Prompt payments weaken further as more companies making partial payments in 2018

By: Phoenix Lee/

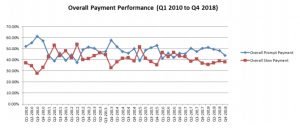

Payment performance of local firms declines for the third consecutive quarter in Q4 2018. According to Singapore Commercial Credit Bureau (SCCB), prompt payments weakened further to nearly two-fifths of total payment transactions while slow payments also accounted for more than one-third of total payment transactions.

https://www.icompareloan.com/resources/sme-loans/

On a quarter-on-quarter (q-o-q) basis, prompt payments fell by 4.48 percentage points from 48.31 per cent in Q3 2018 to 43.83 per cent in Q4 2018. Year-on-year (Y-o-y), prompt payments dropped visibly by 6.57 percentage points from 50.40 per cent in Q4 2017 to 43.83 per cent in Q4 2018.

Table of Contents

Slow payments inched downwards by 0.92 percentage points from 38.94 per cent in Q3 2018 to 38.02 per cent in Q4 2018 on a q-o-q basis. Y-o-y, slow payments increased by 1.10 percentage points from 36.92 per cent in Q4 2017 to 38.02 per cent in Q4 2018.

Meanwhile, partial payments increased by 5.41 percentage points from 12.74 per cent in Q3 2018 to 18.15 per cent in Q4 2018. Y-o-y, partial payments rose by 5.47 percentage points from 12.68 per cent in Q4 2017 to 18.15 per cent in Q4 2018. From a sectoral perspective, q-o-q slow payments have improved across 3 industries. The manufacturing and wholesale industries experienced an increase in slow payments.

Construction

Slow payments within the construction sector improved for the fourth consecutive quarter in Q4 2018.

- Q-o-q slow payments decreased visibly by 4.05 percentage points from 47.28 per cent in Q3 2018 to

43.23 per cent in Q4 2018. - Building construction accounted for the largest decrease in slow payments, down by 4.89 percentage points from 49.07 per cent in Q3 2018 to 44.18 per cent in Q4 2018. Slow payments within the heavy construction sector fell by 4.06 percentage points from 48.66 per cent in Q3 2018 to 44.60 per cent in Q4 2018. Payment delays by special trade contractors decreased by 3.02 percentage points from 44.61 per cent in Q3 2018 to 41.59 per cent in Q4 2018.

- On a y-o-y basis, slow payments fell markedly by 13.60 percentage points from 56.83 per cent in Q4 2017 to 43.23 per cent in Q4 2018.

Manufacturing

The manufacturing sector saw further deterioration in slow payments owing to an increase in payment delays by manufacturers of petroleum and coal products, machinery and apparels.

- Slow payments inched by 1.16 percentage points from 37.82 per cent in Q3 2018 to 38.98 per cent in Q4 2018.

- Manufacturers of petroleum and coal products registered the largest increase in slow payments, up by 16.70 percentage points from 34.72 per cent in Q3 2018 to 51.42 per cent in Q4 2018. This is followed by manufacturers of machinery, up by 2.74 percentage points from 38.63 per cent in Q3 2018 to 41.37 per cent in Q4 2018. Slow payments by manufacturers of apparel and textiles saw the third largest increase, up by 2.39 percentage points from 34.65 per cent in Q3 2018 to 37.04 per cent in Q4 2018.

- On a y-o-y basis, slow payments fell slightly by 0.32 percentage points from 39.30 per cent in Q4 2017 to 38.98 per cent in Q4 2018.

Retail

Following an increase in slow payments, the retail sector experienced some slight improvements largely due to a decrease in slow payments among retailers of general merchandise and food and beverage.

- Slow payments dropped slightly by 2.36 percentage points from 44.11 per cent in Q3 2018 to 41.75 per cent in Q4 2018.

- Retailers of general merchandise registered the largest decrease in slow payments, down by 12.79 percentage points from 54.16 per cent in Q3 2018 to 41.37 per cent in Q4 2018. This is followed by retailers of food and beverage, down by 6.52 percentage points from 54.71 per cent in Q3 2018 to 48.19 per cent in Q4 2018.

- On a y-o-y basis, slow payments jumped by 14.19 percentage points from 27.56 per cent in Q4 2017 to 41.75 per cent in Q4 2018.

Services

Slow payments within the services sector dropped slightly owing to improvements seen in the consumer services, health services and social services sub-sectors.

- Q-o-q slow payments dropped by 0.71 percentage points from 36.70 per cent in Q3 2018 to 35.99 per cent in Q4 2018.

- The consumer services sub-sector recorded the highest decrease in slow payments, down by 4.36 percentage points from 36.34 per cent in Q3 2018 to 31.98 per cent in Q4 2018. This is followed by health services, down by 2.68 percentage points from 32.92 per cent in Q3 2018 to 30.24 per cent in Q4 2018. Payment delays by the social services sub-sector registered the third largest decrease, by 2.15 percentage points from 43.89 per cent in Q3 2018 to 41.74 per cent in Q4 2018.

- On a y-o-y basis, slow payments dropped by 1.85 percentage points from 37.84 per cent in Q4 2017 to 35.99 per cent in Q4 2018.

Wholesale Trade

Payment delays within the wholesale sector deteriorated due to an increase in payment delays within the wholesale trade of durable goods.

- Q-o-q payment delays inched up by 0.35 percentage points from 35.29 per cent in Q3 2018 to 35.64 per cent in Q4 2018.

- Slow payments by wholesalers of durable goods increased slightly by 0.69 percentage points from 35.06 per cent in Q3 2018 to 35.75 per cent in Q4 2018 while payment delays by wholesalers of nondurable goods decreased by 0.60 percentage points from 35.94 per cent in Q3 2018 to 35.34 per cent in Q4 2018.

- On a y-o-y basis, slow payments within the wholesale trade sector increased by 0.92 percentage points from 34.72 per cent in Q4 2017 to 35.64 per cent in Q4 2018.

“Despite the fall in overall prompt payments for the final quarter of 2018, we are seeing continued improvements in slow payments across majority of the sectors on a quarter-on-quarter basis. This is particularly the case for the construction, retail and services sectors. Compared to 2017, there has also been an increase in partial payments which meant lesser firms have deferred their payments completely in 2018.” said Ms. Audrey Chia, D&B Singapore’s Chief Executive Officer.

https://www.icompareloan.com/resources/sme-loans-p2p-loans-compare/

According to SCCB, the average proportion of slow payments dipped slightly from 39.74 per cent in 2017 to 37.47 per cent in 2018 while the average proportion of partial payments increase from 11.87 per cent in 2017 to 14.31 per cent in 2018. Meanwhile, the average proportion of prompt payments slid marginally from 48.40 per cent in 2017 to 48.22 per cent in 2018.

D&B Singapore compiles the figures by monitoring more than 1.6 million payment transactions of firms operating through its Singapore Commercial Credit Bureau (SCCB). Payment data is contributed to the Bureau by local firms.

Prompt payment refers to when 90% or more of total bills are paid within the agreed payment terms. Slow payment refers to when less than 50% of total bills are paid within the agreed terms. Partial payment refers to when between 50% and 90% of total bills are paid within the agreed payment terms.

Established in 2005, Singapore Commercial Credit Bureau (SCCB) operates a database of local enterprises and their credit history to provide clients with the insight needed to build trust and improve the quality of business relationships with their customers, suppliers and business partners. SCCB operates under D&B Singapore.