Finance for Newlyweds in Singapore

When couples come together, it is not simply about love, they also come together bringing different money values and spending habits. This is a major area of potential conflict that can tear couples apart.

By: Paul HO (iCompareLoan.com)

Scientist may finally been able to shed light on love. When you fall in love, the first stage may be lust driven by testosterone and estrogen, your adrenalin rises and you tensed up. People who fall in love have a high level of Dopamine a neurotransmitter in their brain, akin to taking cocaine, then Serotonin explains why you keep missing someone, finally Oxytocin (the chemical responsible for the feeling of attachment and for milk production) is released in the brain during orgasm, this keeps the couples together for caring for the off-springs giving them maximum chance of survival.

Nature has a beautiful way of making sure the human species survive, but it may not be enough to keep the couples together in this complex material world.

Money values – Better talk about it earlier than later

Table of Contents

Money is the root of all evil, lack of money is a bigger evil. If you can talk about sex, you better start talking about money.

Things to know about your life partner

- Are your families of similar economic status?

- Are your incomes vastly different?

Differences in incomes mean divergence in lifestyle. You need to reach a common understanding about it.

- Do you buy first and save later or save first buy later? (Instant Gratification versus delayed gratification)

Bad financial habits comes from bad personal habits

- Does your partner smoke, gamble, indulge in alcohol or other addictions, like fast cars, like expensive watches, jewelry or handbags?

These affect your future financial well-being.

What are the Major Expenses for Young Couple?

- Wedding Ring, Wedding Dinner and Honeymoon.

- Saving for the down-payment of a House.

- Furniture and Renovation.

- A new bomb. Oops I mean a newborn baby.

Wedding Expenses in Singapore

Spend too much on a wedding you will never forget, later you will not want to remember the loans and overdrafts and credit card bills you will continue to remember for the next few years.

It is crucial to spend within your means, after-all many people often want a say in how you do things, but are they paying the bills? Parents will want to have their say too, ultimately you must strike a middle ground between making them happy and keeping within budget.

A table would easily set you back by $1,000. Not to forget, you will need to give 50% of the tables to the bride’s parents. Not to be stingy, but both of you need to discuss how to finance this.

A simple wedding dinner could easily set you back $20,000 to $50,000.

That would take between 20 months to 50 months to repay the principal. During this time, you have exchanged one night of glamour for 4 to 5 years of slavery. How can a couple be happy?

Buying a house in Singapore

If you spend too much on getting married, I doubt you will have money for buying a house, better start to save up for the divorce proceedings.

Younger couples tend to be in junior positions and earning less. If they can squeeze in to stay with their parents, they should do so, until such time that they have built up their down-payment funds for a new house.

If you bought your place, stagger out your furniture purchase or renovation, what use is a perfectly beautiful house that ends up as the source of your financial worries or worse, root cause of your quarrels.

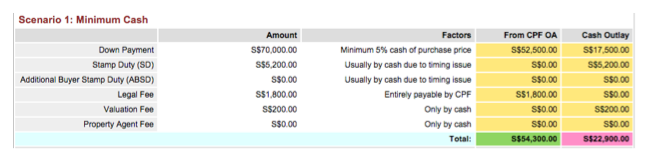

Scenario: Buying a HDB $350,000

Husband, Age: 30, $3,000/mth Salary with 13th Month AWS.

Wife, Age: 30, $3,000/mth salary with 13th Month AWS.

Figure 1: MSR for $280,000 LOAN PASSED FOR HDB, TDSR would allow the couples to borrow $761,000 for Private Property, www.iCompareLoan.com/consultant

The Minimum Cash needed is around $22,000 while the CPF OA savings need to be around $55,000. It will take about 4 to 5 years each to save up the $55,000 based on $3,000 monthly salary.

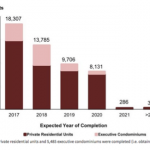

In Singapore, a bank can lend you more money to buy a more expensive condominium while it will not lend you as much for a HDB flat. This led many to buy a Condominium instead of a HDB. Obviously this is a flaw.

Figure 2: Minimum Cash and CPF OA required for Down-payment, iCompareLoan.com

The main reason for this is the MSR (monthly servicing ratio) of 30% for HDB flats while the Condominiums are set at 60%, resulting in higher loan for condominiums while lesser loan for HDB flats.

Nonetheless couples should avoid buying a condominium unless they have very strong financial backers (parents). Having a large loan from day one also means a heavy interest cost payment and a slow rate of paying down the principal.

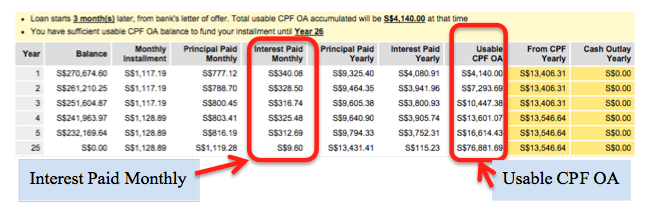

Figure 3: Interest Paid Monthly and Usable CPF OA still accumulating

In this case, the couples earning $3,000 each would have a very humble HDB flat, but at least they do not need to worry about mortgage repayment as there is no cash outlay. In fact their CPF OA can still accumulate if they keep their jobs. (See Figure 3, Usable CPF OA)

Financial Planning For the Future

Plan for the future by having some basic insurance cover such as hospitalisation cover in case of major sickness, Mortgage insurance (which will be covered under HPS) or term insurance, and perhaps a savings plan for a future baby. It is okay to have an interim plan and modify as you go along. It is too early to plan for retirement, but no harm talking about the retirement goals and lifestyles you would both like to have, so that you are on the same page.

Couples who are financially more similar tend to stay together then those who do not.