The overall industrial property market sector is still finding its footing, with selected segments remaining soft in H1 2018, said a Research report by Colliers International. The report said that rents at business parks rose 1.2% HOH, but factory and logistics rents remained under pressure due to oversupply.

Manufacturing growth is still strong in the industrial property market sector but could slow down into H2. Colliers said that it expects new high specification space to lead demand. Given abundant space choices in the industrial property market, Colliers recommended that industrialists plan ahead for future expansion.

For qualified investors, the industrial property market sector offers higher yields than commercial properties, subject to shorter land tenures and usage restrictions, the leading real estate services company said.

Table of Contents

The report said: “According to the Ministry of Trade and Industry, Singapore’s GDP grew 3.9% YOY in Q2, slower than the 4.3% in Q1, but still strong and driven primarily by manufacturing, which grew 10.2% YOY. In its latest Country Economic Forecasts report on 24 July 2018, Oxford Economics adjusted its forecast for 2018 GDP growth down 0.1 pp to 3.0%, expecting manufacturing growth to moderate from the high levels seen in H1 2018. On a seasonally adjusted sequential basis, the manufacturing sector grew 1.8% QOQ in Q2, slowing down from the 26.2% QOQ growth in Q1.”

Leasing volumes picking up but demand in the industrial property market sector still lags supply, said the report:

“Leasing records picked up in H1 2018, possibly due to the abundance of new industrial space coming on stream. According to the JTC’s (Singapore’s lead agency to spearhead the planning, promotion and development of the industrial landscape) database, which goes back to 2000, Q2 2018 saw the highest number of leasing records on a quarterly basis at 2,775, reflecting a jump of 12.8% YOY. This brought total leasing records for H1 2018 to 5,193, an increase of 21% YOY and the highest level on a semi annual basis. This is encouraging but vacancy still increased, suggesting demand still lags supply.”

New high spec space leading rent recovery in the industrial property market sector:

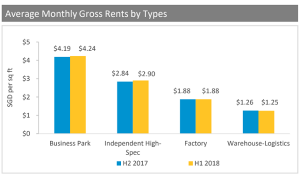

“According to Colliers International’s research, average monthly gross rents stabilised in most industrial sectors. Business park rent edged up 1.2% HOH to SGD4.24 (USD3.11) per sq ft in H1 2018 as tenants continued to gravitate towards newer business park buildings with better specifications which are able to command higher rents. Upper floor rents for independent high specification industrial buildings located outside of science parks and business parks increased 2.1% HOH to SGD2.9 (USD2.12) per sq ft. Rents for factory spaces remained flat HOH at SGD1.88 (USD1.38) per sq ft.

Meanwhile, average gross rents of logistics properties slipped by 0.8% HOH to SGD1.25 (USD0.92) per sq ft due to the supply influx in 2017. Given the slowdown in future supply from 2019 onwards, we expect rents to stabilise across all segments in 2019 – 2022.

Net new supply of industrial space totalled 3.24 million sq ft (301,000 sq m) in H1 2018, taking into account the net withdrawal of 1.62 million sq

ft (150,000 sq m) of single user factory spaces in Q1 2018. The lag in demand resulted in a marginal decline in the occupancy rate of 0.2 percentage points HOH to 89.7% in H1 2018. According to JTC, future new supply is set to ease from the record supply of 20.9 million sq ft (1.9 million sq m, net lettable area) completed in 2017. The supply pipeline for warehouses and single user factories is mainly in the West Region, while factory stock is

concentrated in the West, North East and North Regions. With tapering supply coming on stream from 2019 onwards, we expect average rents and prices to stabilise across all segments”

https://www.icompareloan.com/resources/industrial-property-market/

The report said that abundant data centres will be completed in H2 2018:

“Singapore continued to be a key location for the deployment of data centres in Asia. We estimate at least four data centre properties of over 1 million sqft in gross floor area, are scheduled to obtain their Temporary Occupation Permit (TOP) in H2 2018, including:

- Development by AWAN Data Centre at Tuas Avenue 4.

- Development by Global Switch Property at Woodlands Height. This six storey single user building is its second data centre in Singapore and has building functions that exceed Tier III operational performance.

- Mapletree Sunview 1, a built-to-suit data centre located at 12 Sunview Drive within Jurong Data Centre Park. Completed by Mapletree Industrial Trust in July 2018 with an initial lease term of more than 10 years.

- STT Defu 2, a five storey development under ST Telemedia Global Data Centres. This is its sixth data centre in Singapore.

Google has started construction of its third data centre in Singapore in August 2018. This brings Google’s total investment in data centres in Singapore to SGD1,160 (USD850) million.”

https://www.icompareloan.com/resources/singapore-office-market/

The research by Colliers said that continued restructuring of the industrial landscape was in tandem with the Smart Nation initiative, and was moving towards the next generation of the industrial revolution.

“First mooted in Singapore by the Committee of Future Economy, the Industry 4.0 initiatives are increasingly evident as JTC announced more facilities to consolidate and create industrial clusters. Under JTC, the first high rise hub, TimMac@Kranji, is expected to provide flexible modular spaces for metal, machinery and timber companies while the Innovation Cybersecurity Ecosystem @ Block71 is planned to become the first incubation hub to groom cyber security start ups.

Developers are also rejuvenating their properties in anticipation of the demands from newer industries. Soilbuild is developing Solaris @ Kallang 171, an integrated high tech industrial property at Kallang Way, to house RF360 while AIMS AMP Capital Industrial REIT has recently announced its asset enhancement initiatives for NorthTech industrial building in Woodlands as part of its strategy to build higher quality portfolio.”

Colliers further noted that there was a growing institutional interest in the industrial property market sector for acquiring more industrial spaces:

“Based on records from JTC as of 16 August 2018, a total of 455 caveats were lodged in H1 2018, down slightly 1.5% HOH. However, total strata sales volume jumped 17.6% YOY, suggesting a rising interest in the strata market.

We also notice a growing institutional interest in acquiring more industrial spaces, especially in niche sectors such as data centres, hi-spec facilities and modern ramp-up logistics buildings during H1 2018.

According to JTC, prices of overall industrial spaces stabilised in Q2 2018 after 12 consecutive quarters of declines, led by a positive uptick in centrally located properties and those with more than 60 years leasehold tenure. We project that capital values for prime industrial spaces with freehold or long land tenures will continue to rise on the back of rising demand amidst limited supply. Overall industrial capital values, however, should remain stable for the foreseeable future.”

How to Secure a Commercial Loan Quickly

Are planning to purchase properties for investment in the industrial property market sector but unsure of funding? Don’t worry because iCompareLoan mortgage brokers can set you up on a path that can get you a commercial loan in a quick and seamless manner.

Alternatively you can read more about the Best Commercial Loans in Singapore before deciding. Our brokers have close links with the best lenders in town and can help you compare Singapore commercial loans and settle for a package that best suits your commercial purchase needs.

Whether you are looking for a new commercial loan or refinance, our brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the loan. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them.

For advice on a new commercial loan or Personal Finance advice.

To speak to our Panel of Property agents.

For advise on refinancing advice.