Property Agents: What Is iCompareLoan Loan Analysis System All About?

By PEARL LIM

For property agents, as financing is an essential part of a property purchase for your clients, being able to provide sound and comprehensive home mortgage financing advice will bring you one step closer to selling a property, or helping your clients buy one. By subscribing to our loan analysis system you will be able to enhance your marketability through the professional loan analysis and financing services you can provide.

Our loan reports are only available via our consultants, if you a property buyer or home owner who wants one, email us at loans@PropertyBuyer.com.sg or go here.

iCompareLoan system is the only cloud-based home loan analysis platform in Singapore, and it contains over 100s of the loan packages available in the market. Interest rates and SIBOR/SOR are also regularly updated few times a week. You can generate comprehensive loan reports analysis, with charts and tables for loan packages comparison. In addition, you can also find soft copies of the latest application forms and financial calculators. To make things easier, our system also allows for online submission of loan applications. In a nutshell, it is a one-stop convenience for all your home loan financing needs.

The system is iPad-compatible making navigation through the system, documents uploading and downloading easily done even on an iPad.

A Closer Look at the Features in our System, …

1. Reports, Analysis

Under this section, you can generate professional-looking and reliable loan reports and SIBOR/SOR charts, quickly and effortlessly. We offer five types of reports:

a. New Loan Interest Cost Analysis

b. Refinance Savings Analysis

c. Loan Package Detail Sheet

d. Progressive Repayment Detail Sheet

e. SIBOR/SOR Analysis

The first four reports allow you to compare different home loan packages clearly in the form of charts and tables. You also have the option of including SIBOR/SOR charts for all the reports. After generating the report, you can save it in the system, email it or download it in pdf.

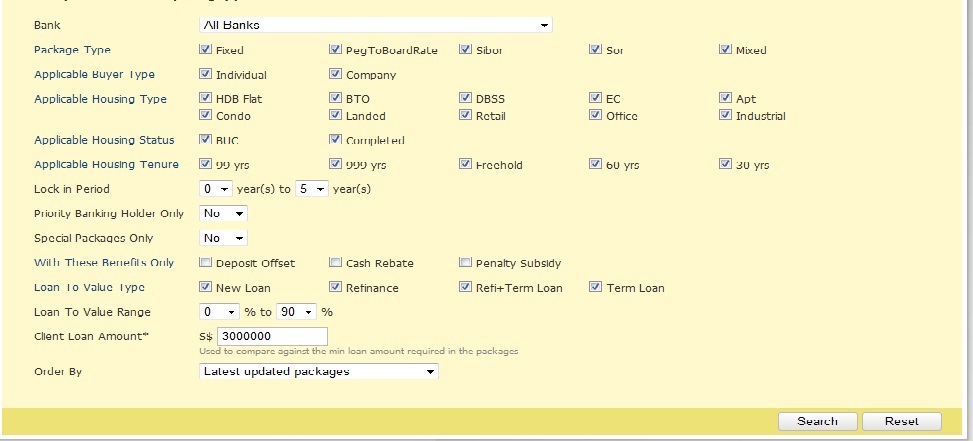

Our system carries home loan packages of all the major banks in Singapore. It allows you to select packages by Buyer Type, Housing Type, Housing Status, Housing Tenure, Lock-in Period, etc. For Housing Status, you can even select loans for completed property or BUC (Building under Construction). Thus you can dispense financing advice even to home buyers making purchases before construction is completed or investors looking to earn a profit from real estate flipping. An example of a loan package selection features is shown in Figure 1.

Figure 1

a. New Loan Interest Cost Analysis

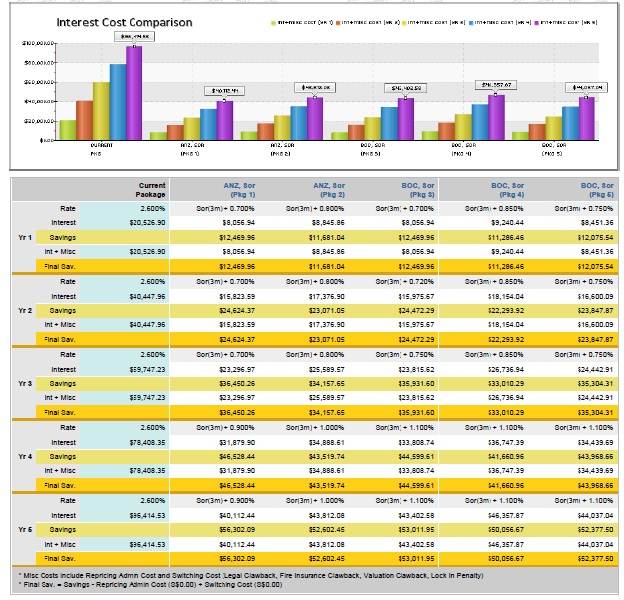

This report will help your clients make comparison of the interest and principal payments, for the first loan year up to the fifth, across different loan packages, up to a maximum of nine at a time. Figure 2 shows an example.

