The new CPF usage rules which was touted as being able to provide more flexibility for Singaporeans to funding homes for life will not affect the majority of home buyers, said a report by List Sotheby’s International Realty (List SIR). It said home buyers will not be affected as they are already purchasing a property which lasts them to the age of 95.

The Government said on May 9 that the new CPF usage rules will now focus on whether the remaining lease of the home can cover the youngest buyer until at least the age of 95.

Under the new CPF usage rules, the total amount of CPF that can be used for property purchase will depend on the extent the remaining lease of the property can cover the youngest buyer to the age of 95.

Table of Contents

| Remaining lease of property is at least 20 years and can cover youngest buyer until at least the age of 95 | New rules on total use of CPF (with effect from 10 May 2019) |

| Yes | Buyer can use CPF to pay for the property up to the VL |

| No | Use of CPF will be pro-rated based on the extent the remaining lease of the property can cover the youngest buyer to the age of 95. This will help buyers set aside CPF savings for their housing needs during retirement (e.g. a replacement property). |

The authorities said to ensure prudent use of CPF monies, as well as for funding homes for life, there will still be a minimum lease requirement for the use of CPF for property purchases.

Previously, buyers of HDB flats faced restrictions on the amount of HDB housing loan they could get to purchase flats with remaining leases of less than 60 years. With this update, buyers will now be able to take an HDB housing loan of up to the full 90% Loan-to-Value (LTV) limit , if the remaining lease of the flat can cover the youngest buyer to the age of 95.

https://www.icompareloan.com/resources/new-cpf-usage-rules/

If the remaining lease of the flat cannot cover the youngest buyer to the age of 95, they can still take an HDB loan but the LTV limit will be pro-rated from 90%, based on the extent that the remaining lease can cover the youngest buyer to the age of 95.

Commenting on the rules change, List SIR said rules have now been updated to take into account the changing needs and higher life expectancy of Singaporeans.

Commenting on the impact of rules change for private properties, the real estate agency said: “We envisage the announced changes to have some impact on buyers and sellers of private properties. First, besides the fact that freehold properties will be more sought afters, the pool of buyers for older leasehold properties with 30 to 40 years of lease left will be increased and with more liquidity injected into the market for such properties.”

“Older buyers will be more open to buy such older properties, while younger buyers will be more akin to look for newer leasehold homes. Older people with larger CPF accounts would also be more willing to invest in properties.

“As for sellers, existing homeowners with properties with 20 to 40 years of lease remaining will likely see a smaller drop in the prices of their properties. This would also extend the economic life of older leasehold properties such as Mandarin Gardens, Pine Grove and Horizon Towers which were unsuccessful in their collective sale process.”

Commenting on the CPF withdrawal rules after age 55 with property, List SIR noted that previously, CPF members above the age of 55 could withdraw their CPF savings above the Basic Retirement Sum (BRS) if they owned a property with a remaining lease of at least 30 years.

List SIR said this was to ensure that they have secured a home in retirement and a basic level of retirement income. To encourage funding homes for life and to secure at least a basic level of retirement income, CPF members will now need to have a property with sufficient remaining lease to cover them until at least the age of 95, before they can withdraw their CPF savings above the BRS.

As all HDB flats and the vast majority of private properties have leases that can last a 55-year old member until the age of 95, this change is not expected to affect most CPF members List SIR said.

Along with the changes in the use of CPF to buy properties, which includes private properties and executive condominium units, there were also updates to HDB housing loan rules for HDB flat buyers, List SIR said. Previously, buyers of HDB flats faced restrictions on the amount of HDB housing loan they could get to purchase flats with remaining leases of less than 60 years. Basically, buyers will now be able to take an HDB housing loan of up to the full 90% Loan-to-Value (LTV) limit, if the remaining lease of the flat can cover the youngest buyer to the age of 95.

Put together, these changes will give buyers more flexibility in funding homes for life while safeguarding their retirement adequacy, List SIR said.

Buyers who bought properties before 10 May 2019 and are still servicing their housing loans will not be affected by these changes. Those who bought their property and turned 55 years old before 10 May 2019 can continue to apply to CPF Board to withdraw their CPF savings above their BRS under the previous rules.

The authorities have also advised those who are mid-way through a property purchase can approach CPF Board or HDB for clarifications and assistance.

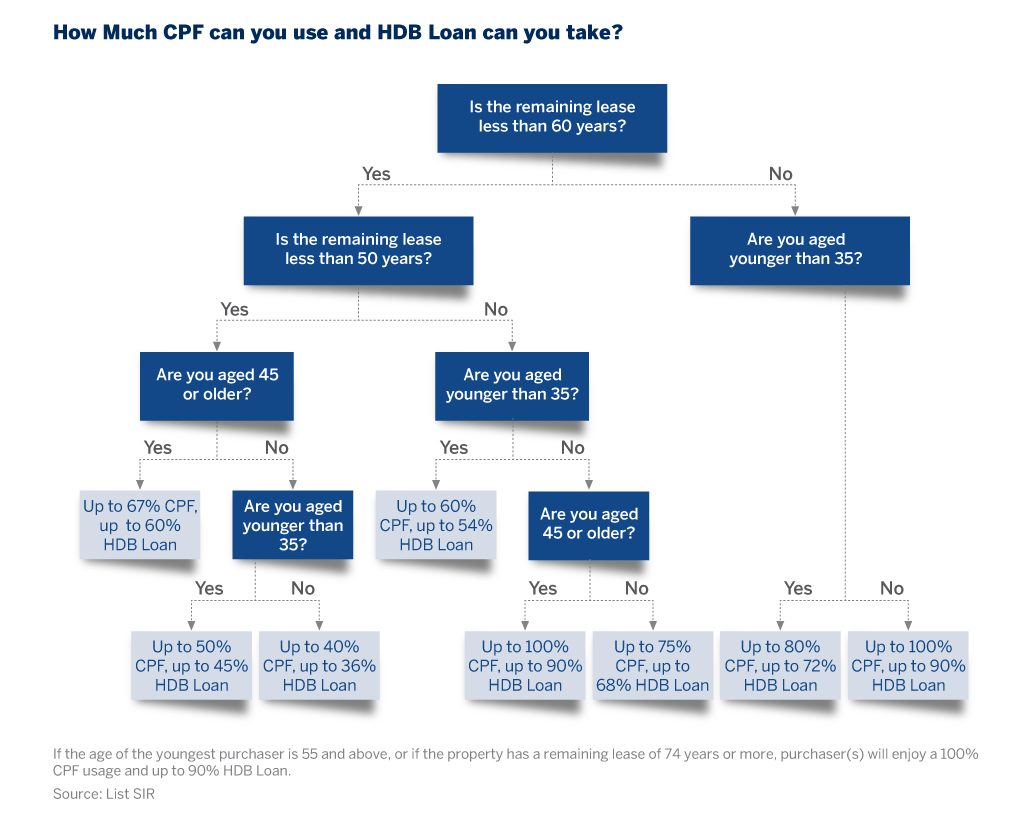

In its report, List SIR also released a flow chart below to help home buyers find out how much CPF they can use to buy their property and how much loan they can take.

How to Secure a Home Loan Quickly

Are you planning to invest in properties during this period of private home price decline but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.