CBRE’s Cross-border Investment Ranking sees Singapore Clinch Second Spot After Tokyo in Top 10 Preferred Cities for Cross-border Investments

- An abrupt, pandemic-induced economic downturn, travel restrictions and uncertainty about the pandemic’s duration sharply curtailed Asia Pacific real estate investment activity for much of 2020.

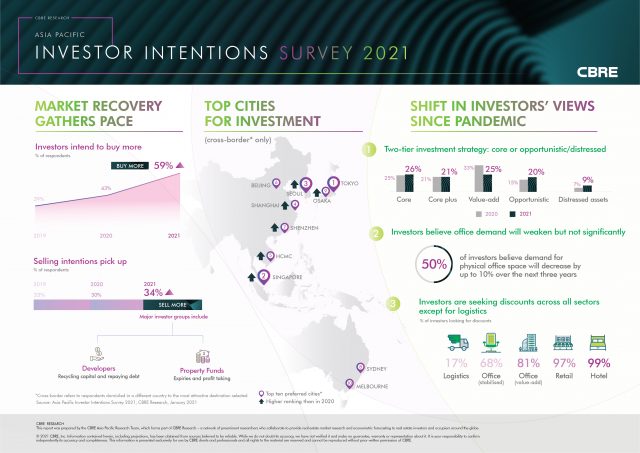

- However, pent-up demand and a substantial volume of dry powder is set to translate to strong buying momentum in 2021, with CBRE’s 2021 Asia Pacific Investor Intentions Survey finding that 60% of investors intend to purchase more real estate this year, the highest level since 2016.

- The survey, which polled more than 490 Asia Pacific-based investors in November and December 2020, found most investor types are exhibiting a stronger appetite for real estate investment compared with last year. Cross-border activity is set to be a major focus, with more than 70% of respondents intending to purchase overseas assets in 2021.

- Other headlines include Tokyo retaining its position as the most preferred city for cross-border investment; logistics being named as the most popular sector for investment for the first time; and investors displaying a strong preference for core and opportunistic/distressed strategies.

CBRE’s 2021 Asia Pacific Investor Intentions Survey, which polled more than 490 Asia Pacific-based investors in November and December 2020, uncovered an increase in investor interest in Singapore, which ranked second as Asia Pacific investors’ most preferred market for investments.

Top 10 Preferred Cities for Cross-Border Investment

Tokyo retained its top position as the most preferred city for cross-border investment. The availability of high-quality assets and strong liquidity has made Tokyo a top-three investment destination since 2018. Seoul made the top three for the first time.

Shanghai (#4), Beijing (#6) and Shenzhen (#7) all ranked in the top ten, with investors likely lured by China’s relatively quick containment of the pandemic and swift economic recovery. Another major mover included Ho Chi Minh City, which reached the top five for the first time.

Singapore’s status as hub for foreign corporations helped it clinch second spot in CBRE’s Cross-border Investment Ranking

Desmond Sim, Head of Research, Southeast Asia, CBRE, says, “Singapore remains an important hub for foreign corporations looking to access Southeast Asia. Although CBD rents declined in 2020, rents are forecast to display growth over the next three years, supported by low vacancy and strong demand. In fact, we expect office demand in 2021 to be fueled by Chinese technology firms and non-bank financial services firms such as investment managers and hedge funds.

“Ho Chi Minh City has already been on the radar of investors in recent years, especially those who are looking to invest in Southeast Asia, as the city is viewed as having the potential for greater appreciation in property values and higher yields,” shares Mr Sim.

Interestingly, investors who expressed interest in investing in Southeast Asia indicated that they are willing to pay more for real estate purchase. 39.4% of these investors are comfortable to pay more than 10% higher this year than what they are willing to pay in 2020, while 19.7% are willing to paying up to 10% higher.

In the search for returns, investors looking at Southeast Asia are turning to value-add and core assets, even though there are some who are starting to look at distressed assets. Industrial/logistics and office remain their preferred sectors, while the hospitality sector is gaining favour.

Findings from Asia Pacific Investor Intention Survey report

– 60% of investors intend to purchase more real estate this year, the highest level since 2016. The higher purchasing intentions are a consequence of pent-up demand from 2020, when the abrupt, pandemic-induced economic downturn, travel restrictions and uncertainty about the pandemic’s duration sharply curtailed investment activity. In addition, there remains a substantial volume of dry powder (capital that is committed but unallocated) searching for yield and ready to be deployed into real estate.

– Despite ongoing travel restrictions, more than 70% of respondents intend to purchase overseas assets in 2021, the bulk of which is expected to be within Asia.

Greg Hyland, CBRE’s Head of Capital Markets, Asia Pacific, shares, “While some investors may be compensating for inactivity in 2020, these upbeat findings reflect a broad-based improvement in market sentiment in recent months. With the recent launch of vaccination programs in several markets further boosting expectations of a gradual economic recovery, improved investment sentiment and more asset availability are expected to support an increase in investment volume by 5% to 10% over last year.”

– Since the onset of the pandemic, CBRE has observed that many investors across Asia Pacific have adopted a two-tier investment strategy focusing on core or opportunistic/distressed assets.

Dr. Henry Chin, CBRE’s Global Head of Investor Thought Leadership and Head of Research, Asia Pacific, weighs in, “Stronger interest in core investment reflects investors’ greater emphasis on tenant credit and stable cash flows. Assets with a solid rent roll of three years or longer typically attract far more bidders than those lacking this type of security.”

“On the opportunistic front, investors continue to deploy capital into a range of development projects including build-to-rent schemes in the Pacific and speculative logistic facilities across both Asia and Pacific. Distressed assets are also now back on investors’ radar for the first time since the Global Financial Crisis, with opportunities emerging in Mainland China and India,” adds Dr. Chin.

– Logistics was the most popular sector for cross-border investment as the pandemic-driven acceleration of e-commerce consumption boosted demand for this asset class. While interest in the office sector weakened, investors retain an optimistic view towards this sector, expecting a contraction in office purchasing activity of no more than 10% over the next three years. CBRE believes that 2021 offers attractive opportunities to acquire office assets in gateway cities, particularly Shanghai, Hong Kong SAR, Sydney and Melbourne.

– Data centres received stronger interest as a surge in demand for video conferencing and other platforms to support remote working led to increased requirements for data storage. Cold storage, which saw substantially increased demand over the course of 2020, and real estate debt rounded out the list of the top three alternatives.