kong, India and Malaysia were surveyed.

Table of Contents

As markets emerge from lockdown restrictions and businesses begin on their road to recovery, 44 per cent of respondents in Singapore identified the need to use technology as a differentiator from competitors.

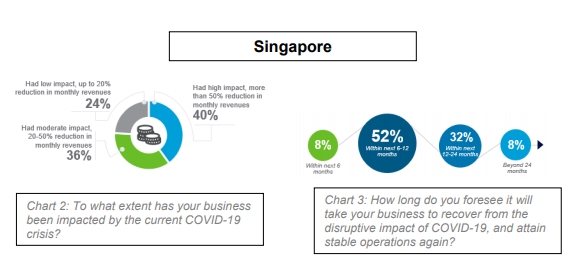

The survey, conducted with decision makers from more than 200 mid sized corporates across Singapore, mainland China, Hong Kong, India, and Malaysia, also highlighted the vulnerability of these businesses due to COVID-19. Some 40 per cent of these corporates in Singapore indicated a reduction in monthly revenues of over 50 per cent. Only 20 per cent of the overall respondent sample said the same.

More than half of the mid sized corporates in Singapore said they foresee that it will take six to 12 months to recover from the disruptive impact of the pandemic and stabilise operations again.

“While mid-sized enterprises tend to be more vulnerable to disruptions than their larger peers, they can leverage their size and agility to pivot and adapt to evolving market needs,” said Goh Beng Kim, Head of Commercial Banking, Singapore, Standard Chartered. “With the appropriate risk management and customised financing strategies, these medium corporates can overcome business challenges and emerge stronger and more resilient from the pandemic.”

To further support mid-sized corporates in their transition towards resilient growth in the post COVID-19 world, Standard Chartered is developing a series of six points-of-view articles that will offer insights anchored around a four-stage framework of immediate response, preservation and stability, preparing for growth and lastly, the goal of maintaining resilience and driving profitability.

These articles will focus on potential issues and challenges faced by mid-sized corporates as reflected from the survey, including regulatory, finance and working capital management, manufacturing and supply chain as well as driving efficiencies through digitalisation.

Beng Kim added: “Building resilience starts from ample preparation. Mid-sized businesses can benefit from first understanding where the challenges and opportunities lie before embarking on the right investments that will help them achieve resilient growth.”

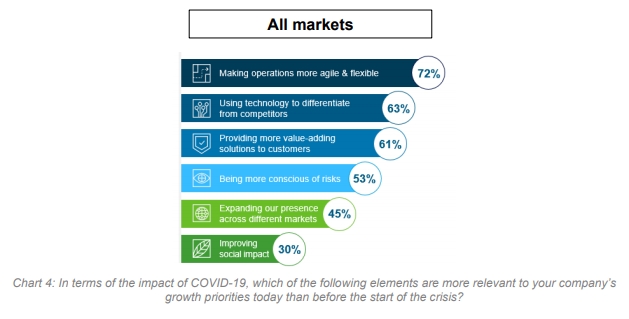

In Asia, mid-sized corporates indicated that making operations more agile and flexible (72 per cent), leveraging technology to differentiate from competitors (63 per cent), providing more valueadded solutions to customers (61 per cent), and being more risk-conscious (53 per cent) are more relevant to their business growth priorities today than before the COVID-19 outbreak.

In another survey, small businesses in Singapore indicated that they were most satisfied with government-led COVID-19 relief measures among their ASEAN peers. In the survey conducted by United Overseas Bank (UOB), Accenture and Dun & Bradstreet, close to three in four (72 per cent) Singapore-based firms surveyed expressed this sentiment, higher than the ASEAN average of 58 per cent.

The survey was conducted among 1,000 small businesses with annual turnover of $20 million and below before and during the COVID-19 pandemic, in the third quarter of 2019 and May 2020 respectively. Small businesses across five ASEAN markets – Indonesia, Malaysia, Singapore, Thailand and Vietnam – were surveyed.

Across the region, Vietnamese small businesses (68 per cent) were the second most satisfied with their government’s relief measures, followed by those in Malaysia (61 per cent), Thailand (47 per cent) and Indonesia (45 per cent).

Given that one in two small businesses across ASEAN are facing cash flow challenges (48 per cent) as a result of the pandemic, the majority of respondents indicated a preference for cash flow-related support from their governments. In Singapore, small businesses felt that wage assistance was the most important government measure (48 per cent) to help them tide over the COVID-19 situation. Next on their list was support for business transformation initiatives (44 per cent) followed by loan assistance (36 per cent). Within ASEAN, small businesses preferred measures that deferred the payment of income tax (50 per cent) and provided loan (46 per cent) and wage assistance (36 per cent).

Small businesses want more digital infrastructure to support their innovation efforts

To support their efforts to strengthen their capabilities, particularly in the area of digitalisation, small businesses in Singapore said more investment in digital infrastructure to support innovation (71 per cent) is vital. Examples of digital infrastructure include national business databases for electronic know-your customer processes and nation-wide networks for electronic invoicing processes. The need for more digital infrastructure was also ranked as the top area of support needed among small businesses across ASEAN (77 per cent).

Other government initiatives that Singapore-based small businesses said would help in the current business environment include funding support (63 per cent) and more education and training programmes to upskill employees, especially older workers (62 per cent).

Mr Paul Ho, chief mortgage officer at iCompareLoan, said: “Regardless of if you are mid sized corporates or small businesses, all enterprises need fluidity and flexibility to survive and grow. The Covid-19 pandemic has stretched many businesses. The Government has helped many businesses to survive in this very harsh times, but the enterprises themselves have to be innovative, dare to use excess cash to expand their business and build capability in the downtime.”

Mr Ho added, “all businesses must remember that they need to borrow money when they don’t need to do so, because when you need it, there may not be many lenders around to give it to you.”