ABS Benchmarks Administration Co Pte Ltd (ABS Co) announced on July 1 that it commenced transitional testing of a new waterfall SIBOR methodology.

By: Phoenix Lee/

SIBOR is administered by the ABS Benchmark Administration Co Pte Ltd, with Refinitiv (formerly known as Thomson Reuters) as the calculation agent.

This follows from ABS Co and the Singapore Foreign Exchange Market Committee (ABS-SFEMC)’s July 2018 announcement of key proposals to enhance SIBOR, by anchoring this benchmark to market transactions to the extent possible.

12-month SIBOR benchmark to continue until new waterfall SIBOR methodology is implemented

Table of Contents

The testing of the new waterfall methodology will be conducted in parallel with the daily ongoing production of SIBOR. Specifically, the existing SIBOR submission process with the current 20 Contributor Banks will continue until further notice. ABS Co said the 12-month SIBOR benchmark will also be published until the new waterfall methodology is implemented.

ABS Co said that the transition testing will be conducted for an initial period of six months from July to December 2019. The outcome of the transition testing will determine if a transition to the proposed waterfall SIBOR methodology is possible, or if further refinements would be needed. ABSSFEMC will provide an update in 1Q 2020, after the completion of the transitional testing.

Background of new waterfall SIBOR methodology

On 24 July 2018, ABS-SFEMC finalised its proposals to enhance SIBOR. This followed from ABS-SFEMC’s joint public consultation in December 2017, which sought feedback on proposals to enhance SIBOR, by anchoring the benchmark to market transactions to the extent possible.

The key changes, which incorporated the feedback received are:

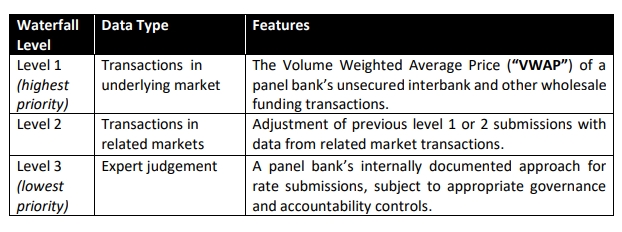

- To increase reliance on market transactions by calculating SIBOR with a new waterfall methodology, comprising the following hierarchy of inputs.Level 1 Transactions in the underlying wholesale funding markets

Level 2 Adjustment based on related transaction-based SGD benchmarks

Level 3 Expert judgementThis waterfall methodology provides greater clarity on the production of the benchmark and facilitates consistency across Contributor Banks that submit input for the calculation of SIBOR.

- To retain the 1-month, 3-month and 6-month SIBOR and discontinue the 12-month SIBOR due to low market usage and a lack of underlying transactions to support its production.

In 2018, ABS-SFEMC proposed to enhance SIBOR by adopting the following waterfall SIBOR methodology:

ABS Co said then that there was broad support for the proposal to discontinue the 12-month SIBOR, given low market usage and a lack of underlying transactions to support the production of this benchmark. It added that one respondent highlighted that the discontinuation of 12-month SIBOR could trigger a re-assessment of the Total Debt Servicing Ratio (“TDSR”) for retail clients with property loans referencing the 12-month SIBOR. The respondent asked if a request could be put to MAS to consider a waiver in such cases, of the TDSR re-assessment.

On the appropriate notice period for discontinuing the 12-month SIBOR, the majority specified that a period of 12 months or less would suffice as this benchmark tenor was not widely used.

ABS Co said that taking into account respondents’ feedback, the 6-month SIBOR will be retained while the 12-month SIBOR will be discontinued when the proposed enhancements to the SIBOR methodology are implemented.

ABS and Singapore Foreign Exchange Market Committee (SFEMC) said that they have brought the TDSR re-assessment issue to MAS’ attention. MAS recognises that financial institutions will need to replace some property loan contracts that reference the 12-month SIBOR with contracts pegged to different benchmark rates. MAS does not expect financial institutions to treat the offering of replacement loan packages to the affected borrowers as a refinancing of property loans.

Correspondingly, the property loan rules, such as the computation of TDSR for refinancing of investment property loans, will not be applicable. Nevertheless, the prevailing refinancing rules will apply to any subsequent refinancing by such borrowers. As good practice, the key features of the replacement loan packages offered to affected borrowers, including applicable fees and charges, should be highlighted.

The name of the benchmark when the new waterfall SIBOR methodology is implemented would remain as “SIBOR”, and the rate would continue to be published on the same data vendor pages, said ABS-SFEMC.

To align SIBOR with evolving practices for benchmarks in other markets, the proposed definition for SIBOR will focus on the rate for a particular business day in Singapore, rather than the prior approach of focusing on the date of publication. Accordingly, when the new methodology is implemented, the revised SIBOR definition will read as follows:

“SIBOR is the benchmark administered by the ABS Benchmarks Administration Co Pte Ltd (ABS Co.). An individual Contributor Bank contributes the rate at which it could borrow SGD funds from the wholesale market on a particular Business Day, in accordance with the Contribution Waterfall Methodology as defined by ABS Co.”

How to Secure a Home Loan Quickly

Are you planning to invest in properties like the collective sale relaunch site but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.