Investing in Real estate still makes sense; and how it compares with property stocks, REITs and land banking

If you are of the view that the property market is at a low point, some of you with idle cash would have been tempted to enter the market to gain exposure to the property sector. The question is would it be better to purchase a property, buy a property stock, a real estate investment trust (REIT) or perhaps venture into alternative investments such as land banking.

In this article, we take a look at some considerations before you make that decision.

Greatest returns?

Of course, there is no guaranteed return in any asset class. Or even if there is, tread with caution.

There is an old adage that says land always increase in value. If that is the case, buying a property at a downturn seems like a no-brainer.

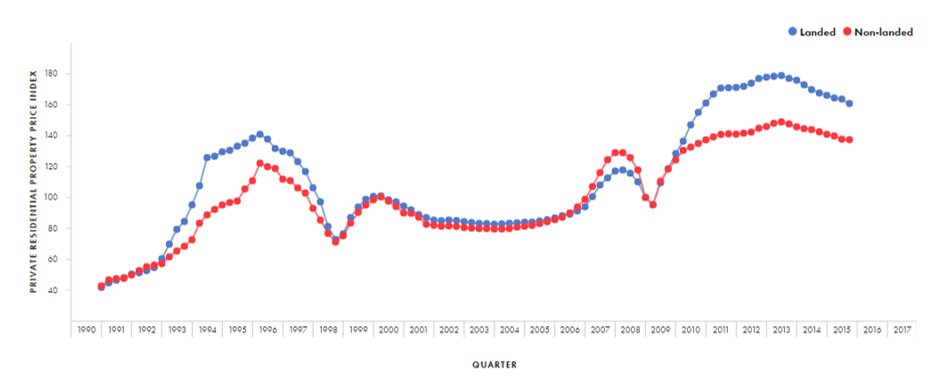

Let’s have a look at the Singapore Private Residential Property Price Index. As shown in the chart below, prices have been on a downtrend since 2014 though if you take a 10 year horizon, the index was up by over 100%. Notably, the index reflects longer term trends and is less volatile.

If the property was rented out, then the investor would have made higher returns on top of price appreciation.

On top of Property capital gains, there is also the ability to leverage on borrowings via home loan to further enhance return on equity (ROE).

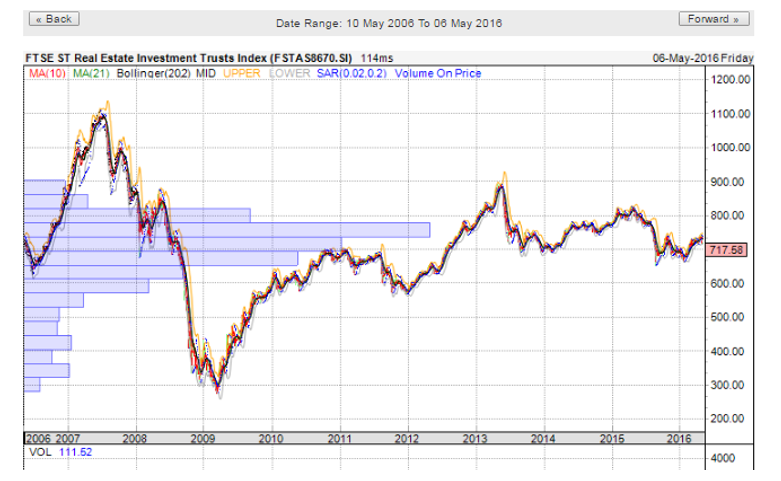

REITs or vehicles which own income-generating assets is another investment option. Over a 10 year horizon, we see that the FTSE ST REIT index had closed near the starting point. But if you had entered the market during the crisis in 2009, your returns would have been very positive. Overall, the index is volatile.

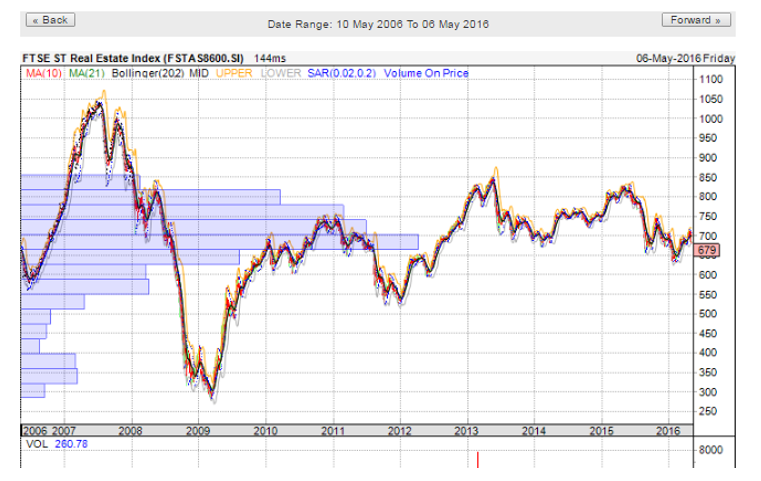

Stocks also offer exposure to the property market. The options are pretty wide, ranging from pure property plays as well as investment companies which buy properties. Some offer exposure to overseas markets as well as to different market segments like commercial and industrial property. Several are trading below their net asset value due to weak market sentiment and various company related factors.

Looking at the FTSE ST Real Estate index over 10 years, the trend is somewhat similar to the REIT chart.

Land banking – there are plenty of options in the market. The time frame is somewhat uncertain and the projected return would depend on the project. The investor is likely to be subject to currency exposure as the projects are typically overseas.

Capital required

In general, stocks and REITs would require the least capital as an investor can buy 100 shares in any company on the Singapore Exchange to gain exposure, meaning an investment below S$1,000 is possible.

Landbanking may require a minimum investment of S$10,000 while a property investment ranges from a few hundred thousand dollars for a HDB flat to several millions for a landed property.

Time horizon

Stocks and REITs are generally liquid and offer an exit option on any trading day. But as we can see in the charts above, the market is volatile and if you can’t hold a stock, you could make negative returns in the short term or possibly higher than average returns.

For land banking, usually the money is locked up for at least 5 years though some firms allow you to sell in the secondary market

For real estate, it depends on whether there is a buyer. Generally, this is not as liquid as equity markets as it takes time to find a buyer and each property is unique.

Convenience

Stocks and REITs are traded instruments, thus it is relatively easy to enter and exit the market once you set up a trading account.

Real estate would definitely involve more paperwork. You need to deal with lawyers, the government agencies, the bank and possibly property agents to buy and sell your property.

Land banking usually involves a sales pitch and the sales person would probably make it convenient for you to close the deal.

Expertise

Stocks and REITs are managed by professionals or the appointed CEO of the company. Usually, they have built a network of connections and a wealth of experience in this field though you do find some companies in unrelated sectors becoming developers to diversify their business.

Land banking companies usually employ professionals in various fields of expertise.

As for real estate, YOU would have to depend on yourself!

Conclusion

Historical data shows that, in the longer term, real estate is an attractive investment option if you have the financial resources and holding power. The government has every incentive to maintain land productivity through high land prices to maximize value of land sales.