The average Loan-to-Value ratio has moderated in recent years, with property values significantly exceeding their loan values.

Loan-To-Value Ratio steadily declined to 44% as of Q2 2022

Minister in Charge of the Monetary Authority of Singapore (MAS), Tharman Shanmugaratnam, said in response to a parliamentary question that the average Loan-to-Value (LTV) ratio has moderated in recent years, with property values significantly exceeding their loan values. This refers to LTV ratios averaged across outstanding mortgage loans granted by financial institutions.

He added that the available data showed that the average LTV ratio increased from 44% to a peak of 54% between 2011 and 2017, before steadily declining to 44% again as of Q2 2022.

Mr Tharman was responding to a parliamentary question of the Workers’ Party MP, Chua Kheng Wee Louis. Mr Chua had asked:

“Since the 2008 Global Financial Crisis, what have been the changes in the average Loan-To-Value ratio and the percentage of mortgage loans being used to finance owner-occupied properties as against investment properties; and in comparison to these changes, what is the Government’s current assessment of the risk to a higher LTV ratio through the downside to residential property valuations.”

In his reply to Mr Chua, Mr Tharman added that the share of mortgage loans for financing owner-occupied properties increased from 74% in 2008 to 79% in 2022. Correspondingly, the share of mortgages for financing investment properties fell from 26% to 21% over the same period.

He believes that the low average loan-to-value ratio provides financial institutions and existing borrowers with a good buffer against falling property valuations.

“However, with interest rates rising and increased uncertainty on global growth prospects, I urge households to exercise prudence and ensure that they are able to service their debts when taking on long-term financial commitments including property purchases,” Mr Tharman said.

To mitigate such risks, the MAS has tightened credit rules over the past year to curtail the loan amount that new borrowers can take out, including a lower Total Debt Servicing Ratio (TDSR) threshold.

From an economic perspective, any change in credit conditions will have an impact on demand thus bringing about a change in market-clearing price and (or) sales volume. Down-payment forms an essential component in the financing of a property purchase. In the Singapore’s context, for residential property purchases, down-payment is funded by cash and (or) Central Provident Fund balances.

This implies that a raise in down-payment as a percentage of the purchase price [equivalent to a lower loan-to-value ratio (LVR)] will lead to, ceteris paribus, a decrease in demand for residential property.

Intuitively, the decreased demand is spurred by the greater number of buyers exiting the market. Generally, for first-time buyers accumulating the savings needed for down-payment constitute a major hurdle in property purchases hence a lower LVR will deter this group of buyers from making purchases. Repeat buyers who wish to upgrade or purchase another property will be hesitant to do so thus depressing demand.

Average Loan-to-Value ratio can be explained simply

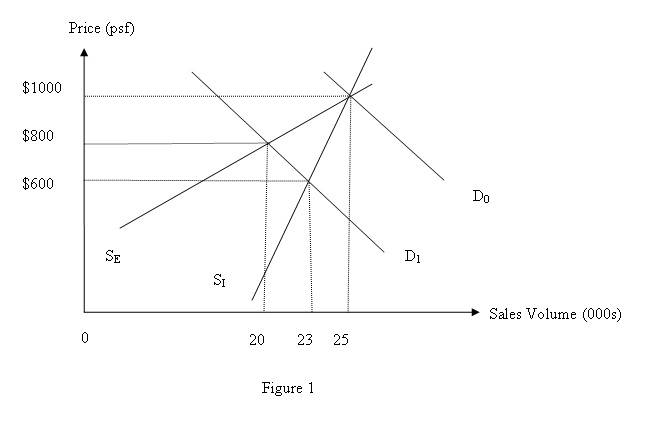

Using a simple demand-and-supply analysis, we will illustrate the dynamics of an increase in the down-payment percentage. We assume the classic case of a downward-sloping demand curve and an upward-sloping supply curve. On the supply side,the key determinant of the magnitude of change in market-clearing price and sales volume is the price elasticity of supply. This parameter measures the relative responsiveness of quantity supplied due to a change in the price of the good itself, ceteris paribus.

For simplicity, we omit the two extreme cases of a perfectly price elastic supply (PES= infinity) and a perfectly price inelastic supply (PES=0).

SI is the supply curve that is relatively price inelastic (PES < 1)

SE is the supply curve that isrelatively price elastic (PES > 1)

Figure 1 shows that when down-payment rises, ceteris paribus

i) the demand curve for property shifts to the left from D0 to D1

ii) there is a decrease from the initial market-clearing price of $1000 psf and sales volume of 25000

iii) the magnitude of decrease in market-clearing price and sales volume is contingent on the price elasticity of supply

iv) when the supply curve is relatively price elastic, SE,the market-clearing price and sales volume decrease to $800and 20000, respectively.

v) when the supply curve is relatively price inelastic, SI,the market-clearing price and sales volume fall to $600 and 23000, respectively.

Hence we can conclude that if supply is relatively price inelastic, the decrease inmarket-clearing price is steeper, but the fall in sales volume will be smaller.

In the short run, it is realistic to believe that the supply of housing is relatively price inelastic as property developers cannot quickly adjust supply in response to demand changes. For example, developers are unlikely to put off property launches that have been planned before the fall in demand.

In contrast, in the long run, developers can reduce the construction of new property; consequently supply becomes more elastic.

Relating this economic analysis to the Singapore’s residential property market, we observe that the Government implementing cooling measures is aimed at increasing the down-payment percentage. Since Sept 2009, the Government has made several attempts to stabilise soaring property prices.

Mr Paul Ho, chief officer of iCompareLoan said: “With the new regulations and the weak economic climate, you will want to optimise your financial resources when applying for new home loans or refinancing your current one.”

“Loans seekers should make use of the mortgage advisory service which are usually free, to find the best home loan in town that will serve their needs,” he added.