Kemaman Point, an 89-unit residential development along Balestier Road, has been collectively sold for $143.88 million to Soilbuild Group Holdings after a trying collective sale process. The site was put up for sale at a tender price of $143.8 million or $1,180 per square feet per plot ratio (psf ppr). Knight Frank Singapore, the marketing agent for the successful collective sale said that each owner stands to receive $1.4 million to $2.32 million from the sale of the freehold condominium.

Knight Frank said that the sale price to redevelop the site to a gross plot ratio (GPR) of 2.8 based on the maximum permissible Gross Floor Area (GFA) of about 122,711 square feet (sq ft), translates to a land price of about $1,173 psf ppr. The agent added that with the inclusion of a 10 per cent bonus balcony and a proposed plot ratio of 3.08, the land price works out to about $1,111 psf ppr, inclusive of a development charge of about $6.1 million.

The conclusion of the sale is however subject to an order of sale by the Strata Titles Board or the High Court. It was previously reported that some residents of the freehold property at Balestier Road were unhappy about the collective sale.

The collective sale committee chairman, Peter Mao, in trying to avoid acrimony between residents, opted for a transparent collective sale process reported Today Online in November 2017.

Table of Contents

Back then, the collective sale was yet to receive the requisite number of residents’ approval. Mr Mao in explaining how some residents are not in favour of the collective sale said how a resident raised his hand to say that he was uncomfortable with the suggested reserve price. “I’ve known him for years…Since then, he’s given me the cold shoulder,” he added.

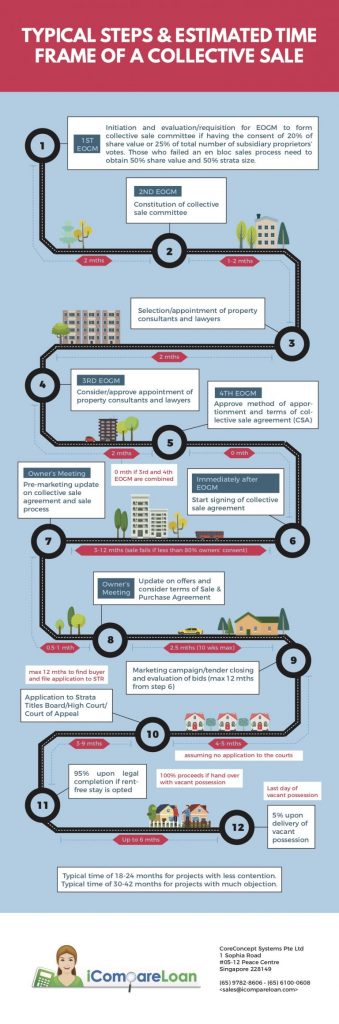

The typical time required for applying to the Strata title Board (STB) or High Court is between 3 to 9 months. If there is a challenge to the collective sale process, objectors may apply to the High Court to block the En Bloc sales process based on certain grounds. This could drag out the process by a further 4 to 5 months.

The collective sale process is such that once the relevant authorities such as Strata titles board (STB) or High Court approves the sale, it takes another 3 months to complete the en bloc sales process.

https://www.icompareloan.com/en-bloc-sales-process-guide-singapore/

Mr Paul Ho, chief mortgage consultant of icompareloan.com, said whatever decision owners facing en bloc sale made, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners. One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

Ian Loh, executive director and head of investment and capital markets at Knight Frank Singapore, said: “The new high-rise development will enjoy unobstructed views towards Jalan Kemaman, over low-rise landed houses. We believe the new development will be sought after given the recent rejuvenation of the Balestier area, as well as the limited supply in the vicinity.”

Mr Mao said: “The (collective sale) process has been transparent and we hope to garner the 100 per cent consensus to quicken the process for owners to proceed with their next home purchase.”

If you have successfully sold your apartment en bloc and are now home hunting, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you now.

Our affordability assessment and best home loans will put your heat at ease and the services of our mortgage loan experts are free. Our analysis will give best home loan seekers better ease of mind on interest rate volatility and repayments.

Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com for a free assessment.