Property firms are generally financially sound although some highly leveraged firms with unsold real estate inventory could face pressures, warned the Monetary Authority of Singapore (MAS) in its latest Financial Stability Review.

The report noted that property firms tend to take on higher leverage due to the capital‐intensive nature of the industry, and have contributed to the increase in overall corporate leverage in the post‐Global Financial Crisis (GFC) period.

“The median debt‐to‐equity ratio for property firms was around 60% for the past few years, compared to the median of 37% for SGX‐listed firms overall (Chart 2.4). However, the sector remains resilient at the firm level with property firms generally having adequate financial buffers. The median ICR for listed property firms held steady at about four times in Q2 2019, above the overall median across all corporates, suggesting that property firms remain well‐placed to meet their debt obligations.”

While larger developers (with total asset size above S$10 billion) tend to have higher debt‐to‐equity ratios compared to smaller and less‐diversified developers, they also have stronger Interest Coverage Ratio (ICR) and more diversified income streams and geographical exposure.

The report suggested that the unsold real estate inventory may have made property developers more cautious in their bidding for land.

“Property developers are more cautious in their bidding for land compared to H1 2018. Unsold (real estate inventory) has also increased, which could weigh on developers with weaker financial ratios, especially if these units remain unsold in the medium term. However, for now, the market continues to see relatively healthy sales for selected new launches.

That said, continued vigilance is needed. Property firms should exercise prudence, especially those that have built up high levels of leverage and hold large unsold (real estate inventory). They should take the significant increase in the upcoming supply of private housing units over the medium term into account in their business and financial planning.”

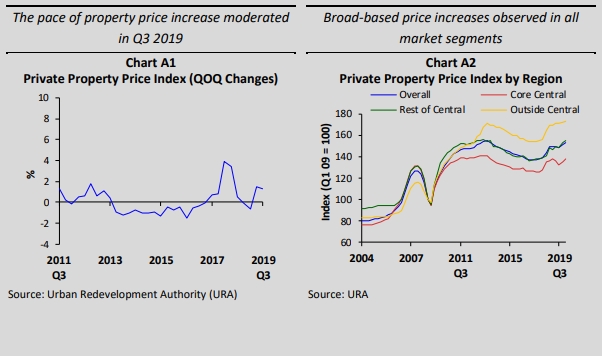

The report noted that price growth has slowed in the quarters since July 2018, although it has risen at a moderate pace in Q2 and Q3 2019. The volume of new developer sales has increased on the back of high launch volume, although sales performance was uneven across projects. Meanwhile, resale volume remained modest compared to pre-2018 July cooling measures level and developers are more cautious in their bidding for land.

The report added that with housing supply coming on stream with an increasing number of launched but unsold real estate inventory, there are potential downside risks to the property market. As such, prospective buyers should be mindful of their ability to service their long-term mortgage obligations and be cautious in their buying and financing decisions.

MAS said that households that are already over-extended should be cautious in taking on new debt amid uncertain economic prospects and downside risks to income growth.

“The July 2018 property market cooling measures have helped to bring prices closer to their underlying fundamentals — price increases have slowed alongside transaction activities, and developers are more cautious in land bidding. This has contributed to improving household leverage risk as reflected in the FVI.

Nonetheless, there are potential downside risks to the property market, given the uncertain economic outlook. There is also further housing supply coming on stream even as the stock of launched but (unsold real estate inventory) builds up. Prospective buyers should be mindful of their ability to service long-term mortgage obligations and be cautious in taking on new commitments to debt financed property and other large purchases. Highly leveraged households would be more susceptible to stresses in macroeconomic conditions, and need to build up financial buffers while ensuring that the debt servicing burdens remain manageable.”

MAS Update on the Private Residential Property Market

“The cooling measures introduced in July 2018 have led to a moderation of the private residential property market. Compared to H1 2018, private housing price movement is more in line with economic fundamentals, overall private housing transaction volume has reduced, and developers are more cautious in their bidding for land.

While relatively healthy developer sales were observed in selected project launches in the past two quarters, this was largely due to project-specific features such as good location. Other projects saw moderate sales in the initial phase of their launches. Secondary market sales volume remained modest compared to pre-cooling measures levels.

Ongoing uncertainties in the economic outlook and a softening labour market could negatively affect households’ incomes and their demand for property. A large supply of unsold units in the medium term could also weigh on the property market. Given these downside risks, prospective buyers should be mindful of risks and remain prudent before entering into long-term decisions, for instance buying a property, taking on a mortgage, and servicing that mortgage.

Price movements have moderated in the quarters since July 2018, and remained modest in Q2 and Q3 2019. Prices increased by 2.1% y-o-y in Q3 2019, lower than the 9.1% y-o-y increase in Q2 2018 (Chart A1). In Q3 2019, prices rose by 1.3% on a q-o-q basis, at a slower pace compared to the q-o-q increase of 1.5% in Q2 2019. Overall price developments in the latest quarter were attributed to price increases in all the three regions (CCR, RCR, OCR) (Chart A2).”

Commenting on the large unsold real estate inventory, Paul Ho, chief mortgage office at iCompareLoan said, “prospective home buyers should take extra care to get only the best mortgage loan at his point. They should take care not to over leverage themselves with large loans in this uncertain economic climate where anything is possible.”