The overall interest rate environment in Singapore is still considered low on a global scale and this is one major reason why Singapore’s property market will remain buoyant with any further interest rates cuts

In March, the U.S. Fed lowered the fed funds rate to 0% for the first time since financial crises. The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at the Federal Reserve Banks) with each other overnight. It is also a benchmark for interest rates on credit cards, mortgages, bank loans, and more.

Key factors that affect interest rate:

- Supply and Demand – an increase in money demand will rise the interest rate, while an increase in money supply will lower the interest rate and vice versa.

- Inflation – the higher the inflation, the more interest rates are likely to rise.

- Monetary Policy from the government – tighten monetary policy by rising interest rate to slow down overheated economic growth and ease monetary policy by lowering the interest rate to boost economic growth.

US President Trump on several occasions suggested that the Federal Reserve should not only cut interest rates, but bring them to zero or below. Further interest rates cuts may boost lackluster property market in Singapore.

Table of Contents

This is because the US Fed rate hike has an impact on credit cards, mortgages, vehicle loans and bank savings accounts here. This is because Singapore interest rates are closely correlated with those in the US.

The Fed’s decision to cut interest rates any further will have an impact on credit cards, mortgages, vehicle loans and bank savings accounts here. This is because Singapore interest rates are closely correlated with those in the US. The SIBOR (Singapore interbank offered rate) for example is expected to go down. This could bring back some of the enthusiasm in the property market.

Since the beginning of last year, banks have raised interest rates for both fixed and floating home loan packages by 10 – 30 basis points (bps). Some banks have already upped their mortgage rate to 2.05 per cent, to keep pace with the increasing interest rates.

ABS Co. SIBOR and SOR on: 17 July 2020

| SGD SIBOR | SGD SWAP OFFER | |

|---|---|---|

| Overnight | – | 0.03230 |

| 1 month | 0.25000 | 0.11508 |

| 3 month | 0.43675 | 0.17350 |

| 6 month | 0.62450 | 0.21278 |

| 1 year | 0.87550 | – |

If the Fed’s decides to go below zero, it will lead to further interest rates cuts soon which may in turn lead to a more buoyant property market here, with the property prices which were subdued by the Government’s new cooling measures introduced since July 2018, rising. Buyers of investment properties may also exercise lesser caution when interest rates are lower. Buyer sentiment may also become positive knowing that they have better ability to service the mortgage on a property.

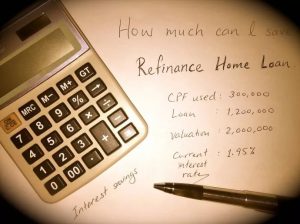

For example, a 1.75 per cent interest rate cut by the Fed’s would translate into 25 basis points (bps) decrease. For every 10 basis points decrease on a $100,000 loan over 25 years, the monthly installment goes down by $4.80. This means that for a $1 million loan, the buyer would have to pay S$120 less every month.

Paul Ho, chief mortgage consultant at iCompareLoan, said the US-China trade war and the Covid-19 pandemic are keeping away “savvy investors – those who already have more than 1 property – away from the market as the prices are crazy and the fundamentals are weak.”

“Even if further interest rates cuts may do good for some financial transactions involving properties, investors are cautious to avoid over-leveraging,” he said

On top of the uncertainties caused by the trade war and the pandemic, the property curbs introduced by the Government in 2018 which increased stamp duties for developers, is expected to halt their enthusiasm to shore up their land bank. This in return would have an impact on bank loan growth.

Residential property buyers’ would also have to increase their cash outlay with the 2018 property cooling measures, this would also make them think twice about acquiring new properties. Home buyers taking a more cautious approach to the purchase of new properties will likely cause developers to take a step back from the fervent acquisition of residential land sites.

Analysts have suggested that the Additional Buyers’ Stamp Duty (ABSD) requirements should lower investment demand while the Loan-To-Value (LTV) limits imply that buyers get reduced financing for their purchases.

“Despite uncertainties in the property market caused by a myriad of factors like the Coronavirus pandemic, the US-China trade war, the 2018 property cooling measures and weaknesses in bank loan growth, the Singapore real estate market still looks positive for property investors,” said Mr Ho.

He added: “The fact is, the overall interest rate environment in Singapore is still considered low on a global scale. This is one major reason why Singapore’s property market will remain buoyant and any further interest rates cuts will only help this.”

How to Secure a Home Loan Quickly

Are planning to purchase a private property but unsure of the funds you have? Don’t worry because trusted mortgage brokers can set you up on a path that can get you a home loan in a quick and seamless manner.

Alternatively you can read more about the Best Home Loans in Singapore before deciding. Most brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs.

Whether you are looking for a new home loan or refinance, mortgage brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the loan. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them.