Knight Frank Singapore, the exclusive marketing agent representing the interests of the owners of Elizabeth Towers via their collective sale committee, on Jan 21, announced the relaunch of the sale of Elizabeth Towers, by tender.

Elizabeth Towers, a prime freehold high-rise residential redevelopment site off Orchard Road, is a private residential estate comprising two residential blocks of 80 apartment and maisonette units, sized between 185 sq m to 417 sq m. The site is relatively regular with a site area of 5,046.3 sq m (approx. 54,318 sq ft), with dual access from Mount Elizabeth and Mount Elizabeth Link.

Elizabeth Towers is zoned “Residential” under the 2014 Master Plan, with redevelopment potential to reach a maximum height of 36 storeys, subject to authorities’ approval.

Table of Contents

Within the immediate vicinity are a plethora of retail malls, a premium hospital, hotels, landed homes and high-end condominiums, with Paragon Shopping Centre and Mount Elizabeth Hospital less than 200 metres’ walk from the development. International schools and established local schools are a close drive away, with Anglo-Chinese School (Junior) within 1 km from the development, and Anglo-Chinese School (Primary), Anglo-Chinese School (Barker Road), St. Joseph’s Institution Junior, St. Joseph’s Institution, Singapore Chinese Girls’ Primary and Secondary Schools, and St. Margaret’s Primary School located within 2 km from the site.

Major arterial roads as well as expressways, such as the Central Expressway (CTE), Orchard Road and Cairnhill Road provide seamless connectivity to other parts of Singapore. Orchard MRT station is also a quick 6 minutes’ walk away.

The owners of Elizabeth Towers have set a reserve price of $610 million – unchanged from their asking price in the earlier collective sale bid last year.

Based on its current as-built Gross Floor Area (GFA) of 23,452.286 sq m which has been verified by the authorities, this translates to a land rate of approximately S$2,416 psf ppr. With the inclusion of a 7% bonus balcony GFA, subject to authorities’ approval, and minimal development charge payable for the balcony area, the land rate is lowered to approximately S$2,297 psf ppr.

“Elizabeth Towers is a rare, choice corner site for developers looking to build an iconic residential development in Singapore, and we believe it will attract strong interest from developers, given its positive site attributes. Couple with its superb location, we are also confident the end product will be in strong demand, especially from owner-occupiers,” says Mr Ian Loh, Executive Director and Head of Investment and Capital Markets at Knight Frank Singapore.

The tender for Elizabeth Towers will close on Tuesday, 26 February 2019 at 3.00 pm.

Mr Paul Ho, chief mortgage consultant of icompareloan.com, said the owners of Elizabeth Towers should ensure that the sale is concluded with minimal delay and maximum benefit to the owners.

https://www.icompareloan.com/en-bloc-sales-process-guide-singapore/

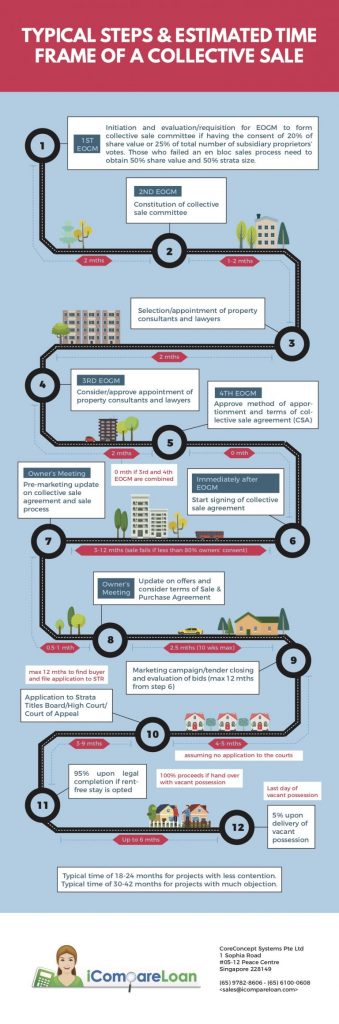

Collective sale process takes 20 to 30 months to complete and during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

How to Secure a Home Loan Quickly

Are you planning to invest in properties in the Orchard Road area area but are ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For advice on refinancing .