Owners of freehold Windy Heights in the Kembangan area in their 2nd collective sale attempt, are seeking to reduce the reserve price by over $50 million in a bid to go for collective sale. This come after its earlier bid in April 2018 which was unsuccessful.

The reserve price in the previous attempt was $806.2 million, but now, with their 2nd collective sale attempt the price may drop by 6.97 per cent to $750 million.

Table of Contents

Windy Heights is one of the largest freehold residential redevelopment sites in District 14 . The private residential estate comprising of four residential blocks of 192 apartment units, 8 penthouses and 2 commercial units has a site area of 23,291 sq m (approx. 250,702 sq ft). The site is regular and enjoys dual frontage onto Jalan Daud and Lengkong Tiga.

Under the 2014 Master Plan, the site is zoned “Residential” with a Gross Plot Ratio (GPR) of 2.1. The current built-up Gross Floor Area (GFA) for the site is verified by the Urban Redevelopment Authority (URA) to be 58,150.74 sq m, which translates to a Gross Plot Ratio of 2.4967. Based on the current GFA and assuming the average size of 100 sq m, there is a potential for 581 new residential units upon redevelopment.

The site is located along the Eastern Coastal Loop (Siglap Park Connector), which connects to Bedok and East Coast Park. The route promotes a relaxing 2-minute cycle or 9-minute walk to Kembangan MRT station. It is only 2 MRT stops to Paya Lebar Business Hub, 3 MRT stops to Changi Business Park, and 8 MRT stops to the Central Business District, improving accessibility for car-lite commuters.

Major arterial roads as well as expressways such as the Pan-Island Expressway (PIE), Sims Avenue, Changi Road and Still Road provide seamless connectivity to other parts of Singapore. The site is 15-minute drive to the Central Business District and Changi International Airport. The shopping and entertainment strip of Orchard Road is less than 15 minutes’ drive away.

Knight Frank Singapore which is the marketing agent for the first as well as the 2nd collective sale attempt, said the $806.2 million reserve price is unchanged from the earlier attempt, but that “owners are going through a re-signing process to revise the reserve price”.

If enough owners agree, the price tag for the 2nd collective sale attempt will drop by 6.97 per cent to $750 million.

The revised price for the 2nd collective sale attempt would work out to $1,089 per sq ft per plot ratio (psf ppr), including a bonus balcony gross floor area of 10 per cent, subject to approval. This is down from the original land rate of $1,171 psf ppr, or $1,288 psf ppr without the balcony area. No development charge is payable.

Mr Ian Loh, Knight Frank’s executive director and head of investment and capital markets, said there “isn’t much impending supply in the Kembangan and Bedok area… hence new launches in the area are likely to be sought after”.

Knight Frank said if the 2nd collective sale attempt is successful, the plot could be redeveloped into as many as 581 new homes, at 100 sq m on average for each unit. The new tender for Windy Heights closes at 2.30pm on Sept 7.

Mr Paul Ho, chief mortgage consultant of icompareloan.com, said whatever decision owners make with regards to the 2nd collective sale attempt, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners.

One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

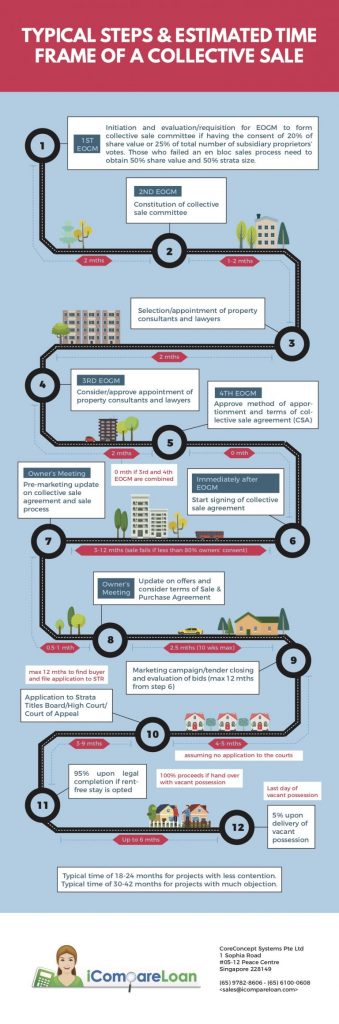

As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

How to Secure a Home Loan Quickly

Are you planning to invest in properties in the Kembangan area but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.