Figure 2

b. Refinance Savings Analysis

You can also help property owners who wish to refinance their current loans with a “Refinance Savings” report. The cost savings may empower them to make another property purchase, and you will be the agent they turn to in their property hunt.

In this report, the interest cost saving for switching from the current package (including BUC loans) to another is tabulated clearly, allowing you to compare up to eight different loan packages. As seen in Figure 3.

Figure 3

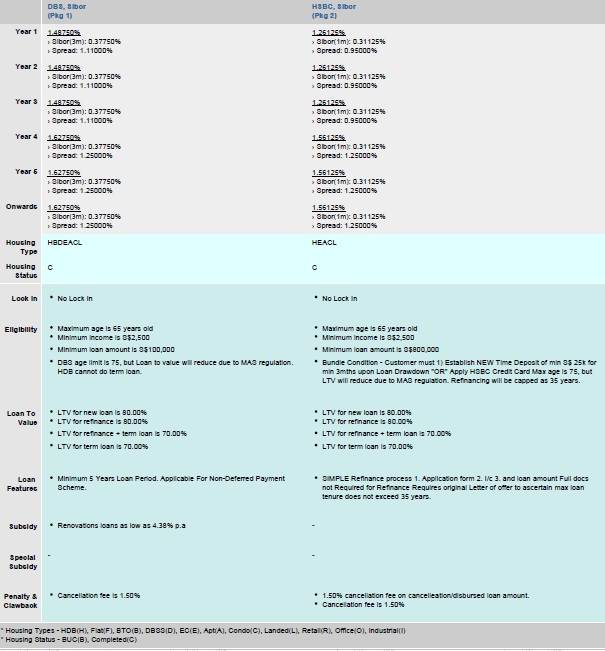

c. Loan Package Detail Sheet

Here, you can help your clients compare and contrast various loan packages through a table detailing the package features, such as eligibility, interest rate, the lock-in clawback, subsidy, loan-to-value ratio, etc. See Figure 4.

Figure 4

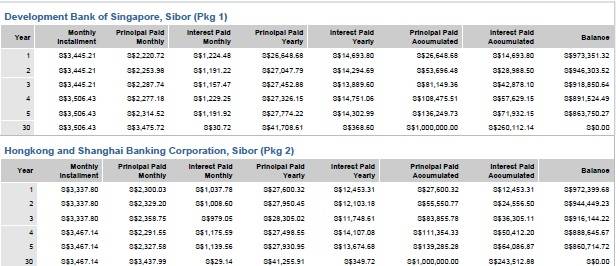

Amortization tables, for each package is also given, which show a detailed breakdown of the monthly and yearly principal, interest, balance for the first 5, 10, 15, 20 years or total duration of the loan. See Figure 5.

Figure 5

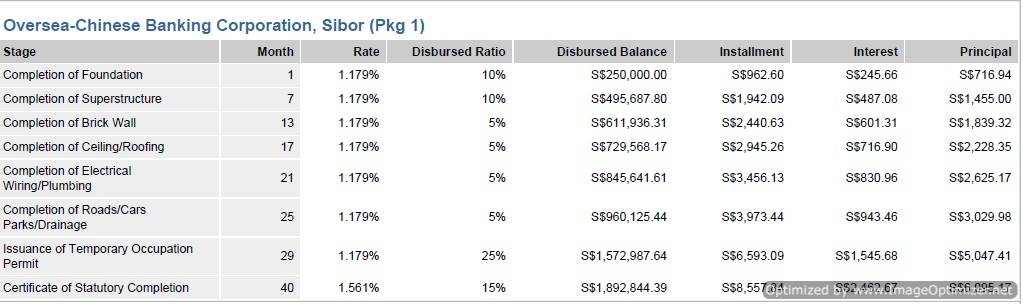

d. Progressive Repayment Detail Sheet

We also have a report devoted solely to BUC loans. Here, you can help clients to buy their dream home and secure financing for it, way before the property is ready.

