Government land sale site tenders awarded, announced URA

The Urban Redevelopment Authority (URA) on Jan 14 announced that it has awarded the tenders for the sites at Jalan Bunga Rampai and Irwell Bank Road to Wee Hur Development Pte Ltd and CDL Perseus Pte. Ltd. respectively. The public Government land sale site tenders for Jalan Bunga Rampai and Irwell Bank Road land banks was launched on 29 August 2019 and 31 October 2019 respectively.

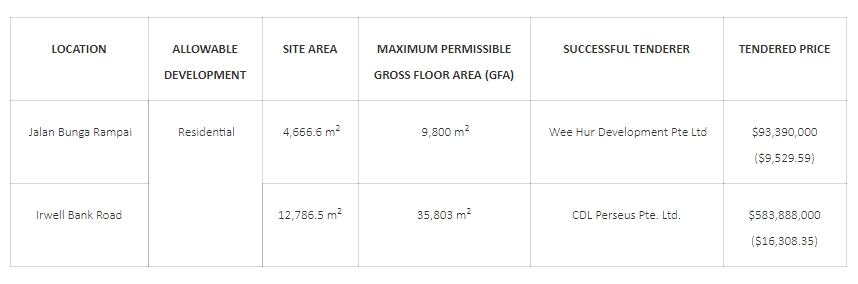

Details of the Government land sale site tenders awarded and the successful tenderers are provided below:

Commenting on the Government land sale site tenders, Colliers International said that the bids submitted were lower than expected.

Ms Tricia Song, Head of Research for Colliers International, Singapore, said:

“The Irwell Bank Road site attracted 7 bids with a top bid of about SGD583.89 million (SGD1,515 per square foot per plot ratio) from City Developments Limited. The second site – in Bartley Road/Jalan Bunga Rampai – attracted 9 bids with Wee Hur Development Pte Ltd placing the highest bid of SGD93.39 million (SGD885 psf ppr).

The bids that were submitted for both GLS sites – Irwell Bank Road and Bartley Road/Jalan Bunga Rampai – were lower than expected, further giving evidence to the cautious sentiment among developers as they continue to adopt a more prudent approach to land bids, amid market uncertainties, ample upcoming supply, and the cooling measures which remain in place.

Meanwhile, we note that the number of bids received for both sites is still healthy, reflecting keen interest in land acquisition but developers appear to be bottom fishing with lower bids for sites – perhaps mindful of potential risks, including the more subdued economic growth and the ABSD penalty. To this end, we believe developers will continue to take a conservative approach in acquiring sites.

IRWELL BANK ROAD

The top bid price was about 11% lower than our earlier expectations of SGD1,700 psf ppr, probably due to developers provisioning a higher margin for the 25% remittable ABSD should they not be able to build and sell the project within the stipulated timeframe of five years.

Performance of new 99-year leasehold projects in the vicinity has been mixed. As of December 2019, 455-unit Riviere, about 600 metres away from the Irwell Bank Road site, has sold 49 units at an average price of SGD2,890 psf since it was launched in May 2019. Martin Modern, another GLS site, has sold 381 units or 85% of its total 450 units since its launch in July 2017. Prices of units at Martin Modern have risen steadily from SGD2,152 psf at launch to over SGD2,600 psf currently.

BARTLEY ROAD/JALAN BUNGA RAMPAI

The Bartley Road site received nine bids, same as the one-north site which closed on 5 September 2019. This came as no surprise as it is the smallest residential site on the H2 2019 GLS programme with the potential to build just 115 units of around 85 sqm each. It is hence of a palatable development quantum which appeals to more developers. It is also deemed to be at a lower risk of not being able to sell-out within the ABSD timeline of five years.

The top bid price of SGD93.39 million or SGD885 psf ppr is slightly below our expectation of SGD900 psf ppr. Interestingly, the bid spread between the top and the second highest bidder was 16.6%, indicating non-consensus on the risk of the site.

Nearby comparable 99-year-leasehold private residential projects: Bartley Ridge (completed 2016), Botanique at Bartley (2019) and Bartley Residences (2015) – all built on previous GLS sites – transacted on the secondary market in 2019 at an average of SGD1,350-1,515 psf.”

The URA had earlier said that it has decided to moderate the total supply of private residential units since 1H2019 was driven by declining transaction volumes and lower demand for land from developers due to property cooling measures. The land supply for the GLS programme since 1H2019 is a slight decrease from the previous two exercises in 2018, which had 15 sites (six on the Confirmed List and nine on the Reserve List) for each six-month period.

Ministry of National Development explained that the private housing supply pipeline as at the close of 2H2018 stands at 45,000 units where 31,000 are unsold units from GLS and en-bloc sale sites with planning approval whilst 14,000 units are from sites that have pending planning approval. Moreover, the ministry revealed that around 28,000 existing private housing units remain vacant.

Mr Paul Ho, chief mortgage officer at iCompareLoan commenting on the Government land sale site tenders, said, “the property cooling measures introduced by the Government in July last year has cooled the demand by property developers. In recognising this, the Government has lowered its land supply for private housing since the first half of 2019 (1H2019).”

Mr Ho added,”but I had hoped that especially for the Jalan Bunga Rampai site, competition for the tender could be stiff. This is because of he fact that absolute land price will be affordable as it is a small site of 0.47 ha, which could generate about 115 units.”

Jalan Bunga Rampai is located in District 19. It is accessible through the nearest train stations such as Tai Seng (CC11), Bartley (CC12), and Mattar MRT (DT25). The nearest primary schools are Maris Stella High School, Methodist Girls’ School (primary), and Paya Lebar Methodist Girls’ School (primary).

This property is close to amenities like NTUC Fairprice at 77 Circuit Road and Hyper Nex, and Giant at Kovan Centre. The closest shopping malls are Upper Serangoon Shopping Centre, ICB Shopping Centre and Nex. Attractions of this site include its 400 metres walking distance to the Bartley MRT station (Circle Line) and partial unblocked view overlooking a low-rise landed estate. It is also within 1-2km from Maris Stella High School and Paya Lebar Methodist Girls’ School. Investors could also consider the potential rental catchment of the nearby Paya Lebar Industrial Park and Tai Seng Industrial Estate.