Buying HDB flat using CPF is often the only option for many buyers in Singapore. Using your CPF Ordinary Account (OA) savings to finance your HDB flat is an alternative to using cash. However, you should not use all your CPF OA savings to finance your HDB flat. CPF is essentially for your retirement. The more you use for property, the less you may have for retirement.

Before buying HDB flat using CPF, do keep in mind the other items you are servicing with your CPF OA savings, such as your children’s local tertiary education and insurance premiums; the reduced CPF contribution rates as you age; and also, you have to be insured under the Home Protection Scheme or a mortgage insurance when you use CPF for monthly installment of your housing loan.

The Home Protection Scheme (HPS) protects CPF members and their families from losing their HDB flat in the event of death, terminal illness or total permanent disability. The HPS is a mortgage-reducing insurance that protects members and their families against losing their HDB flat in the event of death, terminal illness or total permanent disability. HPS insures members up to age 65 or until the housing loans are paid up, whichever is earlier.

You have to be insured under HPS if you are using your CPF savings to pay your monthly housing loan installments on your HDB flat. HPS does not cover private residential properties, such as executive condominiums (ECs) or privatised Housing and Urban Development Company (HUDC) flats.

How do I choose between a bank loan and an HDB concessionary loan when buying HDB flat using CPF?

Table of Contents

https://www.icompareloan.com/resources/types-of-loans-in-singapore-financing-costs/

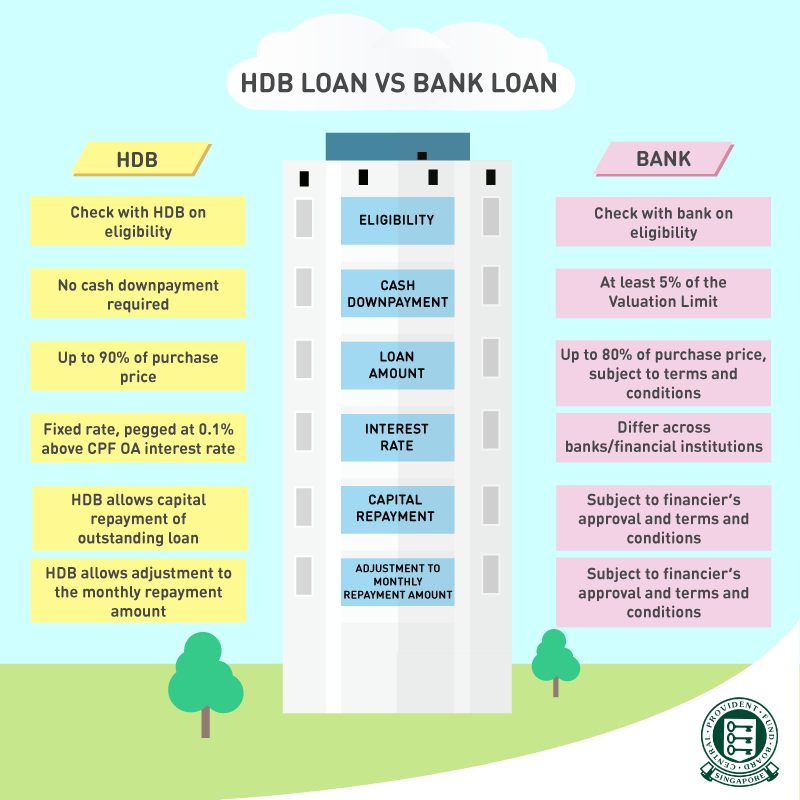

You should consider several factors when deciding between an HDB concessionary loan and a bank loan.

Another important consideration when buying HDB flat using CPF is how to determine a suitable loan amount, repayment period and repayment amount that is within your financial means. You can try the various calculators which provides an estimate of an affordable home price, taking into consideration your gross household income and expenses, as well as the repayment amount with its repayment period.

This is also where the services of a mortgage consultant becomes useful when buying HDB flat using CPF. This is because the consultant, being a professional, will be able to estimate an affordable home price, taking into consideration your gross household income and expenses, as well as the repayment amount and repayment period.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

To use your CPF for an HDB concessionary loan, you should complete the CPF withdrawal form (HPS/9) at HDB’s office. HDB will then forward the completed form to CPF Board. Your application will be processed within five working days upon receipt. You also have to be insured under the Home Protection Scheme if you are using your CPF to repay your HDB concessionary loan.

Before buying an HDB flat, one should check the property prices in the areas of interest and compute their finances and fees payable, to ensure that they are buying within your financial means.What many may want to know is, how much CPF Savings they can use.

One should be mindful not use all their CPF savings to finance their private property, because CPF is essentially for ones retirement. The more it is used for property, the less one may have for retirement. One also has to bear in mind the other items one is servicing with your CPF savings (such as children’s local tertiary education and insurance premiums; and the reduced CPF contribution rates as one ages).

The CPF Public Housing Scheme (PHS) enables CPF members to use their CPF Ordinary Account (CPF OA) savings to buy new or resale Housing and Development Board (HDB) flats. Under the PHS you can use your CPF OA savings to buy an HDB flat – both new Built-To-Order flats as well as resale flats. All CPF members who are eligible to buy a new or resale HDB flat are eligible to use their CPF savings under the Public Housing Scheme.

Written by: Phoenix Lee/Contributor iCompareLoan

How to Secure the Best Home Loans Quickly

iCompareLoan is the best infomercial loans portal for home-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!