Credit rating is a major consideration on personal loan applications. The higher your credit rating, the better your approval chances. A credit rating is a number that the lenders consider before they determine if they should approve your application for loans in Singapore.

By: Hitesh Khan/

It is a joint effort between all the major lenders here, where data about consumers’ credit history is pooled together and aggregated. Within the aggregated data, lenders would have access to records that show the number of accounts that you have across different banks, and your payment history.

After crunching the available data, each account holder is then assigned a credit score. This indicates how good or bad of a risk you might be to the lender as a customer. The higher the credit rating (up to 2,000 and AA rating), the better your credit score.

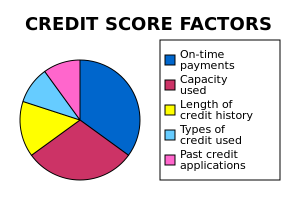

Although the the exact weightage of how your credit rating is calculated isn’t public knowledge, the factors that the Credit Bureau of Singapore (CBS) uses in determining your credit score is.

Factors like usage patterns of loan facility (e.g. if you have been making large purchases or transactions lately); your recent credit account activity (The number of credit facilities an account holder has is considered by banks as liabilities as they may perceive that you are over-extending yourself); and your account delinquency data, or how you have fared as a customer (this means where possible, always avoid making late or partial payments for your facilities).

Other factors considered by CBS include your credit account history, or how long you have been a customer (factors like if you have you been a loyal customer of your bank since you received your first credit card from them); how much available credit do you have (your credit rating is affected by the number of accounts you have with various banks in Singapore); and enquiry activity of how many organisations have asked about you (having too many enquiries might indicate to banks that you could be taking on more debt than you should).

Your credit report is a record of your credit payment history compiled from different credit providers. As most lenders will check your credit file to assess your credit worthiness prior to making a decision, a good credit repayment history will make it easier for you to obtain credit and to qualify for loans.

By reviewing your credit report regularly, it allows you to be aware of any information that is uploaded on your credit file. The other advantage of monitoring your credit file is that it protects against possible fraudulent use of your personal details to obtain credit.

You can request a copy of your credit report online, at any of the SingPost branches, at the Credit Bureau office or at CrimsonLogic Service Bureaus. CBS Credit Report is chargeable at $6.42 (inclusive of GST). Alternatively, and for a limited time only, you may want to get a free Credit Report.

iCompareLoan through its partnership with Credit Bureau can now sponsor your Credit Bureau Report (normally costs $6.42). All you have to do is, fill in your Name, Email and Contact to receive the FREE CODE to access your FREE credit bureau report.

All financial institutions which give out personal loans have one thing in common – they want to get paid back on time – and this will determine the outcome of personal loans approval. This means they approve only borrowers who meet their requirements. Here are five tips to boost your chances of qualifying for personal loans.

Applications for personal loans usually ask for your annual income. This means you can include money earned from part-time or freelance work. So if your income is not up to the mark of the lender, you should think how to supplement your income or to get a raise in your current job.

What’s equally important for personal loans approval is for you to pay down your debts as well. Boosting your income and lowering your debt improves your debt-to-income ratio, which is the percentage of your monthly debt payments divided by monthly income. A lower debt-to-income ratio shows your lender that your current debt is under control and you can take on more.

Most lenders will usually have a maximum amount an applicant with a certain income level can apply for, but requesting more money than you need to reach your financial goal can be seen as risky by lenders. Also, be mindful that a larger personal loan squeezes your budget, as higher loan payments impact your ability to meet other financial obligations, such as education loans or mortgage payments.

A guarantor or co-signer to personal loans is a third party in the loan contract. In the event of a default by the borrower the co-signer is legally obliged to repay the loan. So, if your credit scores are in the “fair” range, adding a guarantor with stronger credit and income can increase your chances of approval. But you should have an honest conversation with the prospective guarantor so they fully understand the risks before agreeing.

Most financial institutions and non-traditional lenders disclose their minimum requirements for lending. If you meet a lender’s minimum qualifications and want to see estimated rates and terms, you can pre-qualify for financing. But pre-qualification is not the same as putting in an application for personal loans. You may pre-qualify for a loan and yet your loan application may be rejected once you put in a formal application – and the more formal personal loan applications you put out, the more the impact is on your credit score.

This is one good reason why you need to work with trusted loan specialists. Loan specialists are able to not only pre-qualify you with multiple lenders and compare rates and terms, they are also able to get you the best personal loans which has costs and payments that fit into your budget.