Investors and developers are looking to convert big-box retail stores to take advantage of the higher returns and strong rental growth of the logistics sector

Pressure on the logistics sector to keep pace with the boom in online shopping is prompting developers to convert large-format retail sites into warehouses.

While big-box retail – those sprawling megastores that have proliferated in recent decades – has performed well compared to other parts of the sector over this year, investors and developers are looking to conversions in a bid to take advantage of the higher returns and strong rental growth of the logistics sector, says Stuart Taylor, senior director of retail investments, JLL.

“Major retail landlords are already evolving their strategy to maximise asset values through the integration of alternative uses, including hotels, office and residential,” he says. “The integration of logistics uses in certain large-format retail assets, or complete conversion of these assets, is a logical next step and is driving new capital sources to the retail sector that is increasingly focused on alternative use potential.”

In Australia, at least two retail sites have been bought with the intention of conversion: The 22,000 square metre City West Plaza in Melbourne, purchased by Cadence Property Group and Assembly Funds Management for A$39 million in May this year, and Homemaker Prospect in Sydney, purchased by Dexus for A$65 million in October 2019.

Dexus is just one among several Australian REITs re-weighting their portfolios towards industrial as institutional investors look to the sector for its resilience and operation criticality amid ongoing economic uncertainty.

“It’s a fantastic location, it’s been bought with a great holding income, and our intention is to convert it over time to industrial,” Dexus chief executive Darren Steinberg, said in The Australian Financial Review at the time of purchase.

Size, speed, location

Most big-box retail stores, which are typically tenanted by heavy home goods stores, are located within densely populated metropolitan areas, as well as close to large logistics hubs. This is practical for supporting not just rapid delivery, but also the high return rates associated with online purchases.

The low site coverage of big-box retail sites is also considered a draw. In Sydney and Melbourne, buildings usually only take up half of the site area, while customer parking accounts for the rest.

Conversions present an opportunity to extend the coverage of sites with income-generating industrial buildings without the need to adjust existing buildings as the physical structure of large-format malls is similar to industrial units, says Taylor.

“Prime large-format retail sites will continue to be in high demand from retailers, but as long as logistics trends continue on their current trajectory, there will be pressure to convert sites where there is underutilised land, a secondary tenant mix, or where the site is competing with a similar asset in the same area,” he says.

Value added

Converting a big-box retail asset in Sydney to industrial use could increase rents by approximately 13 percent if space increased by more than 10,000 square metres, bringing site coverage to 65 percent, according to the JLL report Extracting Value from retail. The capital value would increase by 36 percent.

In the United States there is double the amount of retail space per person. A looser planning system has led to an oversupply of retail buildings, and many defunct malls have converted to industrial.

This includes the Randall Park and Euclid Square Malls in Ohio, which have been converted into fulfilment facilities by Seefried Industrial Properties, resulting in a 20 percent increase in lettable area across the assets.

In the United Kingdom, Industrial property company Prologis purchased Ravenside Retail Park, 15km from central London, for A$103 million (GBP51.4 million) and has earmarked the site for ecommerce fulfilment.

Increasing the number of logistics facilities in metropolitan locations will be key to the ongoing growth of ecommerce, says Andrew Quillfeldt, head of retail research, Australia – JLL.

“Retail to logistics conversions present an opportunity for landlords to leverage off demand for strategically-positioned last mile fulfilment facilities. Large format retail assets have the right physical characteristics, such as location and load bearing capacity, which makes industrial conversion more feasible compared with traditional enclosed shopping centres.

“Self-storage, data centres, cold-storage and entertainment production spaces, are other possible redevelopment options,” he adds.

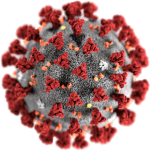

In an earlier report, JLL said that the supply of goods – or lack thereof – has become a burning issue amid restrictions aimed at slowing the spread of COVID-19. From surgical masks to empty grocery-store shelves, supply shortages have highlighted weaknesses in how goods are sourced, distributed and where they’re stored.

While managing these risks has always been important, the rapid development of the pandemic is set to accelerate decisions on building a more robust system, says Rich Thompson, who leads the global supply chain consulting practice for JLL.

“You can be sure to expect probing questions, from Boards of Directors to their CEOs, around what they will be doing to ensure that there is minimal disruption the next time a major global pandemic or any catastrophe happens,” he says.

The recent pandemic is not the first, nor the last, major disruptor to global supply chains. The devastating tsunami in Japan in 2011 kept the auto industry reeling for months, while flooding in Thailand affected the supply chains of many computer manufacturers dependent on hard disks.

A survey last year by global law firm Baker McKenzie found that 50 percent of multinationals were expecting “major changes” to their supply chains, with more than 10 percent advising of a “complete overhaul.”

“As companies focus on adapting their strategies to account for the next disruption, diversification will be key,” says Thompson.