Dalvey Court at 28 Dalvey Estate, a highly coveted and exclusive residential enclave in District 10 has been put up for collective sale. Completed in 1976, Dalvey Court is a nine-storey residential block comprising 32 apartment units of similar size. Cushman & Wakefield, the appointed marketing agent for the property has garnered the requisite 80 per cent consensus by share value and strata area for a tender launch at the reserve price of $160 million.

The District 10 site has a freehold tenure with a land area of 4,103.1 sq m (44,165 sq ft approximately). Under the Master Plan 2014, the site is zoned “Residential” with a plot ratio of 1.6 with a 12-storey height control. Dalvey Court is not affected by any traffic impact study and hence, the potential developer may build up to 93 apartments based on an average unit size of 70 sqm.

Due to the high development baseline, there is no development charge payable. Based on the current estimated gross floor area (GFA) of 7,400.69 sqm (79,660 sqft) the land rate is expected to be about $2,009 psf per plot ratio pending a GFA verification from the relevant authorities.

Dalvey Court is just a stone’s throw from the UNESCO Heritage site, the Singapore Botanic Gardens. Units in the new development will be able to enjoy unobstructed views of lush greenery.

The District 10 site is suitable for a medium-rise residential development in a low density location adjacent to the exclusive and affluent Dalvey Estate and White House Park Good Class Bungalow areas.

Table of Contents

The District 10 property is close to reputable schools such as St. Joseph’s Institution, Singapore Chinese Girls’ School, Anglo-Chinese School (Barker Road) and Nanyang Primary School. The Stevens MRT Station is a five-minute walk away. This station will also serve as an interchange station for the Downtown Line and the future Thomson-East Coast Line.

https://www.icompareloan.com/en-bloc-sales-process-guide-singapore/

Ms. Christina Sim, Director of Capital Markets at Cushman & Wakefield, said: “Despite being so close to the city, Dalvey Court’s proximity to Botanic Gardens ensures that the serenity and quiet surroundings of the estate is not compromised. The development is a rare gem and represents an opportunity for developers to conceptualize and create residences of distinction, befitting the prestige of this prime location.”

Marketing agent Cushman & Wakefield said the he tender for Dalvey Court at District 10 will close at 3pm on 2 August 2018.

The en bloc sale of Dalvey Court comes after another District 10 property set a record with per square foot per plot ratio (psf ppr) price of S$2,910.

The successful en bloc sale of Park House located at 21 Orchard Boulevard came at a time when sentiment in the private residential market continues to be buoyant.

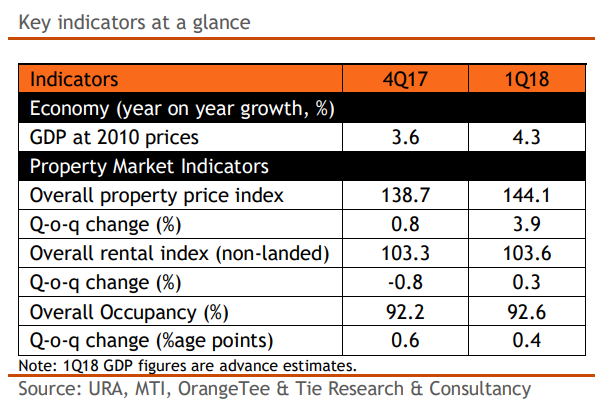

Overall private property prices rose across most market segments, with the largest price surge seen in the Core Central Region (5.5%) and Outside of Central Region (5.6%).

As developers’ existing stock continues to diminish and supply of completed homes remain low, many projects especially those in the CCR have raised prices of their unsold units, some by even double-digits this year. Private residential market continued to gain traction with individual re-sellers have also seized the opportunity of increasing their asking prices in light of the more positive market sentiment fueled by the recent collective sales frenzy.

An earlier report by ET&Co said that higher launch prices at some new projects slowed the buying momentum in the primary market, as sales volume dipped 15.2% quarter-on-quarter. Some developers have also held back their launches in the first quarter in anticipation of higher asking prices. While overall sales had slipped 14.2% q-o-q, volume rose 2.4% on a y-o-y basis.

With positive sentiments of the private residential market, sales is predicted to pick up significantly in the months ahead as more projects are slated to be launched and the prevailing market valuations be supported by banks at the higher benchmark prices.

OrangeTee & Tie research and consultancy head Christine Sun noted: “As it seems, demand for resale homes had rebounded strongly by 67.3 per cent year-on-year, the highest number of Q1 resales since 2012.”

She added: “Owing to higher land cost, stronger economic growth and pent-up demand, we expect prices to trend even higher. Some new homes may even see prices rise beyond 15%, going by the recent pricier enbloc acquisitions.”

Mr Paul Ho, chief mortgage consultant at icompareloan.com noted that Core Central Region (CCR) comprising of Districts 1, 2, 9 and 11 besides District 10, has risen less compared to Rest of Central Region (RCR) for many years now, and that the price differential is narrowing.

“Either RCR is overpriced or CCR is underpriced. For investors who are looking at superlatives, definitely the best of the best will do. Savvy investors (those who already have more than 1 property) will stay away from the market as the prices are crazy and the fundamentals are weak and there is huge supply in the pipeline.

“Current investors, such as those that bought the New Futura comprise mainly of foreigners. I doubt how they will recover their investment given the low rental yields, rising interest costs.

“I got a sense that it is more a portfolio diversification play given that they feel bullish about the Singapore Property market – given that the malaise of over supply has been digested for many years.

“The situation is nowhere as dire. So, this is more about the confidence and the sentiments. The fundamentals of the Singapore property market remains weak.”

If you are home-hunting for prime freehold site in District 10, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you with affordability assessment and a promotional home loan. The services of our mortgage loan experts are free. Our analysis will give best home loan seekers better ease of mind on interest rate volatility and repayments.

Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com for a free assessment.