Minister for National Development said granting a larger loan amount not based on current incomes will not benefit new flat buyers

The Minister for National Development has confirmed that the maximum loan amount granted to a flat buyer is derived based on flat buyers’ current income to provide flat buyers with a realistic indication of their housing budget, and to prevent them from over-committing on their flat purchase.

The Minister was responding to a parliamentary question asking if HDB housing loan eligibility can be computed based on applicants’ higher income prior to their being affected by the COVID-19 pandemic and re-adjusted, if need be, prior to their key collection.

In responding to the question, Mr Desmond Lee, the Minister for National Development said for financial prudence, home seekers should confirm their financing plan based on their current income before committing to a flat purchase and choose a flat that meets their needs and housing budget.

“New flat buyers who wish to take up an HDB housing loan must have a valid HDB Loan Eligibility (HLE) letter before they book a flat. The HLE letter provides them with key information to plan their housing budget, such as the maximum loan amount they are eligible for, the interest rate, repayment period, as well as the monthly instalment payable.

“The maximum loan amount is derived based on flat buyers’ current income to provide flat buyers with a realistic indication of their housing budget, and to prevent them from over-committing on their flat purchase. While we empathise with flat buyers who have experienced income losses, it would not be to their benefit for HDB to grant them a larger loan amount based on their higher income levels before COVID-19, but subsequently reducing the loan quantum if their incomes have not recovered by key collection. This may result in flat buyers being unable to complete their flat purchase.

“For financial prudence, home seekers should confirm their financing plan based on their current income before committing to a flat purchase and choose a flat that meets their needs and housing budget. For applicants with extenuating circumstances who may need further assistance to complete their flat purchase, HDB can assess their situation on a case-by-case basis and see how best to help them.”

Mr Paul Ho, chief mortgage officer at iCompareLoan, said: “it is prudent that the housing loan is based on the buyer’s current incomes. A larger loan amount not based on current incomes may not be to the advantage of the buyer. For a lot of people, their house may be most expensive item they will buy in their lifetime and they must be able to service the housing loan for 20 – 30 years.”

“There is absolutely no guarantee that their incomes will return to pre-Covid19 levels after the pandemic ends. A larger loan amount based on a lot of uncertainties is not advisable,” he added.

Table of Contents

Responding to another parliamentary question on HDB’s housing loan, Mr Lee said HDB does exercise flexibility to provide a third HDB housing loan for those who have exhausted their financing options, and are in urgent need of housing, on a case-by-case basis.

He was responding to the question by Associate Professor Jamus Jerome Lim, Workers’ Party Member of Parliament. Assoc Prof asked on average, how many appeals are received requesting a third HDB loan; what is the share of these loans against total loans requested; and what proportion of these requests have been the result of children adding their names to their parents’ flats.

The Minister responded to him and said:

“HDB provides up to two housing loans at the concessionary interest rate to eligible Singapore Citizen households, subject to credit assessment and the prevailing mortgage loan criteria. Beyond this, households who require another housing loan have to seek financing from Financial Institutions regulated by the Monetary Authority of Singapore.

“Nevertheless, HDB does exercise flexibility to provide another HDB housing loan for those who have exhausted their financing options, and are in urgent need of housing, on a case-by-case basis.

“In 2020, HDB received about 6,000 appeals for a third HDB housing loan. These appeals formed about 20% of the total number of loan appeals received by HDB. Of the 6,000 appeals for a third HDB housing loan, about 1% had appealed for a loan to include their children as co-owners to help with the servicing of the loan instalments.”

What is a HDB loan?

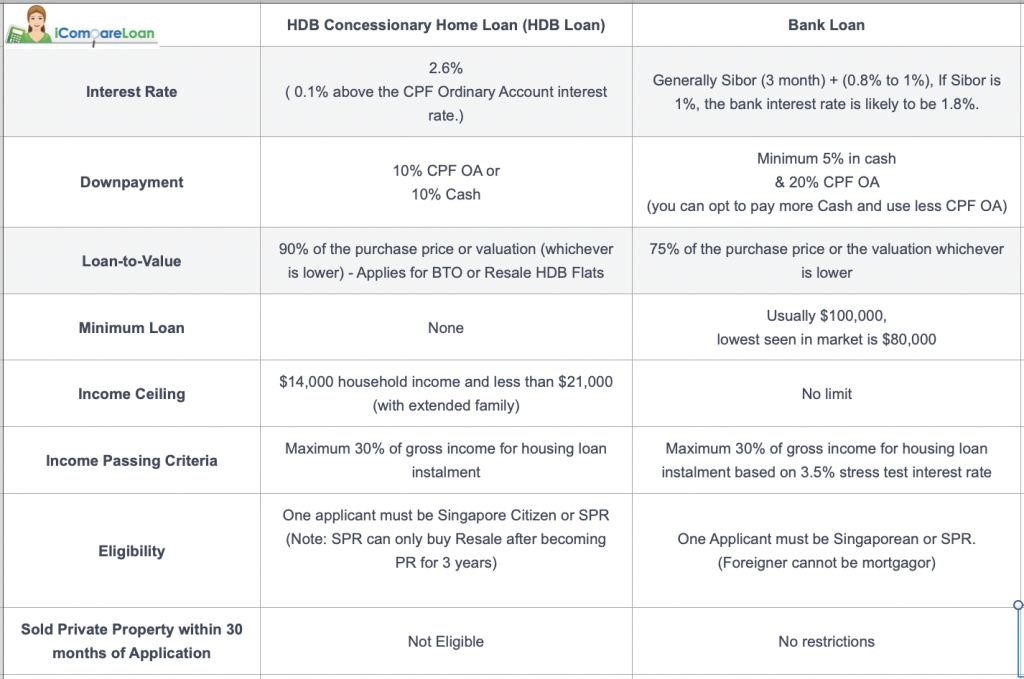

For a HDB flat, you have the choice of choosing a bank loan or a HDB loan.

Housing development board (HDB) offers a concessionary home loan and interest rate for family members that meet eligibility conditions. Buyings of HDB flat can submit a HLE (HDB Loan Eligibility) letter online.

- You can “Apply for an HLE letter and upload your documents at www.hdb.gov.sg/hleapply” (Source HDB)

In short, a HDB loan is a Housing loan offered by the HDB, whereas a bank loan is a loan for the HDB flat offered by the Bank.

HDB Loan is more lenient when you are unable to keep up repayment

If you are unable to keep up your HDB Loan repayment, based on anecdotal feedback, HDB does not take back your house immediately. However you are still best to avoid taking this path if you can afford to repay your home loan.

HDB Loan has Higher Loan to value compared to Bank Loan

If your incomes are justified, you can generally apply for up to 90% of the property valuation. But you must also make sure that you are not buying a HDB flat with too few years remaining on the lease.

Age limit is 65 years old while the maximum tenure is 25 years. The remaining lease must cover the youngest buyer’s age up to age 95.

Scenario of Person A = Age 45 and Person B = Age 40.

The HDB flat has a remaining lease of 50 years. That means that at the age of 90 years old (partner’s age 40 + 50 years remaining lease), assuming that the younger partner is still alive, he or she will be without a home. Hence for the loan to be accepted, the remaining lease must then be 55 years or more.

For those families who may not have sufficient down payment of 25%, taking a HDB loan that allows you up to 90% Loan-to-value and hence a lower down payment of 10% may allow you to quickly buy a HDB flat.

CAN YOU GO BACK TO A HDB LOAN AFTER CHOOSING A BANK LOAN?

No, once you choose a bank loan, you cannot go back to take a HDB loan.