Figures released by the Urban Redevelopment Authority showed that developers sold 928 new Singapore private homes (excluding Executive Condos) in October 2019, easing by 26.9% from the 1,270 units transacted in the previous month as launches declined 48% month-on-month to 892 units.

However, Singapore private homes sales rose markedly by 84.9% from the 502 units shifted in October 2018, where there were fewer attractive launches and as prospective buyers contemplated their options following the introduction of new cooling measures in July 2018.

October’s Singapore private homes sales numbers took overall new home sales to 8,397 (excluding ECs) for the first 10 months of 2019 – up 12.5% from 7,461 units transacted over the same period in 2018.

Commenting on the Singapore private homes for October, Colliers International said, “firm prices at new launches appear to have driven some buyers to look at projects that are already on the market. Several previously launched projects continued to sell units at a relatively steady clip in October, with Parc Esta and Treasure at Tampines topping sales performance during the month.”

Colliers Research projects that new home sales in 2019 will likely exceed 9,000 units, surpassing the 8,795 units (excluding ECs) transacted last year.

The best selling private residential projects in October were: Parc Esta which sold 92 units at a median price of SGD1,686 psf; Treasure at Tampines which moved 88 units at a median price of SGD1,373 psf; Neu at Novena which transacted 54 units at a median price of SGD2,585 psf; Parc Botannia which shifted 49 units at a median price of SGD1,334 psf; and Midtown Bay which saw 48 units changed hands at a median price of SGD2,900 psf.

Top 10 Selling Projects in October 2019 (including EC)

| Project Name | Street Name | Locality | Units Sold in the Month | Median Price ($psf) in the Month | % sold to date (of total) |

| Parc Esta | Sims Avenue | RCR | 92 | 1,686 | 62% |

| Treasure At Tampines | Tampines Lane | OCR | 88 | 1,373 | 37% |

| Neu At Novena | Moulmein Rise | CCR | 54 | 2,585 | 62% |

| Parc Botannia | Fernvale Street | OCR | 49 | 1,334 | 90% |

| Midtown Bay | Beach Road | CCR | 48 | 2,900 | 22% |

| Stirling Residences | Stirling Road | RCR | 45 | 1,848 | 69% |

| Riverfront Residences | Hougang Avenue 7 | OCR | 43 | 1,337 | 80% |

| Royalgreen | Anamalai Avenue | CCR | 42 | 2,741 | 15% |

| Avenue South Residence | Silat Avenue | RCR | 40 | 1,990 | 37% |

| Parc Clematis | Jalan Lempeng | OCR | 32 | 1,606 | 31% |

Source: Colliers International, URA

Four new launches in October 2019

| Project Name | Street Name | Locality | Total Number of Units in Project | Units Launched in the Month | Units Sold in the Month | Median Price ($psf) in the Month | % sold (of launched) |

| Midtown Bay | Beach Road | CCR | 219 | 50 | 48 | 2,900 | 96% |

| Midwood | Hillview Rise | OCR | 564 | 100 | 24 | 1,640 | 24% |

| Neu At Novena | Moulmein Rise | CCR | 87 | 65 | 54 | 2,585 | 83% |

| Royalgreen | Anamalai Avenue | CCR | 285 | 108 | 42 | 2,741 | 39% |

Source: Colliers International, URA

Commenting on the Singapore Private Homes outlook, Ms Tricia Song, Colliers International’s Head of Research for Singapore said, “despite the global trade and geopolitical uncertainties, we believe demand for Singapore private homes is still relatively stable given the tight labour market, favourable interest rate environment, and relatively healthy household balance sheet.”

She added: “Home buyers continue to be value-conscious and selective, favouring projects that are near key transport nodes such as the Parc Esta, Treasure at Tampines, and Neu at Novena. We expect prices to continue to stabilise and rise by 2% for the full year 2019. Prices will likely be kept in check with the economic slowdown and an ample launch pipeline. There are also 4,653 private homes (excl. ECs) that have been launched but still unsold.”

“November’s launches got off to a good start. Sengkang Grand Residences reportedly sold 216 of the 280 units released for sale at the project’s 2-3 November weekend launch at an average selling price of around SGD1,700 psf. We believe the good demand at Sengkang Grand Residences could be due to its being the first integrated community and lifestyle hub in the north-east region. It appears buyers are willing to award a 30% premium for superior convenience and amenities as pure residential projects nearby such as The Quartz (completed in 2009) and Jewel (2016) transacted at about SGD1,000 – 1,300 psf in 2019-to-date.

On the other hand, Pullman Residences – a 340-unit hotel-branded residences with concierge services in Newton – reportedly sold 12 of the 25 units released over the 9-10 November weekend at an average price of SGD3,000 psf.

Looking ahead, we should expect buying interest to be sustained as developers roll out more new projects. Some of the potential launches include:

• In the prime CCR – Hyll on Holland (321 units, former Hollandia and The Estoril), Van Holland (69 units), One Holland Village (296 units), The Avenir (376 units), The Iveria (51 units), and former Tulip Garden (672 units)

• In the city fringe, launches include – Verticus (162 units) at Balestier, Verdale (258 units), and Amber Sea (132 units)

• In the suburbs, launches include – Dairy Farm Residences (460 units)”

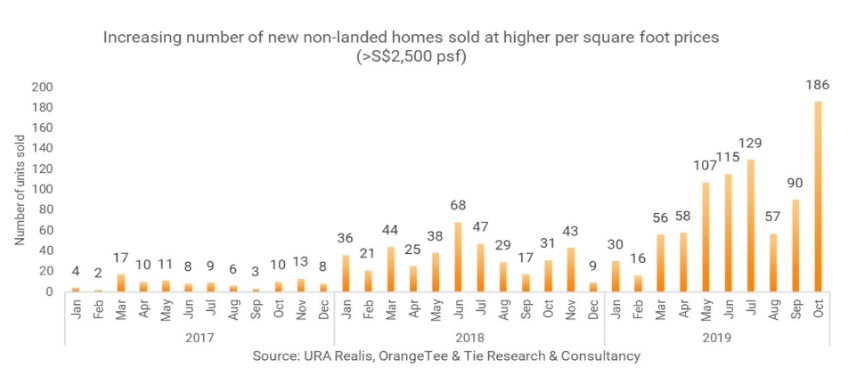

Orange Tee commenting on the same set of data by URA noted, “On a per square foot basis, the number of private homes (excluding bulk purchases of more than 1 unit) sold above S$2,500 psf has also reached a ten-year high with 844 units being transacted from January to October 2019. In October alone, 186 units were transacted above S$2,500 psf.”

It added: “Luxury properties in Singapore remained popular among both locals and foreigners. Singaporeans (72.7 per cent or 133 units) accounted for the lion’s share of non-landed new home purchases in CCR in October. The number of new luxury non-landed homes bought by foreigners (non-permanent residents) in CCR continued to rise with 36 units inked last month. For the first ten months of this year, foreigners bought 173 new luxury non-landed homes. This is higher than the number sold in the first ten months of 2016 (160 units), 2017 (150 units) and 2018 (161 units).”

“Luxury home sales volume is poised to rise further as there will be a number of high-profile luxury projects slated to be launched in early 2020 including One Holland Village (Holland Road), The Avenir (River Valley Close), The Atelier (Makeway Avenue), Van Holland (Holland Road) and a new project at Kampong Java Road.”