Property investment decisions are made base on factors like quality of life and innovation says new research by JLL

JLL’s latest research with The Business of Cities reveals that no longer are a city’s economic fundamentals the main draw for corporate occupiers and investors. Instead, quality of life, innovation, sustainability, governance and resilience increasingly factor into location and investment decisions.

Cities that adapt to new economic models – such as the innovation economy, experience economy, sharing economy and circular economy – will enjoy new sources of property investment demand and attract higher cross-border investment.

Table of Contents

“What businesses need from cities is changing, as a result of technological disruption, growing concerns over climate change and geopolitical tensions,” says Jeremy Kelly, Director, Global Research at JLL. “By sifting through more than 500 city indices, we pinpointed key trends that will matter most for our clients.”

Singapore among top 7 destination and poised for global property investment draws:

Several new economic models are shifting attention to how cities build a customer service culture, foster urban experiences, expand innovation industries and achieve sustainability:

- The innovation economy demands that locations become flexible, optimize space and break down barriers between building uses. The model renews focus on central business locations as venues for collaboration, innovation, clustering and commercialization.

- The experience economy amplifies customer expectations for on-demand services, thrives on customized experiences facilitated by data collection and fosters concentration of a mix of activities in high-amenity locations.

- The sharing economy promotes the rise of new living and working patterns (including co-working and co-living), raises demand by fast-moving tenants for easily reconfigurable locations and increases returns from effective space and asset utilization.

- The circular economy creates an imperative for buildings to become more operationally efficient and resilient, and achieve greater density through shared occupancy and longer asset lifespans.

“Global cities are being judged on a wider set of competitive criteria, including their ability to attract and accommodate new forms of value creation,” says Dr. Tim Moonen, Managing Director at The Business of Cities. “The dividends to asset holders in cities that can successfully adjust to these new trends are becoming increasingly apparent.”

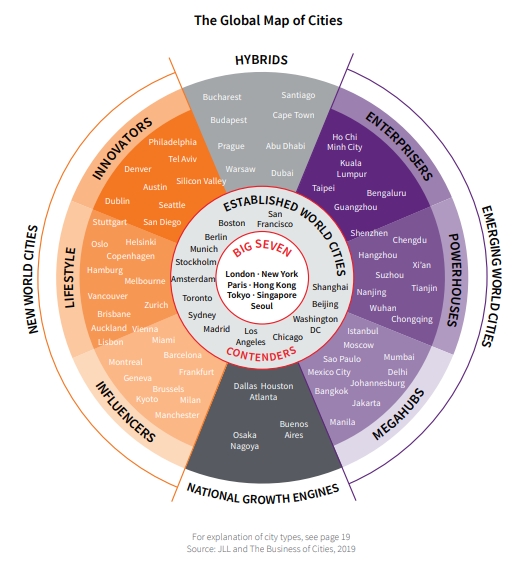

The new economic models have a strong impact on the landscape of global cities. Seven cities continue to demonstrate competitive strength – London, New York, Paris, Singapore, Tokyo and Hong Kong have topped JLL and The Business of Cities’ Established World Cities list since 2013, with Seoul joining in 2017. Another group of contending cities follows closely behind, including San Francisco, Los Angeles, Shanghai, Toronto, Chicago, Beijing, Amsterdam, Sydney, Madrid and Washington, DC.

This year, Berlin, Munich, Boston and Stockholm joined the global leaderboard, as they continue to build on their quality of life advantages, innovation capabilities or institutional strength, and punch above their weight as destinations for cross-border real estate investment.

“Our data shows a strong positive correlation between cities’ all-round competitiveness and their attraction for cross-border real estate investment. Investment performance and the desirability of cities among corporate occupiers and investors is now shaped by a much broader set of factors than before.”

The report added that property investment decisions are made after paying attention not only to economic fundamentals but also to aspects of quality, innovation, sustainability, place, and promotion performance across longer timescales, adding layers of complexity to their investment decisions.

JLL’s 2018 report World Cities: Mapping the Pathways to Success identified three core groups of ‘New World Cities’ that have gained a competitive advantage on the global stage because of their innovation capabilities (‘Innovators’), quality-of-life advantages (‘Lifestyle’) or institutional strength (‘Influencers’).

These cities are smaller and more specialised and offer distinctive points of difference and opportunity relative to larger and more ‘Established World Cities’.

In 2019 many cities in this group continue to record world-class performance – notably Barcelona, Melbourne, Vienna, Dublin and Copenhagen. They are improving not only their ability to attract and retain talent and diversified business, but also to deliver high-quality living standards, support innovation and maintain broader global influence through their widely recognised brand identities.

“The top ‘Emerging World Cities’ are experiencing such high productivity gains that they are rapidly decoupling from national trends and starting to leapfrog stages of infrastructure development through deployment of technology-led systems.”

The report said 2 Chinese cities are emerging as property investment destinations – Guangzhou and Shenzhen. The report added that this gives rise to ever more urgent imperatives to upgrade public services, tackle sprawl and congestion, retrofit infrastructure, fight pollution and build more integrated transport networks. The benchmarks highlight that Chinese and East Asian hubs continue to make the fastest strides on infrastructure and core living standards.

How to Secure a Home Loan Quickly

If you are eyeing a private property, but are ensure of funds availability for purchase, our mortgage consultants at iCompareLoan can set you up on a path that can get you a home loan in a quick and seamless manner.

Our consultants have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.