Lenders will want to know your credit score to obtain a fast and objective assessment of your credit risk

Understanding Your Credit Score

Have you ever wonder how would the lenders view your credit risk level when applying for a credit facility?

You need to find out how lenders view you as most base their lending decision on credit report prior to making a decision. In most cases, they will also want to know your credit score to obtain a fast and objective assessment of your credit risk.

Hence, it is important to check your credit report regularly because your credit report changes whenever any of CBS members update your credit payment patterns on a monthly basis. A good credit repayment history will make it easier for you to obtain credit and to qualify for loans.

What is A Credit Score?

A credit score is a number used by lenders as an indicator of how an individual is likely to repay his debts and the probability of going into default. CBS credit score is based on the many types of information in the credit report to calculate a number that estimates your level of future credit risk.

The score ranges from 1000 to 2000, where individuals scoring 1000 have the highest likelihood of defaulting on a repayment, whereas those scoring 2000 have the lowest chance of reaching a delinquency status.

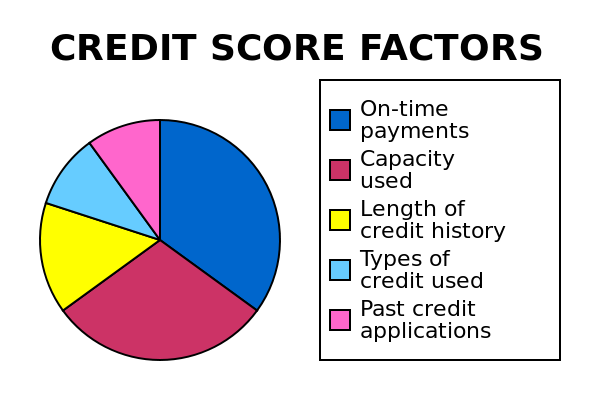

Factors Affecting Your Credit Score

- Utilization Pattern – This refers to the amount of credit owed/ used per account.

- Recent Credit – Number of newly opened credit accounts. It is advisable to apply for new credit in moderation.

- Account Delinquency Data – Presence of delinquency (late payment) on your loan accounts will reduce your credit score.

- Credit Account History – Accounts with a history of prompt payments will help to boost your credit rating.

- Available Credit – This refers to the number of accounts available (open or active) for credit.

- Enquiry Activity – Each time a potential lender pulls your credit report in response to a new credit application, an enquiry is placed on your file. Having too many enquiries in your credit report indicate to lenders that you are trying to take on more debt, therefore increasing your credit exposure.

How Do I Improve My Credit Score?

Here are some tips which you can adopt to enhance your credit reputation:

- Paying your bills on time and in full.

- Not having overdue/ outstanding balances.

- High outstanding debt will have a negative impact on your score.

- Not having bankruptcy and default information in your credit report.

- Limit the number of credit facilities you own.

- Not applying for lots of credit within a short period of time.

Understanding your credit report and score not only enables you to understand your current financial situation but as well have a clearer picture of how the lenders assess your credit worthiness.

It is important to check on your credit report regularly to ensure that information is accurate and up-to-date.

Mr Paul Ho, chief officer at iCompareLoan, said: “Although primary card holders are primarily responsible for the usage and payments due on the supplementary cards, the credit report will only show the factual credit data available of the principal cardholders. The credit history and repayment behaviour of supplementary card holders will not affect the principal cardholders.”

Lenders may use your credit score as a tool to assess your credit worthiness to decide if a loan should be granted. If your credit score is in good standing, your loan may be approved faster, with higher line assignment and lower pricing. Lenders will also take into consideration other factors such as the individual’s income, application documentations, existing banking relationship with the lender, the lender’s risk appetite, etc before extending credit to the individual. One thing to note on is, CBS does not play a part in the lender’s lending decision.

Credit repair is possible. A score is a “snapshot” of your risk at a particular point in time. The bureau score is dynamic and it changes as new information is added to your credit file such as taking up a new HDB loan with the bank. Your score is a reflective behaviour of your repayment history and it changes gradually as you change the way you handle credit. For example, a good credit score is derived from paying your credit card bills on time, all the time.

If you apply for multiple credit applications within a short period of time, it may have a negative impact on your credit score. Looking for new credit can equate with higher risk. Always approach credit in moderation.

If you have a joint credit account, these items could affect a score if they appear on your credit report. It is important that joint account holders understand that his or her repayment behaviour impacts the other joint account holder’s credit score.

A credit account held solely in the name of your spouse cannot impact your credit score if it is not a joint account.