Flash estimates from the Urban Redevelopment Authority (URA) on Monday (4 January 2021) showed that private residential property prices grew at an increasing rate, by 2.1% quarter-on-quarter (QOQ) in Q4 2020, after rising 0.8% in Q3. This brings private home prices to be up 2.2% for the full year 2020, compared to a growth of 2.7% in 2019. Private home prices are now 4.9% above the most recent peak in Q3 2018 and 1.6% above its all-time peak in Q3 2013.

Based on caveats downloaded on 2 January 2021, developers sold 2,381 new private homes (excluding ECs) in Q4 2020 — down by 32.3.0% QOQ (3,517 in Q3 2020), and a marginal 2.5% decline year-on-year (YOY) from 2,443 in Q4 2019. This should bring the full year new sales to 9,760 units, down 1.5% from 2019’s 9,912 units.

The secondary market was more resilient in Q4. The number of secondary sales fell just 5.6% QOQ but was up 36.9% YOY to 3,334 units in Q4 2020. This brings the full-year secondary sales to 9,905 units, up 7.2% from 2019’s 9,238 units.

Commenting on the private residential property prices shift upwards, Ms Tricia Song Head of Research for Singapore at Colliers International, said: “In Singapore, private residential property prices rose in Q4 2020 for the third straight quarter, on pent-up demand and against the weak macroeconomic conditions.”

Table of Contents

Ms Song added, “Based on advance estimates for the fourth quarter of 2020, the Singapore economy contracted by 3.8% YOY, but grew 2.1% QOQ seasonally-adjusted. This brings the full-year GDP growth to -5.8%, the worst recession in Singapore history. 2019’s GDP growth was +0.7%.”

“We believe home prices, which historically were highly correlated to GDP growth, actually rose against the deep recession, largely due to the following reasons:

- The pandemic and recession have had an uneven impact on different sectors of the economy. Tech, financial services and biomedical/ healthcare sectors have been sheltered or have even thrived, while aviation, transport, tourism, retail services have been affected adversely;

- For those affected, the government has been quick to dish out financial help – some S$100 billion over four fiscal stimulus packages, including job support schemes to protect local jobs, and legislating temporary measures on moratoriums or waivers on commercial rents, home mortgages, interest payments. These have helped, to a large extent, most businesses and individuals tide through the most difficult six months;

- Property prices were relatively in line with fundamentals before the recession. In fact, cooling measures on the private home market were imposed in July 2018, and home prices have declined 0.7% in Q4 2018-Q1 2019, before rising 3.4% in Q2 2019-Q4 2019.

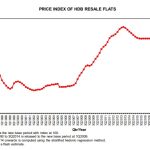

- Public housing has also started seeing resale HDB volumes and prices rise, which support upgraders’ demand in private housing.

“In the future, with a brighter economic outlook in 2021, we expect private residential prices to move in the same direction. However, with the resilience of the market and prices up 2.2% in 2020, we expect private home price growth to be a modest 5% in 2021, tracking the expected GDP growth.”

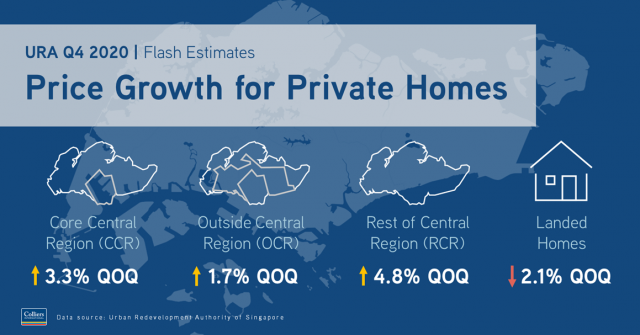

Colliers International analysed the private residential property prices by region as follows:

“The non-landed segment led the price increase in Q4 2020 (up 3.2% QOQ) while the landed segment declined 2.1% QOQ. The non-landed segment was led by Rest of Central Region (RCR) which saw a price increase of 4.8% QOQ, followed by the Core Central Region (CCR) where prices rose 3.3% and Outside Central Region (OCR) where prices rose 1.7% QOQ.

“Private residential property prices in the Core Central Region (CCR)

“According to URA’s data, prices in the CCR rose 3.3% in Q4 from the previous quarter, after falling 3.8% QOQ in Q3 2020. This brings the volatile CCR home prices to a mild 0.2% decline for the full year 2020. CCR home price index is now 2.9% below its recent peak in Q3 2018 and 5.2% below its all-time peak in Q1 2013.

