Owners of St Francis Court, an 11-storey residential tower at 90 Saint Francis Road, have put up their 99-year leasehold apartment for collective sale. The exclusive marketing agent of the en bloc sale, ERA Realty, said the owners of the 99-year leasehold apartment expect offers above $95 million. While no differential premium is payable, the intensification and top up premium for the site stands at between $9 million and $15 million.

Owners of the 99-year leasehold apartment, depending on the size of their units, can expect to receive sales proceeds of over $1 million to $1.5 million each.

Table of Contents

The 71-unit 99-year leasehold apartment sits on a 34,111.12 sq ft site with a plot ratio of 2.8 under the 2014 Master Plan. With 73 years left on its 99-year lease, the site site can be redeveloped to yield 100 to 120 units, and a pre-application feasibility study is also not required.

“The proposed redevelopment would not require a Pre-Application Feasibility Study (PAFS) as confirmation with the Land Transport Authority (LTA),” said ERA.

Located within the central region and close to City Square Mall and Boon Keng MRT station, St Francis Court is a short drive away from the Orchard Road shopping belt and central business district. The development is also within 1km from Bendemeer Primary School, Hong Wen School and St Andrew’s Junior School.

The tender for the 99-year leasehold apartment, St Francis Court, closes on 29 November.

Mr Paul Ho, chief mortgage consultant of iCompareLoan said owners of the the 99-year leasehold apartment were right in acting quickly and decisively. Whatever decision owners facing en bloc sale make, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners.

One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on. As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

https://www.icompareloan.com/resources/good-property-agents-qualities-look-find/

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

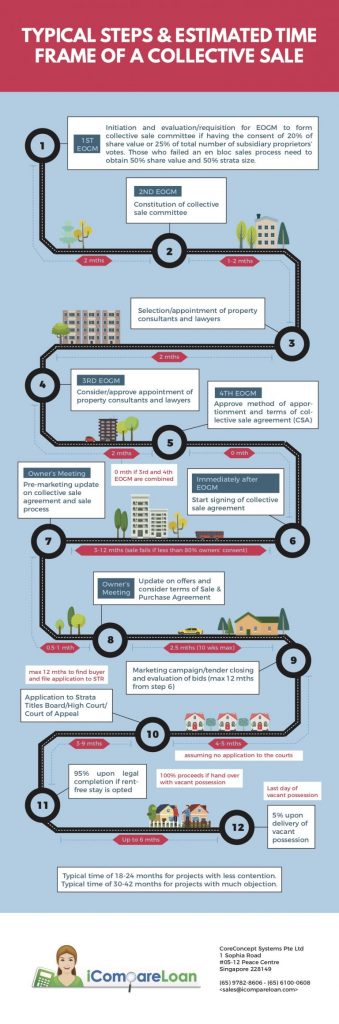

In order to understand how and whether to go into an En Bloc sales and sign on the Collective Sales Agreement (CSA), the owners will need to know how long it will take you to complete the En Bloc sales in case it is successful.

| Stage | Milestone | Duration (Est.) | Timeline (months) |

| 1 | 1st EOGM to appoint CSC. | 1 month | 1 |

| 2 | 2nd EOGM to appoint Marketing agents, solicitors and approve CSA. | 1-2 months | 2 – 3 |

| 3 | Signing of Collective Sales Agreement (CSA) | 12 months | 3 to 15 |

| 4 | Owners meeting prior to launch of public tender for sale | 1-2 months | 4 to 17 |

| 5 | Launch and close of tender | 1 month (Max) | 5 to 18 |

| 6 | Award of tender. | – | |

| 7 | Negotiate sale by private treaty (if bidding falls below reserve price) | 10 weeks (Max) | 7.5 to 20.5 |

| 8 | Apply to STB or High Court | 3 – 9 months | 10.5 to 29.5 |

| 9 | Completion of sale | 3 months | 13.5 to 32.5 |

| 10 | Handover of vacant possession | 6 months | 18.5 to 38.5 |

The maximum and minimum duration of the en bloc sales process as indicated in the cumulative timeline in the table is roughly between 18.5 months to 38.5 months.

The earliest any home owners can receive any en bloc sales proceeds could be around 13.5 months and the latest will be 32.5 months.

How to Secure a Home Loan Quickly

Are you planning to invest in properties like the 99-year leasehold apartment but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.