Angeline C (iCompareLoan.com)

Edited by Paul HO

In Singapore, it is common to see many of the elderly working as cleaners, food stall assistants, selling tissue paper, collecting cardboards – basically jobs that young Singaporeans shun.

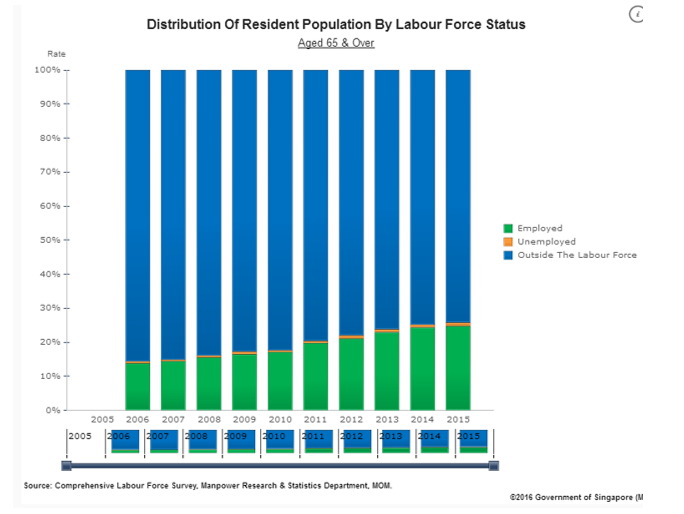

It reflects a growing problem that Singapore is struggling with – ie elderly who need to work to make a living; not that they want to. In the chart below, we see that the % of elderly aged 65 who are working has risen over the years.

While studies show that it may be good to work[1], the fact is most elderly are engaged in jobs which ironically require physical strength and lower skilled.

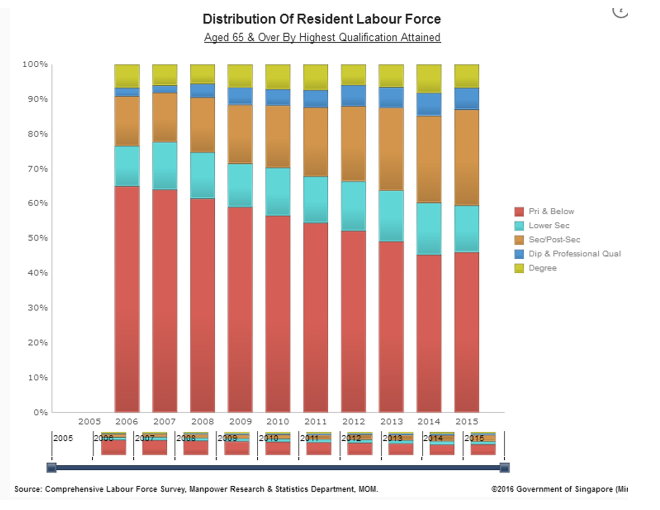

Many may not have enjoyed the same educational opportunities of today. As seen in the chart below, the majority of those aged 65 and over who are still in the labour force have primary education and below.

[1] According to a recent study by the Journal of Epidemiology & Community Health, the risk of dying from any cause over the study period was significantly lower for those who postponed retirement beyond the age of 65. Possible reasons include a delay in the natural age-related decline in physical, cognitive and mental functions and reducing risk of chronic illness.

Further, according to a study by DBS[1], the majority of those aged 65 and below were earning $1,500 and below.

This suggests that the current assets of the retiree are inadequate to meet their daily requirements.

Let’s take a look at the three basic sources of wealth for a retiree assuming they do not receive allowances from their children – social security, savings and home equity.

Social Security

In Singapore, we have a compulsory social security scheme where part of our salary goes to the Central Provident Fund (CPF) and the funds are basically locked up with exceptions such as healthcare expenses, insurance, housing or reaching the retirement age where a portion of savings can be drawn. However going to a polyclinic consultant (list price) is more expensive than a private clinic, if there are no “subsidy”, after the so called “huge Subsidy”, the prices are only slightly lower than the private clinics.

In recent years, the government has been rolling out programmes to fill the cash flow gap of the elderly such as the Silver Support scheme, and the compulsory CPF LIFE Plan, a national annuity plan. The Pioneer Generation package also helps a lot in terms of covering healthcare expenses.

Savings

Savings are accumulated over the years since young from which you can draw upon to meet your spending needs. They can be in cash, investments or annuity, among others.

One way to achieve higher savings at retirement would be to increase your earning power now.

The government has been promoting continuous learning for a while such as the SkillsFuture Credit for Singaporeans aged 25 and above as well as Workfare Training Support for Singaporeans age 35 and above earning not more than $1,900 a month.

The idea is that you could progress on to a higher paying job.

Another way is to get a higher return on your investments or adjust your spending.

Home Equity

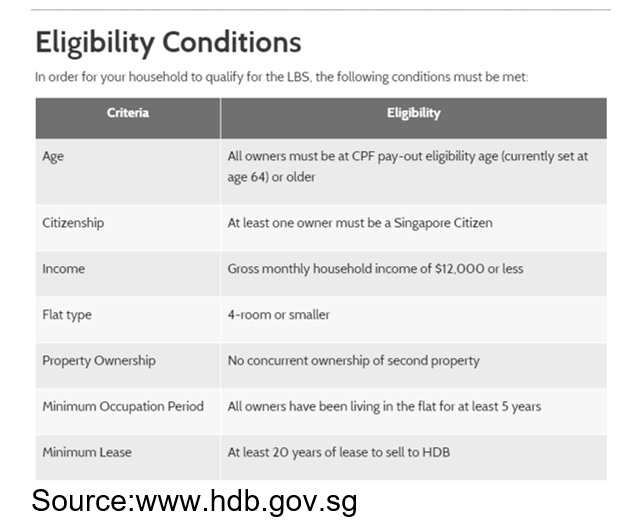

For most Singaporeans, a large portion of their wealth would be stuck in their property. And to monetise this, you can downgrade to a smaller house. Or if you are staying in a HDB, there is the Lease Buyback Scheme. To be eligible, all owners must be at the CPF pay-out eligibility age (currently at age 64) or older and have a gross monthly household income of up to $12,000, among others.

[1] https://www.dbs.com.sg/iwov-resources/pdf/retirement/retirement_report.pdf

If they stay in a Private housing above 4m in valuation where outstanding loan is less than 30%, they can take out an equity term loan to enhance returns.

Conclusion

Thus, it is important to start planning for your retirement early. Every choice you make from the purchase of your first property, decisions on whether to buy a car, take up an insurance plan or use your credit card will all add up and affect your accumulated wealth when you hit 65 years. At that age, your range of options, whether it is a job or investment, would likely be limited and it would be helpful to have the financial flexibility to lead the lifestyle you choose.

Maybe it is better to retire in thailand as the costs are potentially lower.