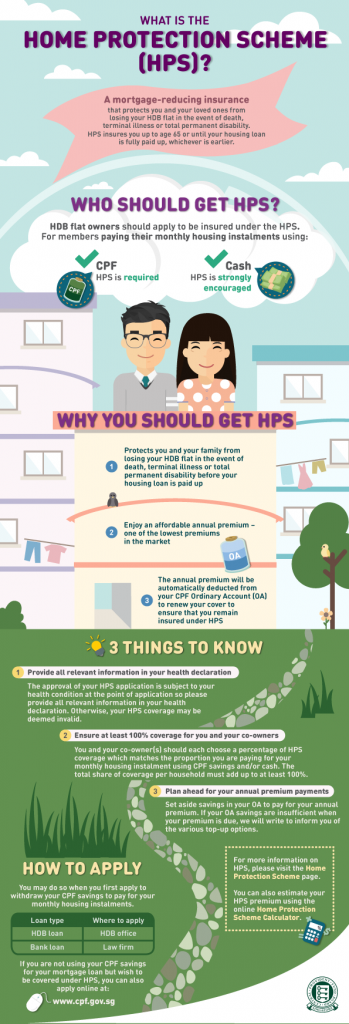

The CPF Home Protection Scheme (CPF HPS) protects CPF members and their families from losing their HDB flat in the event of death, terminal illness or total permanent disability.

The CPF HPS is a mortgage-reducing insurance that protects members and their families against losing their HDB flat in the event of death, terminal illness or total permanent disability. CPF HPS insures members up to age 65 or until the housing loans are paid up, whichever is earlier.

Table of Contents

You have to be insured under CPF HPS if you are using your CPF savings to pay your monthly housing loan instalments on your HDB flat. HPS does not cover private residential properties, such as executive condominiums (ECs) or privatised Housing and Urban Development Company (HUDC) flats.

Your CPF HPS cover starts when you are the legal owner of the flat, have completed the loan application with HDB or the approved mortgagee and are now legally responsible for the loan, have made your health declaration which is accepted for HPS coverage, and have paid the first Home Protection Scheme premium.

https://www.icompareloan.com/resources/mortgage-broker-singapore-best-rate/

Your share of the Home Protection Scheme cover should at least match the proportion of the monthly housing installment which is payable with your CPF savings and/or cash. This is because Home Protection Scheme pays off the outstanding housing loan, up to the sum assured, based on the percentage share of cover of the insured in the event of death or permanent incapacity. For example, if you are paying 80% of the monthly housing installments, and your co-owner pays the remaining 20%, you should be insured for 80% of the loan and your co-owner 20%.

The total share of cover per household for CPF HPS should add up to at least 100%.

However, you may each choose to insure for a higher or lower share based on your individual needs and circumstances, up to 100% share of cover per owner. For example, if you and your co-owner are paying 80% and 20% of the loan respectively, you can both be insured for 100%. This means that the CPF Board would settle 100% of the outstanding housing loan up to the insured sum in the event of death or permanent incapacity.

New members insured under Home Protection Scheme will be covered under Annual Premium (AP) up to 65 years old or until your housing loan is paid up, whichever is earlier. For members insured under Home Protection Scheme before 1 March 2001, your Single Premium (SP) CPF HPS will cover you up to 55 or 60 years old, depending on when you joined the scheme. This is stated in your SP certificate. The CPF Board will extend an AP cover when your SP cover has expired and you still have an outstanding housing loan. The issuance of AP cover is subject to premium payment.

You will only need to pay annual premium for 90% of your Home Protection Scheme cover period. For example, if your CPF HPS cover period is 30 years, you will only need to pay the premium for 27 years.

The annual premium will be deducted automatically from your CPF Ordinary Account (OA) to renew your cover. CPF HPS premium deduction has priority over that of your monthly housing instalment. This is to ensure that you remain insured under Home Protection Scheme before you use your CPF to service the loan.

You will receive a notification from the Board to top up your OA if the balance is not enough to pay the premium.

If you have insufficient funds in your CPF OA account your spouse/parent/child/sibling, who co-owns the flat with you, can also authorise us to use his/her CPF OA savings to pay your premium shortfall.

If you do not pay your Home Protection Scheme premium, your cover will lapse and you will not be covered under the scheme. You will need to re-apply for cover if you wish to be covered under CPF HPS and your eligibility for coverage will be subject to your health condition at the point of the re-application.

You have to fully disclose all information regarding your health conditions, which include all your past and current illnesses, any past or planned surgery, and any physical or mental impairment. You may also be required to undergo a medical examination. The CPF Board may also request a copy of the medical report on your health condition.

https://www.icompareloan.com/resources/cpf-home-protection-scheme/

The Home Protection Scheme premium is calculated based on four factors:

- Outstanding housing loan on the flat;

- Loan repayment period of the flat

- Type of loan (concessionary or market rate); and

- Age and gender of member

Written by: Phoenix Lee/Contributor iCompareLoan

How to Secure the Best Home Loans Quickly

iCompareLoan is the best infomercial loans portal for home-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!