Singapore Budget 2019 is expected to have real estate impact.

Singapore’s Finance Minister, Mr Heng Swee Keat, delivered his Budget speech for 2019 on Feb 2019. It comes amid latest statistics on the economy which registered 3.2% growth in 2018, easing from 3.9% in 2017. Commenting on Budget 2019, which is expected to have real estate impact, CBRE Research said that the growth outlook is expected to moderate further in 2019, dampened by an increase in global uncertainties and downside risks such as a worsening of the trade conflict between US and China and a no-deal Brexit.

“In view of this, the 2019 Budget is a comprehensive forward-looking package that looks to strike a balance between enhancing the competitiveness of businesses and workers, addressing the social needs of citizens, continuing the development of infrastructure and tackling climate change – all to prepare Singapore for the future.”

Noting some key policies may have real estate impact, CBRE said that it was “music for the masses”.

Table of Contents

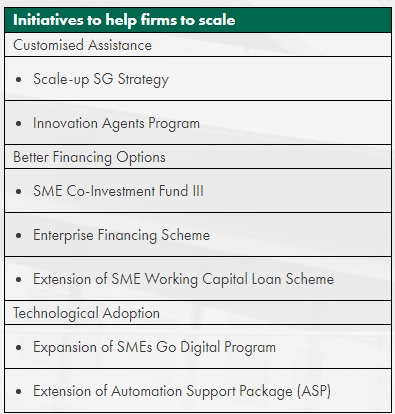

There was a strong focus placed on enabling firms to scale up through various initiatives to assist SMEs with customised assistance, greater access to financing options and ease of technology adoption.

In saying the Government needs to ensure Singapore firms and workers remain competitive and stay relevant to the world, Budget 2019 included three key thrusts to support industry transformation: first, building deep enterprise capabilities, second, building deep worker capabilities, third, encouraging strong partnerships within Singapore and across the world.

“To build deep enterprise capabilities, we will provide support in three areas: providing customised assistance, better financing options, and supporting technology adoption. These will be done through programmes such as Scale-up SG programme, a streamlined Enterprise Financing Scheme, and an expanded SMEs Go Digital programme. The Government will also continue to invest in R&D and new Centres of Innovation.

We want our people to have the skills, knowledge, and attitude to adapt and thrive in a competitive and technology-intensive environment. Professional Conversion Programmes will be launched for new growth areas. The Career Support Programme will be extended. A new Global Ready Talent Programme will streamline existing schemes to support students and professionals in gaining international experiences through internships and job postings.

To encourage strong partnerships, the Government will enhance the Local Enterprise and Association Development programme, and strengthen Singapore’s position as an innovation node, among other measures.

To press on with economic restructuring efforts, we will reduce the services sector Dependency Ratio Ceiling. Meanwhile, to support firms as they adjust to these changes, we will put in place transitional support measures, till end-FY2022.”

With better support for the SME ecosystem, CBRE Research said that it expects the initiatives to have real estate impact, in that occupier demand from SMEs may be more significant in the medium term.

https://www.icompareloan.com/resources/using-mortgage-brokers/

Budget 2019 said that to build on the SG Cares movement, the Government will nurture youth leaders, encourage volunteerism among seniors and older employees, and encourage public officers to volunteer through the Public Service Cares initiative.

https://www.icompareloan.com/resources/home-mortgage-refinance-calculator/

In addition, it launched two special initiatives to commemorate the Singapore Bicentennial: a $200 million Bicentennial Community Fund to encourage more Singaporeans to give back to the community, and a $1.1 billion Bicentennial Bonus to share Singapore’s surpluses with various segments of society. Budget 2019 said the Bonus will go some way in helping Singaporeans meet their daily needs.

The Bicentennial Bonus, which includes up to S$300 in GST voucher-cash that will benefit 1.4 million people, is expected to have real estate impact by boosting consumption and domestic spending. CBRE Research noted that this is further supplemented by a personal income tax rebate and another year of service and conservancy charges rebates for HDB households.

On the public housing front, CBRE Research noted that plans for the rejuvenation and renewal include the Home Improvement Program (HIP), the Neighbourhood Renewal Program (NRP) and the Remaking Our Heartland (ROH) initiative. And for the longer term, there are the HIP 2 and the Voluntary Early Redevelopment Scheme (VERS).

In noting that the details for these plans will be revealed in due time by the Committee of Supply, it said that the upcoming URA Master Plan 2019, will guide urban development over a 10-15-year time frame and have real estate impact.

“Overall, this Budget offers something for Singaporeans from all walks of life while keeping an eye on the longer term,” said CBRE Research. Adding: “There is a continued strong focus on investment in businesses, in particular SMEs and workers in order to transform the economy and to ensure that Singapore stays relevant and competitive for the future.”

How to Secure a Home Loan Quickly

With the private residential property market settling, are you planning to buy a new private home but are ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner. We are the experts who do the work for you for free, while you lean back, rest and rely on our professionalism at absolutely no cost to you.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

You may also contact us for advice on mortgage refinancing.