Why are Cars so expensive in Singapore

Paul HO (iCompareLoan.com)

In May 26, 2016, MAS relaxes car loan regulations. Car borrowers are now able to borrow up to a higher amount: –

- 60% of Car Price if OMV is above $20,000; up to 7 years.

- 70% of Car Price if OMV is below $20,000; up to 7 years.

This is the traditional car loan scheme from Singapore banks for individuals.

In many countries, people pay cash for their cars or simply swipe their credit cards. In Singapore cars that go for $100,000 are the norm than the exception. People will not usually carry around $100,000 to $200,000 of cash and it is unusual for people to have a credit limit of S$200,000 as average monthly wage in Singapore is about S$4,500 and credit limit is usually 2 times the monthly salary.

For those of you who are not Singaporeans, US$1 = S$1.4 to S$1.5. So @ US$1:S$1.5, S$100,000 is about US$66,667.

What makes up a Car Price in Singapore?

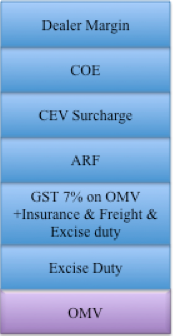

Figure 1: What makes up a car price in Singapore, LTA, iCompareLoan.com

- The Open Market Value (OMV) is the basic price of the car. (car must be less than 3 years old)

- There is an Excise Duty of 20% of the OMV. Goods and services tax (GST) of 7% is charged on the (OMV + Insurance & Freight + Excise Duty).

- Vehicle Inspection and Type Approval System (VITAS). Fees will be charged for VITAS applications and inspection.

- Additional Registration Fees (ARF) is $140 + percentage of OMV: –

- First S$20,000 = 100%

- Next S$30,000 = 140%

- Above $50,000 = 180%

- Special Tax – i.e. diesel car, hybrids, etc. (Refer Tax structure for cars)

- Surcharge of $10,000 if registering a used imported car (less than 1 year old)

- CEVS surcharge (You will need to read manufacturer’s specifications as to what carbon emission as the tax is dependent on it)

- (Place $10,000 deposit with participating bank)

What is Open Market Value (OMV)?

OMV is the price of the car in its most basic form. Without crazy taxes, this is the price you would pay for a basic car in most countries.

For example a Toyota Camry 2.0 may have an OMV of around S$28,000, this is the price you would likely pay in another country for the most basic model. But in Singapore, this car would cost around $130,000 to $160,000.

Excise Duty

The excise duty is charged at 20% of the OMV.

Goods and Services Tax

If you thought excise duties are bad, a further GST is charged on top. GST of 7% is charged on the OMV, Insurance and freight and excise duty. Tax on top of a tax.

Additional Registration Fee (ARF)

This is the second largest component of the car price. This is not a tax, it is a simply a fee. What a fee!

If the Car is a BMW 318i for instance, the OMV is $29,000. The ARF payable is: –

- 100% on OMV (up to $20,000) = $20,000 x 100% = $20,000

- 140% on OMV (Next $30,000) = $9,000 x 140% = $12,600

- 180% on OMV (Thereafter) = $0 x 180% = $ 0

- Admin Fee = $ 140

You will end up with a additional registration fee (ARF) of $32,600 + $140 administrative fee = $32,740.

After all these fees, and you still get slapped with an Admin. Fee of $140.

Special Tax

If you feel special and have an urge to have special cars, then there is a “special tax”. The “special tax” is only applicable to Diesel cars for the moment. A special tax is imposed on top of the Road Tax for diesel cars.

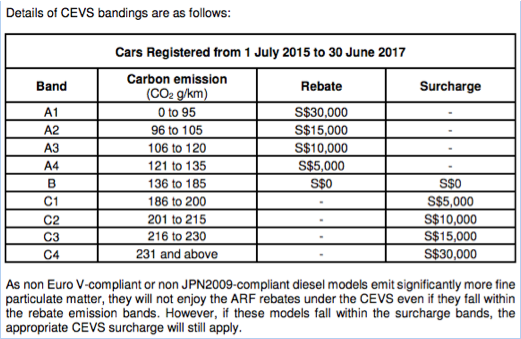

Carbon Emission Variable Surcharge (CEVS)

There is also a carbon emission surcharge or rebate. Cars that are Euro V compliant and emits very little carbon will have rebates. However unfortunately most cars would fall within the 0 rebate range. A Toyota Vios 1.5A (2013 model) has been measured to be in 147g/km of carbon emission while a Toyota Camry 2.0A (2016) comes in at 167g/km. It’s not easy to get rebates at all.

