Singapore remains an attractive top investment destination with investment sales volume growing at an average growth of 5% per annum in over 2019-2024, not withstanding an expected decline in 2020

- Full-year 2020 transactions for commercial real estate activities to match 2019’s levels on REITs’ M&A activities.

- Residential transactions improved by 113% in Q1 quarter-on-quarter (QoQ) on strong public land sales.

- Residential market sentiment to recover in the longer run, underpinning an average growth of 12% per annum over 2019-2024.

- Merger and acquisitions in the industrial property sector to pick up in the second half of 2020.

Colliers International in publishing its latest market research report which examines the performance of Singapore real estate investment in Q1 2020 and its prospects ahead said Singapore remains an attractive top investment destination.

Colliers Research projects that Singapore investment sales volumes will grow on average by 5% per annum in longer-term, over 2019-2024 despite a 24% forecasted drop year-on-year (YOY) in 2020 as Singapore’s strong policy response to the coronavirus (COVID-19) pandemic is reinforcing its safe haven status.

Despite Covid-19 challenges Singapore remains top investment destination for the long term

Jerome Wright, Senior Director of Capital Markets at Colliers International, said, “The global disruption to economic activity caused by COVID-19 will mean challenging times in the short-term. However, the longer-term fundamentals of the Singapore real estate market remain strong and intact, and we can expect the market to recover as the successful control measures are lifted and industries regain full momentum.”

In the short-term, based on advance estimates from the Ministry of Trade and Industry (MTI), Singapore’s Q1 GDP contracted by -2.2% YOY, and Singapore is experiencing the worst decline since the global financial crisis.

In addition, according to Oxford Economics, as of 24 March 2020, the Singapore economy is forecast to head into its first recession in two decades, putting 2020 growth in the range of -4% to -1%.

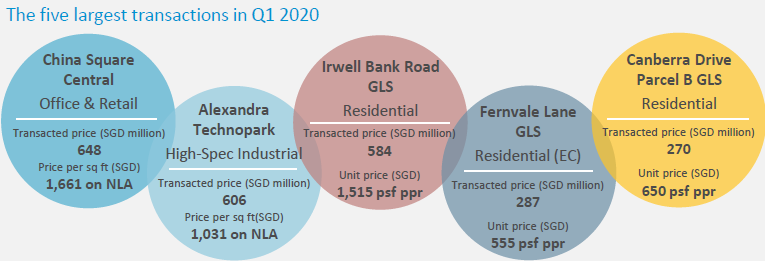

Colliers Research also reports some of the largest residential deals were closed during Q1 including five residential public land sales totaling S$1.4 (US$ 1.0) billion and two properties transferred during the Frasers Logistics and Industrial Trust (FLT) – Frasers Commercial Trust (FCOT) merger –China Square Central for S$648 million and Alexandra Technopark for S$606 million.

Tricia Song, Head of Research for Singapore at Colliers International, said, “In the absence of big-tickets deals, the residential sector led the quarter’s total investment volume for the first time since Q3 2018 at 51%. Developers’ sentiment is still cautious, judging from the relatively robust number of bidders but subdued bid prices during the land tenders.”

Commercial (Office and Retail)

Commercial investment sales slumped by 46.9% QOQ and 35.4% YOY to S$758 million, possibly due to fewer investible assets and price mismatch, coupled with the slowdown in office rental growth and the impact of COVID-19 outbreak.

Nevertheless, Colliers forecasts commercial real estate activities in 2020 to match 2019’s levels mainly on the upcoming materialisation of the CapitaLand Malls Trust (CMT) – CapitaLand Commercial Trust (CCT) merger in Q2.

Commercial Sector takes top spot in investor interest as Singapore remains attractive as a top investment destination

Jerome Wright added, “The commercial sector remains the most attractive for investors, as short-term disruption could give way to long-term opportunities. Investors should remain on the lookout for assets and position for a recovery. A significant rebound in H2 in Singapore is possible, given Singapore’s strong policy response to COVID-19, reinforcing its safe haven status.”

Residential

Residential transactions more than doubled QOQ and surged by 68.5% QOQ to S$2.0 billion in Q1 on strong public land sales. While developers had bid cautiously for these GLS sites given the market uncertainties ahead, buyers’ demand remained sustained at new condominium launches as well as in landed housing and Good Class Bungalow (GCB) sales.

Colliers Research anticipates the market sentiment to recover in the longer run, underpinning a growth of 12% p.a. on average over 2019-2024.

Industrial

Industrial investment sales saw a 50.8% drop QOQ as Q4 2019 was boosted by the MCT’s acquisition of MBC II, despite sales more than doubling up YOY to S$1.1 billion, anchored by FLT’s acquisition of Alexandra Technopark and Ho Bee Land’s tender for Biopolis Phase 6 site.

Steven Tan, Senior Director of Capital Markets at Colliers International, said “We forecast merger and acquisitions in the industrial property sector to pick up in the second half. Full-year volume, however, should ease from a strong 2019. Industrial assets remain attractive to qualifying investors due to their higher yields.”

Cushman & Wakefield said recently that Investment volume remained muted in 1Q2020 with sale of Government Land Sales dominating investment sales in 1st Quarter of 2020. Investment volume remained muted in 1Q2020 with a transaction volume of $3.02 billion, a 37 per cent reduction in volume from the fourth quarter of 2019. Cushman & Wakefield (C&W) who reported that investment volume remained muted said, “the 1Q 2020 investment sales tally was dominated by the residential sector with a volume of $2.02 billion, double the previous quarter’s volume.”

C&W added that the surge in volume was mainly attributed to the award of numerous residential GLS sites during the quarter, resulting in the public sector accounting for 68 per cent of the total residential volume.

An earlier report by CBRE said that as Covid-19 compels investors, investment volume will be supported by public and bite-sized deals. Preliminary real estate investment volume in Singapore for the first quarter this year amounted to S$2.47 billion, a 36.1% drop from the previous quarter. This marks the second consecutive quarter of decline in real estate investment volume.

The quarterly decline was due to the absence of significant transactions compared to last quarter and the lack of sizeable assets for sale this quarter. Nonetheless, investment sales were propped up by the luxury residential market and government land sales. There were also a fair number of related-party transactions, as well as bite-sized deals (deals below S$100 million), and this is likely to be the trend going forward.