“Indeed, while we noted sporadic secondary market transactions at below-market prices during the year, prices appear to have recovered as sentiment improved towards the end of the year. Ongoing launches which have offered some discounts during the year have also seen steady interest into Q4 2020:

- Leedon Green recorded 29 caveats in Q4 at a median price of S$2,686 psf, compared to 41 units sold at S$2,789 psf when it was launched last January 2020;

- 8 Saint Thomas recorded 12 caveats in Q4 at a median price of S$2,788 psf compared to earlier units sold at S$3,100-3,200 psf.

- Fourth Avenue Residences sold 24 units in Q4 at a median price of S$2,295 psf, compared to its 2019 average launch price of S$2,400-2,450 psf.

- The Avenir sold 18 units in Q4 at a median price of S$3,140 psf, compared to 18 units sold at a median price of S$3,244 psf in Q1 2020, when it was launched.

“Private residential property prices in the Rest of Central Region (RCR)

“Home values in RCR rose 4.8% QOQ in Q4, after rising 2.5% in Q3. This brings RCR home prices to a full-year increase of 5.1%, the highest among all segments. It is now at an all-time peak, at 3.6% above the peak in Q2 2013.

“The popular large launches such as Parc Esta, Stirling Residences and Jadescape have sold 13, 44 and 73 units respectively in Q4 and we note that their prices have inched up as they sold down their inventory.

“Forett at Bukit Timah, The Linq and The Landmark sold the most units in Q4, with 70, 119 and 108 units respectively at S$1,941 to S$2,171 psf.

“Private residential property prices Outside Central Region (OCR)

“Non-landed home values in OCR rose 1.7% QOQ in Q4, following a similar 1.7% increase in Q3 2020. This brings OCR home prices to a full-year 2020 increase of 3.1%.

“The resilient trend could be driven by upgraders’ demand, as public housing (HDB) resale price index flash estimate also showed a 2.9% increase in Q4 and a full-year increase of 4.8%.

“In Q4, new launch Clavon was the top seller in OCR, having sold 471 units at a median selling price of S$1,637 psf. Another new launch, Ki Residences at Brookvale, sold 165 units at a median price of S$1,766 psf.

“Earlier launches such as Treasure at Tampines and Florence Residences continued their progressive takeup.

- Florence Residences sold 46 units at a median price of S$1,635 psf, compared to 168 units at S$1,559 psf in Q3 2020;

- Treasure at Tampines moved 119 units at S$1,419 psf in Q4, compared to 326 units at S$1,359 psf in Q3.

“Outlook and forecasts

“Based on advance estimates for the fourth quarter of 2020, the Singapore economy contracted by 3.8% YOY, but grew 2.1% QOQ seasonally-adjusted. This brings the full-year GDP growth to -5.8%, the worst recession in Singapore history. 2019’s GDP growth was +0.7%.

“We believe home prices, which historically were highly correlated to GDP growth, actually rose against the deep recession, largely due to the following reasons:

- The pandemic and recession have had an uneven impact on different sectors of the economy. Tech, financial services and biomedical/ healthcare sectors have been sheltered or have even thrived, while aviation, transport, tourism, retail services have been affected adversely;

- For those affected, the government has been quick to dish out financial help – some S$100 billion over four fiscal stimulus packages, including job support schemes to protect local jobs, and legislating temporary measures on moratoriums or waivers on commercial rents, home mortgages, interest payments. These have helped, to a large extent, most businesses and individuals tide through the most difficult six months;

- Property prices were relatively in line with fundamentals before the recession. In fact, cooling measures on the private home market were imposed in July 2018, and home prices have declined 0.7% in Q4 2018-Q1 2019, before rising 3.4% in Q2 2019-Q4 2019.

- Public housing has also started seeing resale HDB volumes and prices rise, which support upgraders’ demand in private housing.

“In the future, with a brighter economic outlook in 2021, we expect private residential prices to move in the same direction. However, with the resilience of the market and prices up 2.2% in 2020, we expect private home price growth to be a modest 5% in 2021, tracking the expected GDP growth.

“For transaction volumes, full-year 2020 developer sales came to 9,760 units, just 1.5% below 2019’s 9,912 units, reflecting resilient demand, despite the deepest recession on history.

“With economic recovery expected in 2021, we expect stronger buying power partially offset by fewer new launches, so buyers will likely have to dip into ongoing launches, or go into the secondary market. We now expect 2021 developer sales to be around 10,000 units, 2.5% better than 2020.”