If you have a higher credit rating, you will have a pretty easy time getting loan offers from a wide variety of funding sources to expand your business

If you have a higher credit rating, you will have a pretty easy time getting credit offers from a wide variety of funding sources to expand your business. If your score is low or nonexistent, however, you won’t.

But a low score isn’t something you can run away from, and even if you avoid it, it won’t go away. The trick is to fund your business in ways that actually get your score back on track so when you’re ready to move your business to the next stage, your score will start opening doors rather than getting them slammed in your face.

Here are some ideas for entrepreneurs who want to achieve higher credit rating to get better loans:

- Look beyond credit cards and bank loans for financing. Studies show that credit card and bank financing account for just 25 percent of the total funding needs of early-stage entrepreneurs. This statistic should provide you some comfort, because it implies that 75 per cent of the money you need can come from other sources that rely less high credit score.

While there are credit cards and lending programs designed for individuals with poor credit, these options will typically charge a higher interest rate to compensate for the credit risk posed by a sub-prime borrower. One bank option for those with poor credit scores is a home equity line of credit, though you should be wary of putting your home on the line to finance a risky early-stage venture.

- Seek personal loans from your relatives and friends. Everyone likes the idea of entrepreneurship, which may be why, at some point, more than 50 per cent of all business owners get financing help from friends and relatives. Chances are, your relatives and friends want to see you succeed and may be able to help make your business dream a reality.

They also may not dwell on your poor credit score because they trust you, or they believe your business concept to be sound. (Banks used to evaluate your character and business conditions the way family and friends still do, but credit scoring models have made lending decisions more automated, resulting in the critical power your credit score holds over you.)

Also, you can now use private personal loans from relatives, friends and business associates to rebuild your higher credit rating. - Don’t overlook gifts and grants. If you need to avoid making debt payments, focus on getting “free” money in the form of gifts and grants. Your search will be long and hard–despite what you read on the internet, there is no silver bullet here. Be wary of services that promise to locate government or private grant programs for you. If you want to avoid scams, you will need to do your homework to locate programs that are available for your type of business.

Health-care businesses, technology companies, and retail businesses in low-income areas tend to qualify for the bulk of grant money. Other forms of “free” money include gifts from relatives, free office space from former employers, and free services from friends or business associates. If you’re creative, you can reduce your startup costs by brainstorming a list of people who would be willing to provide you with gifts and subsidised personal loans.

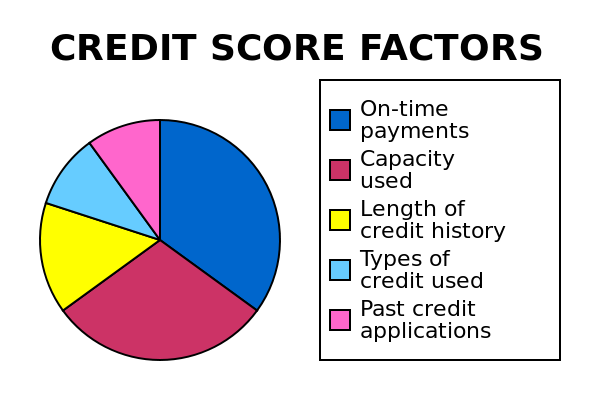

Factors which can affect higher credit rating

- Utilization Pattern – This refers to the amount of credit owed/ used per account.

- Recent Credit – Number of newly opened credit accounts. It is advisable to apply for new credit in moderation.

- Account Delinquency Data – Presence of delinquency (late payment) on your loan accounts will reduce your credit score.

- Credit Account History – Accounts with a history of prompt payments will help to boost your credit rating.

- Available Credit – This refers to the number of accounts available (open or active) for credit.

- Enquiry Activity – Each time a potential lender pulls your credit report in response to a new credit application, an enquiry is placed on your file. Having too many enquiries in your credit report indicate to lenders that you are trying to take on more debt, therefore increasing your credit exposure.

How Do I Improve My Credit Score?

Here are some tips which you can adopt to enhance your credit reputation:

- Paying your bills on time and in full.

- Not having overdue/ outstanding balances.

- High outstanding debt will have a negative impact on your score.

- Not having bankruptcy and default information in your credit report.

- Limit the number of credit facilities you own.

- Not applying for lots of credit within a short period of time.

Understanding your credit report and score not only enables you to understand your current financial situation but as well have a clearer picture of how the lenders assess your credit worthiness.

It is important to check on your credit report regularly to ensure that information is accurate and up-to-date.

Mr Paul Ho, chief officer at iCompareLoan, said: “Although primary card holders are primarily responsible for the usage and payments due on the supplementary cards, the credit report will only show the factual credit data available of the principal cardholders. The credit history and repayment behaviour of supplementary card holders will not affect the principal cardholders.”

Lenders may use your credit score as a tool to assess your credit worthiness to decide if a loan should be granted. If you have higher credit rating, your loan may be approved faster, with higher line assignment and lower pricing. Lenders will also take into consideration other factors such as the individual’s income, application documentations, existing banking relationship with the lender, the lender’s risk appetite, etc before extending credit to the individual. One thing to note on is, CBS does not play a part in the lender’s lending decision.

Credit repair is possible. A score is a “snapshot” of your risk at a particular point in time. The bureau score is dynamic and it changes as new information is added to your credit file such as taking up a new HDB loan with the bank. Your score is a reflective behaviour of your repayment history and it changes gradually as you change the way you handle credit. For example, a good credit score is derived from paying your credit card bills on time, all the time.

If you apply for multiple credit applications within a short period of time, it may have a negative impact on your credit score. Looking for new credit can equate with higher risk. Always approach credit in moderation.

If you have a joint credit account, these items could affect a score if they appear on your credit report. It is important that joint account holders understand that his or her repayment behaviour impacts the other joint account holder’s credit score.

A credit account held solely in the name of your spouse cannot impact your credit score if it is not a joint account.