Table 1: CEVS carbon emission rebate – surcharge table, LTA

Certificate of Entitlement (COE)

What is the certificate of entitlement COE? You can only drive a car if you bid and win a license to run the car on the road for 10 years. What are the categories of COE?

- Category A – Cars up to 1,600cc and 130bhp

- Category B – Cars above 1,600cc or 130bhp

- Commercial Vehicles

- Motorcycles

- Open category – Can be used for any category.

Each month there are 2 auction of COEs. The Land transport authority (LTA) will release the number of quotas available for each category.

A COE for Cat A or Cat B usually comes in at $40,000 to $80,000.

Dealer Margin / Premium

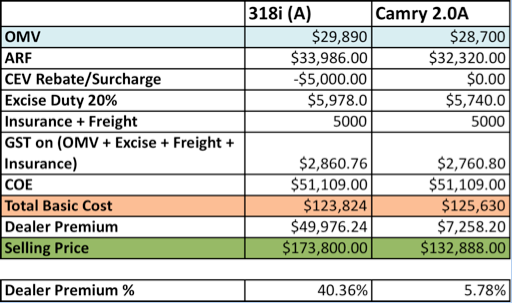

After doing so much hard work, surely the dealer deserves some profit margin. The margin differs from model to model. Let us take a look at what the list prices are for 318iA and Camry 2.0A in Dec 2016.

If we add up the costs, just government taxes and fees added up to almost $100,000 of the car cost.

Table 2: How a Car Price is added up, iCompareLoan.com

The dealer premium depends on the car. Some are 5 to 6% while the others can be up to 30-40% margin.

Should we begrudge the Dealer’s margin?

On the surface some of the margins look really great. If you check the prices of such cars in Europe or Japan, would you be able to buy them at the OMV prices if you had gone and source it yourself? Car importers buy in bulk, that is why they can get the car’s OMV cheap.

A slight increase in OMV prices will surely bump up the government taxes and fees.

Also the dealer is importing the car in its barest form.

- No polishing

- Most probably fabric seats

- No radio

- No rear sensors

- No camera

- Basic tyres, metal rims.

- No tinted glass or solar film.

- No installation of ERP reader

- Help bid for COE

- In some cases, no air conditioners.

An importer will also need to submit the paperwork for importation, Vehicle Inspection and type approval system (VITAS) and incur the fees for it. Clear customs, bid for COE, touch up the car with all the specifications. Surely you would not buy the car in its most basic form, right?

Can I buy a Car Cheaper?

We cannot avoid government taxes and fees, however unreasonable they are. However, we can do a bit of these things ourselves and obtain the prices cheaper.

If you are willing to buy a car DIY, you can bid for the COE yourself, buy your own tyres and rims, install your own radio, in exchange to buy a car cheaper, will you do it?

Find out how to buy a car DIY.

Obtain a car loan to buy your dream car. As the cost of a housing equity loan (Cash out) is cheaper than the cost of a car loan, some people prefer to leverage their house borrowing and pay cash for their cars.

If you want to make money from your personal car, you can find out here.

Appendix 1 – Where to place a bid for COE

You can bid for the COE yourself by placing a $10,000 deposit with participating banks: –

DBS/POSB – 1800-111-1111 for Individuals – ATM

DBS (for companies and Motor Traders) – 1800-222-2200 – Online

UOB (for companies and Motor traders) – 1800-226-6121 – Online

Maybank (for Companies and Motor traders) – 1800-777-0022 or +65-6777-0022 (overseas)

You can watch the COE bidding live on: –

LTA Open Bidding Website (https://ocoe.lta.gov.sg)

Reading References

- Vehicle tax structure, https://www.lta.gov.sg/content/ltaweb/en/roads-and-motoring/owning-a-vehicle/costs-of-owning-a-vehicle/tax-structure-for-cars.html

- How to self import a new vehicle, https://www.onemotoring.com.sg/content/onemotoring/en/lta_information_guidelines/buy_a_new_vehicle/self_importation_.html