Covid-19 Tested Office market and gave rise to tele-commuting

The Covid-19 pandemic have led to more than 80% of the Singapore workforce telecommute during the lockdown period, noted a recent research by List Sotheby’s International Realty (List SIR). Businesses have made that leap to remote working, setting off a trend that might displace the need for huge office spaces, noted List SIR.

Even as the lockdown is gradually easing, companies will have to rethink how work desks should be arranged and whether ideas such as hot desking should be continued. As telecommuting becomes more and more acceptable, firms may downsize their footprint within the Central Business District (CBD) to reduce a high workforce concentration in one location as they adhere to social distancing requirements through creative scheduling of headcounts.

With the lockdown, businesses are suffering a double whammy from the loss of income and bearing of business costs. Although fiscal measures in the form of job support schemes, waiver of foreign workers’ levy, rental and tax rebates, and skills upgrading have provided some relief, the economic uncertainty is still there because no one knows how long the pandemic will last.

Covid-19 Tested Strata Office Sales and caused Marked Slowdown

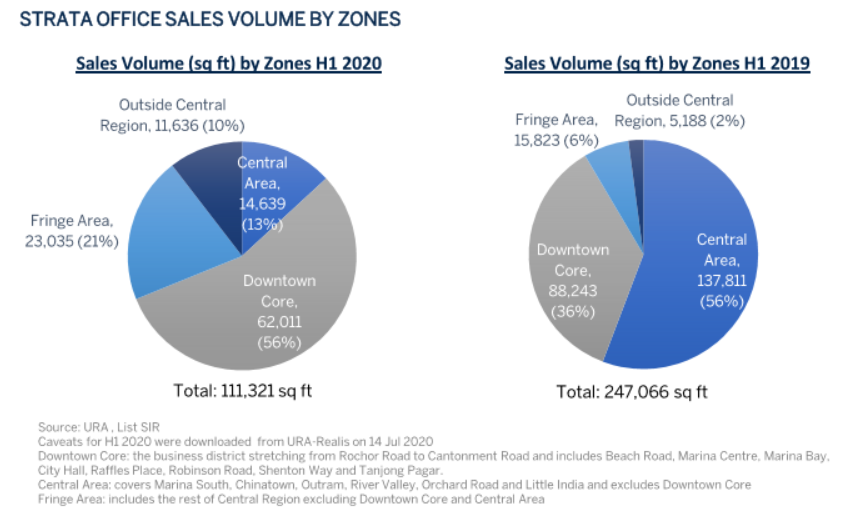

List SIR noted that based on URA’s caveat data, a total of 111,321 sq ft of strata office space had changed hands in H1 2020. This volume is only 45% of the strata office space transacted over the same period in 2019. In terms of investment value, the total amount invested in H1 2020 was $272.21 mil, less than half of the $598.45 mil in H1 2019.

“Transactions in the Downtown Core dominated the sales volume, with a large share of 56%. Transactions in the Fringe Area clinched the second place with 21% of the market share, followed by 13% in Central Area and 10% in Outside Central Area. In H1 2019, transactions in Central Area led with 56% of the sales volume while Downtown Core came in second with a 36% share. The Fringe Area and Outside Central Region had only single digit share in the market.

“Suffice to say that sentiments in H1 2019 were totally reversed as the market then was very robust, driven by expansion of technology companies and flexible workspace operators. The steep decline in office transactions in H1 2020 could be attributed to businesses holding back their expansion plans during the crisis.”

Covid-19 Tested the Downtown Core

In H1 2020, a total of 61,086 sq ft of strata office space were transacted in the Downtown Core. This was 31% lower than the total space transacted in H1 2019. The decline was seen in Tanjong Pagar and Cecil Street/ Robinson Road/ Shenton Way sub-markets. While transactions in Raffles Place was similar in the two periods, City Hall saw a 39% rise to 42,486 sq ft over 30,602 sq ft in H1 2019. The spike in the City Hall sub-market could be attributed to mega units at Suntec City that were sold: a 14,380 sq ft office on level 10 and an 11,840 sq ft office on level 33.

Based on the caveats lodged, prices of strata office at Raffles Place and City Hall were still on the rise in H1 2020. At Raffles Place, there was only one single transaction at Samsung Hub. It comprises four strata units adding up to 13,100 sq ft and the $3,800 psf is the highest for a single strata office floor within the CBD in the last five years. Prices at City Hall sub-market rose by 13% from a year ago to $2,700 psf, underpinned by a few high floor units that fetched between $2,900 psf and $3,200 psf.

Of the 20 deals in Downtown Core in 2020H1, seven were below $1.0 mil each, for sizes below 500 sq ft. Another seven deals were in the $1.0-$5.0 mil price band for sizes between 600 sq ft and 2,000 sq ft. The remaining six deals ranged from $6.0 mil to $38.0 mil.

Office leasing activity slowed down in H1 2020, following the implementation of the circuit breaker in April. URA’s data for Category 1 space (good quality buildings with large floor plates in Downtown Core and Orchard Planning Area) showed that median rents peaked in Q3 2019 and corrected to $10.59 psf/month in Q1 2020. As for Category 2 space (rest of the island), rents peaked in mid-2019 and eased to $5.49 psf/month in Q1 2020.

Bearing in mind the weakening global economy, leasing demand is expected to decline, pressurising rents to fall further in H2 2020.

Covid-19 tested the Investment Deals

List SIR noted that the largest investment deal in 2020H1 was the purchase of a 50% stake in AXA Tower by Alibaba Group for around $840 mil based on a total value of $1.68 bn. Approval has been obtained to further increase AXA Tower’s gross floor area to 1.55 million sq ft should it integrate hotel and residential usage under the CBD Incentive Scheme.

Another notable deal was the sale of a 30% stake in TripleOne Somerset to Shun Tak Holdings for around $342 mil, based on a total property value of $1.14 bn.

A third significant sale was that of the retail and commercial units in 30 Raffles Place to Saudi Arabia-based Olayan Group. The retail lots at levels B2, B1, Levels 1 and 2 were sold at $192.7 mil while the office lots on levels 3, 4 and 5 were sold for $122.3 mil.

Covid-19 Tested the Resilience of the Co-Working Space

There were some newly opened co-working venues during the circuit breaker period. JustCo opened a 45,000 sq ft premise at OCBC Centre East and Arcc Spaces debuted its 19,000 sq ft flagship centre at One Marina Boulevard.

More new flexi workspaces are scheduled to be opened in Q3 2020. They are WeWork at 30 Raffles Place (82,000 sq ft), JustCo at The Centrepoint (60,000 sq ft) and The Work Project at CapitaGreen (21,500 sq ft).

Outlook

In noting that the Singapore economy entered technical recession in Q2 2020 as the GDP contracted by 12.6% y-o-y, following a mild 0.3% y-o-y contraction in the previous quarter, List SIR said.

“The sharp fall was due to the lockdown from 7 April to 1 June, as well as weak external demand. It is unsurprising that the International Monetary Fund (IMF) recently downgraded its outlook on the global economy as the pandemic ravaged on and projected a contraction of 4.9% y-o-y.

“The road to recovery in the coming months will be challenging, depending on how well the infections can be contained and reduced. Businesses will likely keep a nimble budget so as to tide over this tough period.

“Should companies trim their office space footprint after the Covid-19 outbreak blows over, landlords of older buildings would be pressed to consider the option of redeveloping their buildings. This might speed up the transformation of the CBD from a district dominated by office use to a more diversified and mixed-use district. Coworking firms may also shift towards having a combination of private offices and dedicated spaces in lieu of the big, open-plan places they now have in order to adhere to safe distancing rules.”