Colliers International announced on Sep 12 that Gisborne Light, a district 10 boutique site, located in Ewe Boon Road will be put up for collective sale via public tender for $37 million on 13 September 2018.

The asking price for the freehold district 10 boutique site development at $37 million translates to a land rate of $1,671 per square foot per plot ratio (psf ppr). The land rate of Gisborne Light is attractive and fairly adjusts for the current market sentiment following the introduction of new cooling measures on July 06, 2018. Transactions in the area included: Crystal Tower at $1,840 psf ppr; City Towers at $1,847 psf ppr; Balmoral Mansions at $1,734 psf ppr and Balmoral Gardens at $1,812 psf ppr.

Built in 2003, the Gisborne Light sits on a 1,285.9 square metre (approximately 13,841 sq ft) site and comprises 17 apartment units with sizes ranging from 936 sq ft to 2,885 sq ft.

Each owner of the district 10 boutique site stands to receive between $1.7 million and $4.3 million from the successful sale of the development. Owners of 16 out of the 17 units have signed the collective sale agreement, representing approximately 95% consent level.

Table of Contents

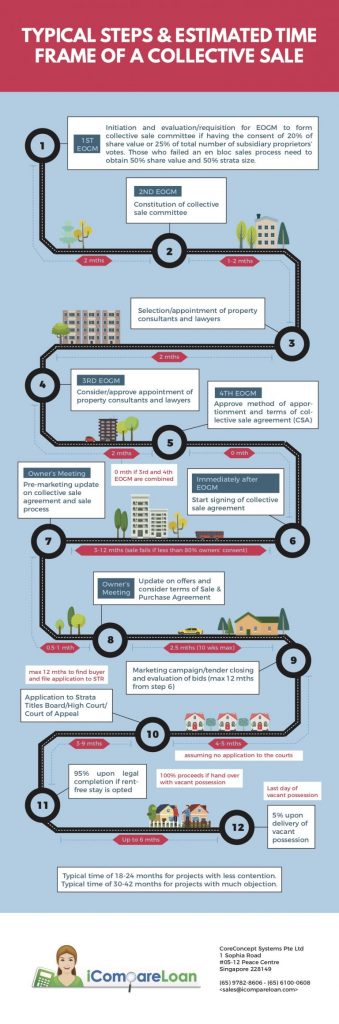

https://www.icompareloan.com/en-bloc-sales-process-guide-singapore/

Ms. Tang Wei Leng, Managing Director at Colliers International, said, “Based on our observation, developers are still enquiring about collective sale sites although they have become more selective and cautious after the fresh cooling measures kicked in. We believe Gisborne Light’s prime location in District 10 as well as its boutique scale and relatively palatable quantum should still make it attractive to developers and investors. The site can be developed into a luxury residential project that appeals to professionals and young families.”

Future residents at the new development will be well-served by a range of amenities in the vicinity. These include prestigious schools: Singapore Chinese Girls’ Primary School, Anglo-Chinese School (Barker Rd) and St. Joseph’s Institution. Singapore’s premier shopping district in Orchard Road, the Novena Medical Centre, as well as UNESCO World Heritage Site Singapore Botanic Gardens are also a short drive away.

The redevelopment district 10 boutique site – in the upscale Bukit Timah area – is conveniently located within walking distance to the Stevens MRT station, providing excellent connectivity to the rest of Singapore via the North-South Line and the Downtown Line.

Come 2021, Stevens MRT station will also be connected to the Thomson-East Coast Line, offering easy access to numerous attractions and recreational spots, such as Gardens by the Bay, Marine Parade, Shenton Way and Tanjong Katong.

Under the Master Plan 2014, the Gisborne Light site is zoned ‘Residential’ with a Gross Plot Ratio of 1.6. Subject to relevant approvals from the authorities, it can potentially be redeveloped into a luxury boutique residential project comprising 27 units with an average unit size of 780 sq ft.

Mr. Dennis Ling, Chairman of the Gisborne Light Collective Sale Committee, said, “This is our maiden attempt at collective sale. Despite the new cooling measures and uncertainty in the residential property market, we are still hoping to garner a good outcome for the owners. We will be looking to Colliers International, which has a wealth of experience and excellent track record of marketing prime sites, to make this tender a success.”

The collective sale tender for the district 10 boutique site will close at 3pm on 11 October 2018.

Mr Paul Ho, chief mortgage consultant of icompareloan.com, said whatever decision owners facing en bloc sale make, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners. One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

How to Secure a Home Loan Quickly

Are you planning to invest in properties like the district 10 boutique site but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.