Progress payments refers to schemes by lenders to help you make payments at different stages of the property construction

Once upon a time there was this thing called the Deferred Payment Scheme, But since 26 October 2007, deferred payment schemes (which defers payment till a later date) was disallowed.

This means that buyers have to rely on the standard payment schemes or Progress Payments instead of deferred payment schemes. Progress Payments allow you to make payments at different stages of the property construction.

Table of Contents

In 2019, answering a parliamentary question on deferred payment schemes, the Minister for National Development said that due diligence and prudence were needed before buyers committed to such schemes. The Minister was responding to a parliamentary question asking:

“…what is the Ministry’s position on developers who offer two-year deferments to prospective buyers; whether the buyer and seller stamp duty will be based on the date of signing the Option-to-Purchase obtained earlier under the two-year deferment plan or on the date of signing the Sale and Purchase Agreement; and whether developers are required to pay stamp duty for unsold units after five years even after an Option-To-Purchase has been obtained but a Sale and Purchase Agreement has not been executed yet.”

The Minister answered the question on deferred payment schemes saying:

“Since October 2007, the Government has disallowed deferred payment schemes for uncompleted private residential properties. So deferred payment schemes are only applicable for completed private residential developments. As with any property transaction, buyers should exercise due diligence and prudence before committing to a purchase under such a scheme.

“For the purpose of stamp duties, a unit is only considered sold when the Sale and Purchase (“S&P”) Agreement has been executed. The buyer’s and seller’s stamp duties are based on the date of execution of the S&P Agreement. Likewise to qualify for ABSD remission, developers will have to ensure that all units within the development are sold, with the S&P Agreements executed, within the prescribed period of 5 years.”

A Building-Under-Construction (BUC) loan also follows such progress payments schedule.

Unlike a loan for a completed property which is 100% disbursed at one time, a BUC loan has a progressive disbursement schedule. In other words, a certain percentage of the loan is disbursed at each stage of the property construction. The following example illustrates this.

Example 1

Purchase Price: S$2,000,000

Loan Quantum: S$1,600,000

Table 1: Disbursement Schedule for a BUC Loan

|

Stage |

Month |

Disbursed Ratio |

Interest Rate |

Disbursed Balance |

Monthly Installment |

| Completion of Foundation |

1 |

10% |

1.250% |

S$200,000.00 |

S$666.50 |

| Completion of Superstructure |

7 |

10% |

1.250% |

S$397,243.81 |

S$1,342.32 |

| Completion of Brick Wall |

13 |

5% |

1.450% |

S$491,658.14 |

S$1,731.45 |

| Completion of Ceiling/Roofing |

17 |

5% |

1.450% |

S$587,100.42 |

S$2,086.91 |

| Completion of ElectricalWiring/Plumbing |

21 |

5% |

1.450% |

S$681,580.43 |

S$2,445.75 |

| Completion of Roads/CarsParks/Drainage |

25 |

5% |

1.450% |

S$775,079.97 |

S$2,808.04 |

| Issuance of Temporary OccupationPermit (TOP) |

29 |

25% |

1.450% |

S$1,267,580.46 |

S$4,637.19 |

| Certificate of Statutory Completion |

40 |

15% |

2.750% |

S$1,534,842.41 |

S$6,759.05 |

Source: www.iCompareLoan.com

Repayment of the loan commences at the first disbursement. That is in the first month. Disbursed Ratio is the percentage of the purchase price, not the loan quantum. In the first month 10% is disbursed and in the seventh month, another 10% is disbursed, and so on.

Do note that this schedule is only a guide, the actual completion time for each stage may vary in reality, but the amount payable at each stage should be the same.

If you still need clarification on the payment schedule of a BUC loan, you can turn to the professional mortgage consultant at www.iCompareLoan.com, who dispenses free advice and reports generated from Singapore’s most advanced loan analysis system.

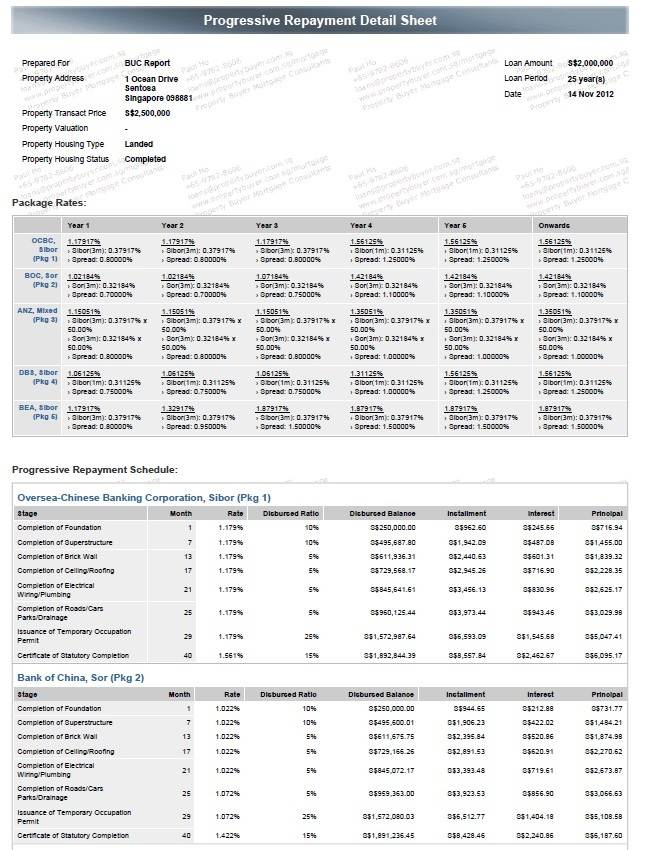

Figure 2: Sample of a BUC Loan Report

Source: www.iCompareLoan.com

What are the types of BUC loans?

Similar to the loan for a completed property, a BUC loan comes in the usual types:

- Fixed Rate Package

- Variable (Floating) Rate Package

- Board rate (bank’s internal reference) – pegged

- SIBOR-pegged

- SOR-pegged

- Combo SIBOR/SOR [recently introduced by Australia and New Zealand Banking Group Limited (ANZ)]

Previously, interest-only loans were popular among buyers of BUC projects because this type of loans allows them to defer principle repayments till a later date. This makes monthly installment much lower as it consists only of interest repayments. However, this fuelled property speculation, causing the Government to cancel interest-only loans since 14 September 2009.

For the existing loan types (ie. fixed rate or variable rate package), conversion if allowed is usually after TOP.

Things to take note of

As BUC loans are disbursed progressively, full repayment will be subjected to a cancellation fee, normally 1.5 – 2.0% of the un-disbursed amount. If the repayment is during the lock-in period, you will have to bear the cancellation fee on top of the lock-in penalty.

Please note that interest rates for BUC loans are not necessarily higher than loans for completed properties. Consequently, it well may be more worthwhile to buy a property while still under construction as the loan quantum is smaller, and hence interest payment, during the initial few years.

How to Secure a Home Loan Quickly

If you are planning to invest in properties during this period of private home price increase but are ensure of funds availability for purchase, don’t worry because trusted mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner. Good brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. You should also find out about money saving tips.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them.