This report tabulates the disbursed ratio, interest rate, etc. at each stage of the construction. See Figure 6.

Figure 6

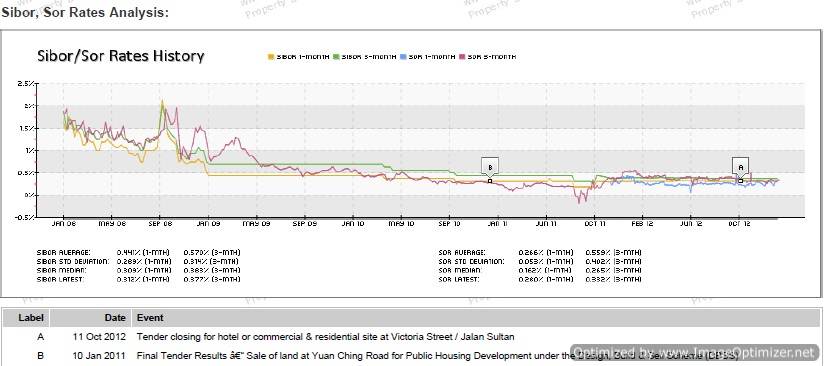

e. SIBOR/SOR Analysis

Finally, we have the 1-, 3-, 6- and 12-month SIBOR (SOR ) from July 1997 (2006). All the rates, along with labels for significant events, can be depicted beautifully in charts to allow you to identify trends at a glance. See Figure 7.

Figure 7

2. Forms

Stored in our system are 36 loan application forms for most of the financing institutions, this facilitates the loan application process.

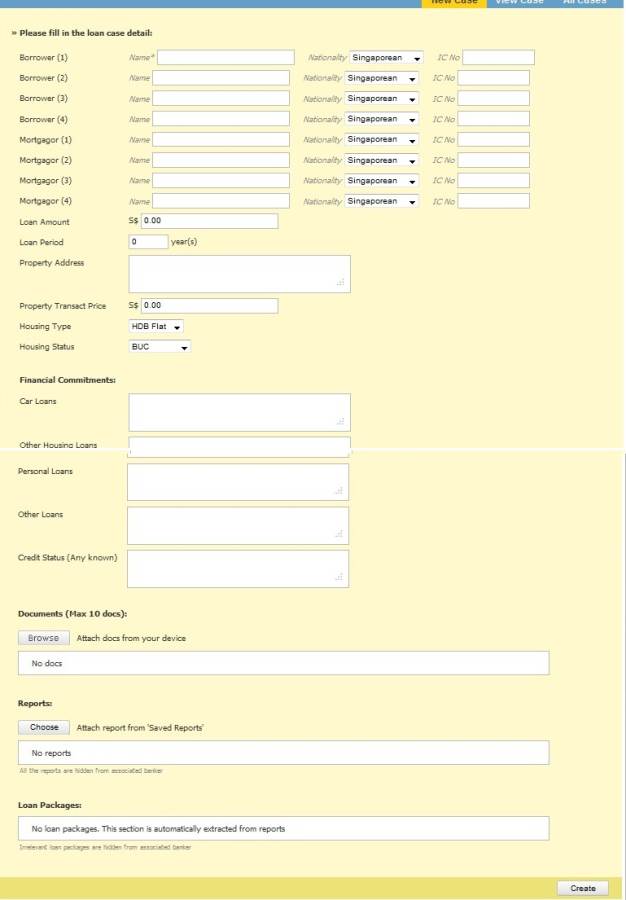

3. Loan Cases

Prefer an online application? You can make the loan submission directly to the financing institution via our system. All you have to do is to fill in an online form and upload your clients’ documents. As seen in Figure 8.

Figure 8

Not ready to submit? You can save the cases in our system and come back to it at a later time.

4. Calculators

Our system also provides 5 calculators to help you make all the necessary financial calculation for a housing mortgage loan.

a. Affordability Calculator

b. Mortgage Payment

c, Housing Payment

d. Investment

e. Interest Rate Sensitivity

5. Events

Finally, succinct summaries of financial events from 2007, which you can insert into any of the reports.

For advice on a new home loan.

For refinancing advice.

Download this article here.