Under the CPF Housing Grant Scheme, you may be eligible to receive a housing subsidy to help with the purchase of your resale flat.

CPF Housing Grant Scheme for Single Singapore Citizen Applicants

As a first-timer single Singapore Citizen (SC) who is 35 years old or above, you might be eligible for the Singles Grant, as well as the Additional CPF Housing Grant (AHG) (Singles). The Singles Grant is meant to provide assistance to single applicants aged 35 or above who buy an HDB resale flat. Such singles may apply under the Single Singapore Citizen Scheme or the Non-Citizen Family Scheme.

You must be a first-timer applicant, meaning that you must not be the owner of a flat bought from HDB, or an Executive Condominium (EC) or Design, Build and Sell Scheme (DBSS) flat bought from a developer. You must also not have sold a flat bought from HDB, or an EC/ DBSS flat bought from a developer.

In addition you must not have received any CPF Housing Grant for the purchase of an HDB resale flat, and also not received any form of housing subsidy (e.g. benefitted under the Selective En bloc Redevelopment Scheme (SERS), HUDC estate privatisation).

Your average gross monthly household income must not exceed $6,000 if you are buying a resale flat under the Single Singapore Citizen Scheme, and $12,000 if buying a resale flat under other schemes.

Single Singapore Citizen Applicants may buy a 2 to 5-room flat under the Single Singapore Citizen Scheme, or 2-room or bigger unit under other schemes. The remaining Lease of Flat for the resale flat has to be at least 30 years.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

CPF Housing Grant Scheme for First-Timer Applicants

Table of Contents

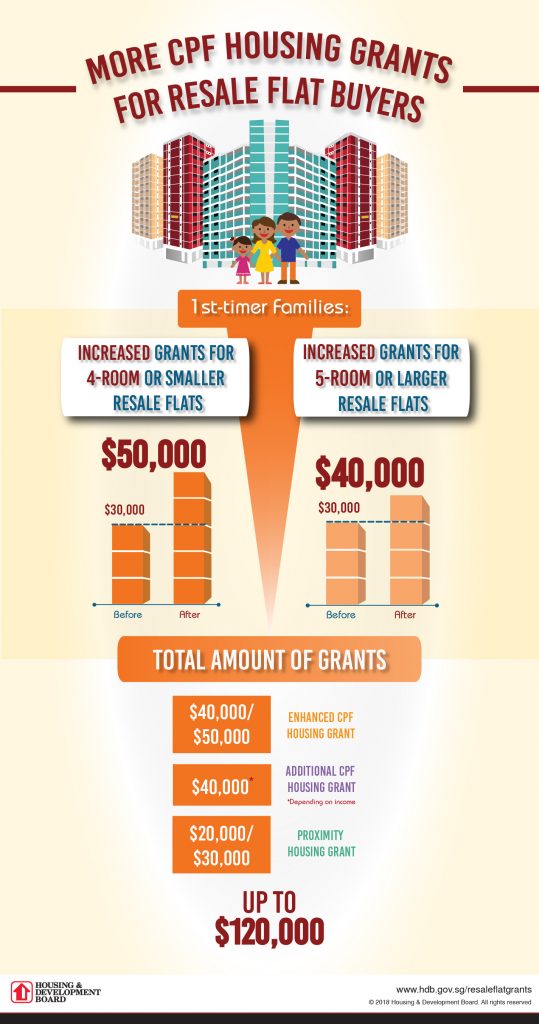

Eligible first-timer applicants can apply for the Family Grant or Additional CPF Housing Grant (AHG). Those who are buying a resale flat to live near or together with their parents can also apply for the Proximity Housing Grant.

The Family grant of between $30,000 – $50,000 is meant to provide assistance for married/ engaged couples or families who are first-timer applicants buying an HDB resale flat.

To be eligible, applicants have to comprise of a Singapore Citizen and at least 1 more Singapore Citizen or Singapore Permanent Resident, and be at least 21 years of age. In addition, you family nucleus must comprise of spouse and children (if any), or a spouse-to-be (a photocopy of your marriage certificate must be submitted within 3 months from the resale completion date, if your marriage is registered overseas). Your family nucleus may also consist of children under your legal custody, care and control if you are widowed/ or divorced. If the care and control of your children under the age of 21 is shared with your ex-spouse, you must obtain his/her written agreement before you can list your children in a flat application.

https://www.icompareloan.com/resources/buying-hdb-flat-using-cpf/

You and the family member(s) buying the resale flat must be first-timer applicants meaning that you must not be the owner of a flat bought from HDB, or an Executive Condominium (EC) or Design, Build and Sell Scheme (DBSS) flat bought from a developer. You must also not have sold a flat bought from HDB, or an EC/ DBSS flat bought from a developer.

Your average gross monthly household income must not exceed $12,000, or $18,000 if you are applying with your extended family. First time applicants may buy a 2 to 5-room flat under the Single Singapore Citizen Scheme, or 2-room or bigger unit under other schemes. The remaining Lease of Flat for the resale flat has to be at least 30 years.

CPF Housing Grant Scheme for First-Timer and Second-Timer Couple Applicants

You can apply for a Half-Housing Grant/ Top-Up Grant, as well as the Additional CPF Housing Grant (AHG) if you are a first-timer Singapore Citizen applicant married/ engaged to a spouse/ spouse-to-be that has previously received a housing subsidy, i.e. a second-timer applicant.

If the second-timer applicant has previously taken a CPF Housing Grant for singles or bought a 2-room BTO flat in the non-mature estates as a single, the couple may request for the CPF Top-Up Grant for their existing flat or next resale flat.

Such applicants may get a grant of $25,000 to buy a 2- to 4-room flat, or $20,000 to buy a 5-room or bigger flat. The Grant is meant as assistance for first-timer Singapore Citizen applicants whose spouse/ spouse-to-be had previously received a housing subsidy. The Half-Housing Grant amount is half of the Family Grant that you and your spouse/ spouse-to-be would qualify for if both of you were first-timer applicants.

CPF Housing Grant Scheme for Non-Citizen Spouse Scheme (NCS)

The NCS is similar to the CPF Housing Grant Scheme for Single Singapore Citizens. The only noticeable difference is, the applicant has to be at least 21 years old. It is meant to provide assistance to married applicants aged 21 or above who buy an HDB resale flat under the NCS.

Then there is the CPF Housing Grant Scheme for Joint Singles or Orphans which is meant to provide single applicants aged 35 or above who buy an HDB resale flat.

By: Phoenix Lee/Contributor iCompareLoan

How to Secure the Best Home Loans Quickly

iCompareLoan is the best infomercial loans portal for home-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!