A recent research by Knight Frank said that auction property listings under owner sale owner sale increased 15.8% q-o-q to 227 listings in Q2 2019, and that more owners are seeking auction to divest their properties to expedite their sales.

In contrast, the number of auction property listings under mortgagee sale declined 8.2% q-o-q amid a slower economy, said the same report.

Table of Contents

Sharon Lee, Head of Auction & Sales at Knight Frank, said: “While the external environment is uncertain, buyers that purchased in auctions during similar market conditions in 2015 and 2017 enjoyed higher returns if they are able to hold out through the downturn.”

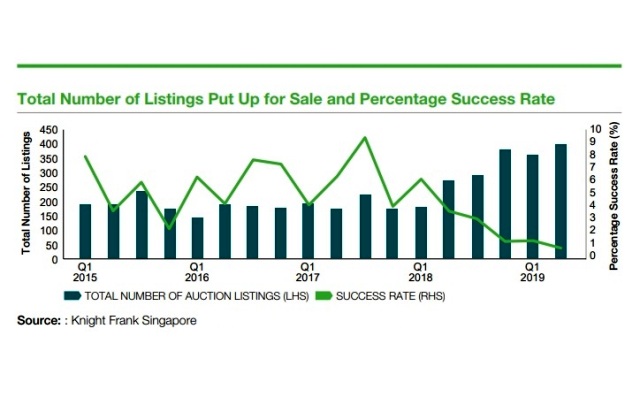

The research report highlighted that there were 400 property auction listings in Q2 2019, up 10.5% quarter-on-quarter (q-o-q). Compared to a year ago, the number of auction listings was 47.6% higher. It noted that three properties were sold under the hammer in Q2 2019, amounting to a total sales value of S$3.9 million.

The properties successfully auctioned were an apartment in Skysuites @ Anson, an apartment in Cote D’zur, and a HDB shop at Boon Lay Shopping Centre. The report added that the success rate based on total number of auction listings lowered to 0.8% in Q2 2019.

“The success rate has declined progressively since 2018, falling from 6.4% in Q1 2018, to 1.4% in Q1 2019, and to 0.8% in Q2 2019. More buyers were on the side lines under the current market conditions, but they would still bid if they find value in properties in the listings.”

In view of the continued uncertainty in global macro-economic outlook, Knight Frank envisages number of auction property listings to increase y-o-y by end 2019.

Ms Lee said, “the volatile financial markets and the digital transformation in the service sectors are likely to result in a more active capital flow in asset owners as they recalibrate their portfolio to optimise returns.”

She added, “the overall success rate for 2019 is envisaged to remain low. Buyers are likely to remain discerning and hold a wait-and-see approach. Nonetheless, choice properties with attractive locational attributes priced reasonably will remain in demand.”

An earlier report by Edmund Tie & Company (ET&Co) said that property auction market is affected by last year’s cooling measures. It said that many buyers appear to adopt a wait-and-see attitude, especially with many upcoming new launches, giving buyers a wide variety of choices.

Head of auction & sales at ET&Co, Joy Tan, who was handling the sale of the unit commented, “In the ever-changing Singapore landscape, one will never know if a high-rise building may be built in front of your property affecting the views. For example, many buildings in District 1 currently enjoy unblocked sea views.”

M Tan added, “however, with the draft URA Master Plan 2019 being announced for more residential buildings to enter the district, one might worry if their views are indeed permanent. Nonetheless, with our unit at Grange Residences, such a GCBA and embassy cluster is unlikely to be shifted. The new buyer will thus enjoy this breathtaking view for a long time.”

Another report by Colliers International said that property auction market in 2018 reached record high amid slower sales. Colliers said that it expects property auction listings and sales to grow in 2019 as residential cooling measures continue to bite, and interest for non-residential properties grows.

Ms Tricia Song, Head of Research for Singapore, Colliers International, said “Going by our data, the number of mortgagee listings has risen gradually in the last five years, possibly stemming from the bull run in the market in 2011, 2012 and 2013 where some buyers might have snapped up units at elevated prices, and subsequently found themselves unable to service the mortgage payments.”

She added, “This year, we expect property auction listings – both owners’ and mortgagee listings – and sales to grow as cooling measures continue to bite for the residential segment and more owners putting up non-residential properties for sale.”

Mr Paul Ho, chief mortgage consultant at iCompareLoan, commenting on the research on auction property listings said, “the property auction sales is comparable to the time when the Total Debt Servicing Ratio policy was introduced in 2013.” He added, “generally, in this season, there will be a lack of high quantum properties sold via property auction sales.”

Unlike other property auction sales markets, successful sales in Singapore may not result in significant savings for the successful bidders. The bidding wars of the past which saw properties being sold for higher prices than their valuation price are also almost non-existent.

How to Secure a Home Loan Quickly

If you are eyeing freehold landed site like the one at 537 Upper Changi Road, but are ensure of funds availability for purchase, our mortgage consultants at iCompareLoan can set you up on a path that can get you a home loan in a quick and seamless manner.

Our consultants have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.