Singapore hotel investment volumes set for new high of S$2.5 billion in 2019, says JLL. Singapore hotel investment volumes will be buoyed by increasing tourist arrivals, infrastructure developments and limited hotel supply.

Singapore is on course to close out 2019 with record high hotel transaction volumes of S$2.5 billion with a number of deals expected to close before the year ends, according to JLL.

“According to the “Destinations 2030: Global Cities’ Readiness for Tourism Growth” report by JLL, it ranked Singapore as a city with one of the most balanced dynamics in terms of readiness for future tourism growth. This includes established infrastructure, and potential for travel and tourism growth, which is evident with the string of new tourism initiatives recently laid out by the government. In anticipation of the future tourism growth, the expansion of Changi Airport will see the construction of the new Terminal 5, which will significantly increase the airport’s current capacity from 82 million to 135 million when completed in the 2030s.”

The latest research from the global real estate consulting firm reveals that Singapore’s hospitality industry has seen an uptick in properties changing hands, including the sale of existing assets and land sites, totalling approximately S$1.7 billion so far this year.

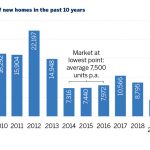

“Hotel supply in the next three years is expected to remain relatively limited, growing at a compound annual growth rate (“CAGR”) of 0.7% from end-2019 to end-2022. By comparison, the future supply growth is anticipated to be slower than the 4.2% CAGR registered during the three-year period from end-2015 to end-2018, emphasising the potential for further upward trading performance.”

Singapore hotel investment volumes set to benefit from the Republic being viewed as a safe haven destination by investors

Table of Contents

“Despite ongoing geopolitical uncertainty, there remains a strong weight of global capital seeking opportunities in what our investors perceive as safe haven destinations. As a key global gateway city, Singapore remains high on our clients’ radar, largely supported by its positive trading performance, strong visitor arrivals and new tourism initiatives,” explains Nihat Ercan, Managing Director, Head of Investment Sales Asia, JLL Hotels & Hospitality.

“Overall, the hotel sector remains resilient with market-wide RevPAR remaining relatively unchanged y-o-y at SGD 186 as at YTD July 2019, according to the STB. Notably, occupancy reached at 93.8% in July, the highest ever recorded in a month since STB began tracking market-wide trading performance in 2005.”

In September, JLL advised OUE Limited in an agreement to sell Oakwood Premier OUE Singapore at S$289 million, the largest hotel transaction in Singapore to date this year. The buyers are joint venture firms formed by Hong Kong financial services firm AMTD Group and hotel operator Dorsett Hospitality International, a subsidiary of Hong Kong-listed property giant Far East Consortium International.

“This deal represents the unwavering investor confidence in Singapore,” says Mr Ercan. “The city’s hotel sector remains resilient with average room rates per night and occupancy levels staying positive. Notably, occupancy registered at 93.8 per cent in July 2019, the highest monthly level since 2005.”

With the island nation attracting more than 11.1 million visitors in the first seven months of 2019, tourism is expected to continue to support hotel trading performance. Major inbound source markets showing notable year-on-year growth during the period include China (+5.2 per cent), Japan (+7.3 per cent), the Philippines (+6.0 per cent) and the U.S. (+11.5 per cent), according to Singapore Tourism Board’s latest figures.

The local government has also put in place several infrastructure developments, including plans to introduce new attractions at The Greater Southern Waterfront, the expansion of Marina Bay Sands and Resorts World Sentosa, as well as a new eco-tourism hub in Mandai, and an integrated tourism development at Jurong Lake District.

Singapore hotel investment volumes set to rise with the overall outlook for Singapore’s tourism sector being positive

“The overall outlook for Singapore’s tourism sector is positive and the hotel market is expected to benefit from the robust supply and demand fundamentals in the short to medium term,” says Adam Bury, Senior Vice President, Investment Sales Asia, JLL Hotels & Hospitality.

“Overall, the outlook for Singapore remains strong and the market is expected to benefit from the robust supply and demand fundamentals in the short- to medium-term. In the longer-term, the government’s strategies and infrastructure investments will continue to support Singapore as an attractive destination for tourism, as well as investors seeking stable secure capital appreciation.”

He concludes: “In the long term, we foresee that the government’s strategies and infrastructure investments will support Singapore as a desirable destination for tourists as well as attract investors seeking stable secure capital appreciation.”

How to Secure the Best Home Loans Quickly

iCompareLoan is the best infomercial loans portal for home-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!