Paul HO (iCompareLoan.com) 30th Nov 2016

A trump presidency caught many by surprise on the 8th Nov 2016. The market started to react, the effects can be seen in the Share Market, Forex markets as well as the bond markets and the Sibor and SOR has also reacted to it.

How will this impact Singapore’s Mortgage Loan market?

Why is the market reacting to a Trump presidency?

Trump made many statements and campaign promises during the election trail. The market is scrutinising his trade and economic policy stance to predict the direction of the economy. The market is made up of hedge funds, pension funds, Institutional investors, Unit trust funds and more. This constitutes what is generally regarded as “Smart money”.

Smart money tends to move their funds earlier in anticipation of certain funds movement or policy announcements and profit from being right about it.

What does the Market think about Trump’s economic and trade policies?

Trump has yet to take office, hence we will yet know what will become policy and what not. Nonetheless here is a simplified view of the impact on Trump’s presidency.

Infrastructure

Trump advocated large infrastructural spending to the tune of US$1 trillion dollars over a 10-year period. However this comes in the form of tax credits to infrastructure operator for a Build-Operate-Transfer model, hence the actual spending by the government is expected to be 15 – 25% of the actual announced figure. And when divided by a 10-year time frame, the spending is negligible. Hence large infrastructural spending is not the main cause for any potential future inflationary expectation as is only a drop in the ocean of a 18-19 Trillion US dollar economy.

Tax reduction & Increased Business activity

A large reduction in corporate tax rates as well as personal tax rates mean a potential tax shortfall. Businesses will flourish with lower taxes. This stimulus of business activity may not fully make up for the loss in tax revenues from tax reduction. Hence the US government will need to issue more bonds to raise funds to cover the deficit. Raising funds when the US deficit is already so large will mean creating inflation and having to pay a higher interest rate.

Higher levels of business activities and investments at a point when the US is near full employment at around 5%, is likely inflationary as it can drive up labour cost.

Repatriation of foreign earned monies by US corporations will pay a flat 10% tax. This will cause demand for US dollar.

Funds are Flowing to the US dollar

All the major currencies have depreciated against the US dollar in expectation of a stronger US dollar. This means a funds outflow from these currencies into US dollar.

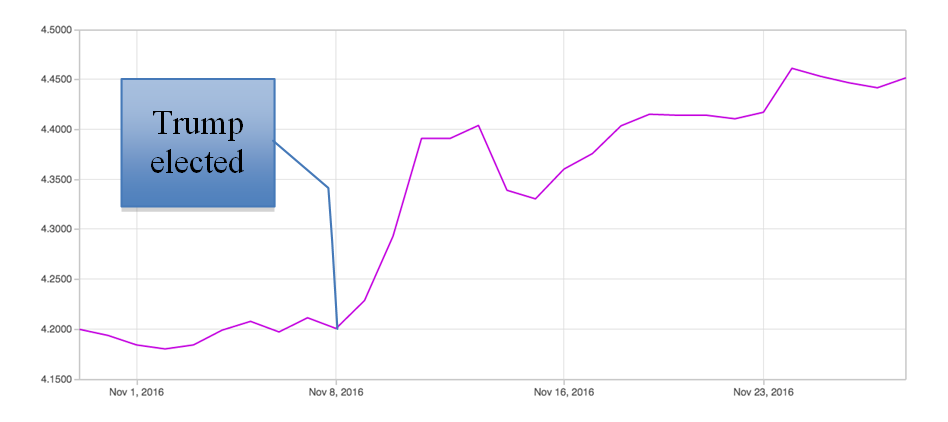

Chart 1: USD to MYR, Oanda

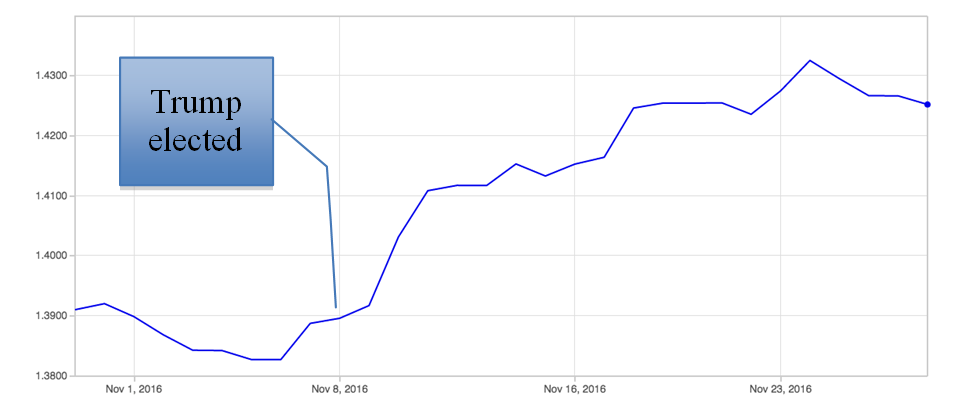

Chart 2: USD to SGD, Oanda

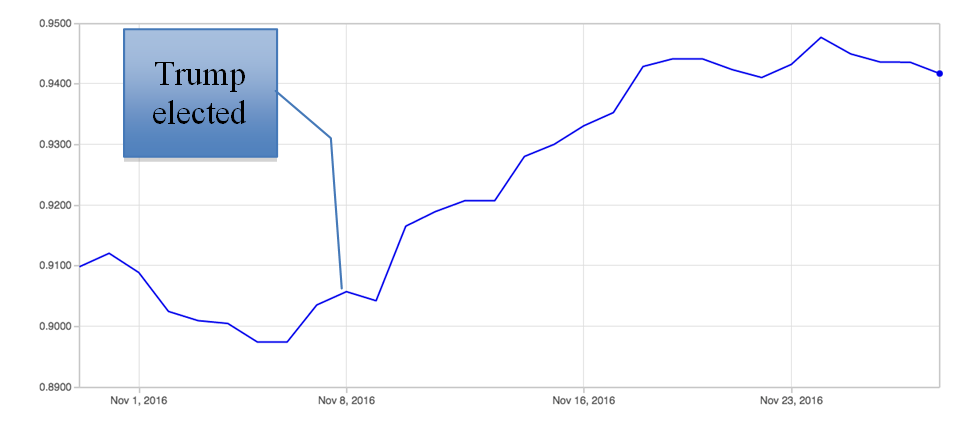

Chart 3: USD to CNY (Chinese Yuan), Oanda

Chart 4: USD to EUR, Oanda

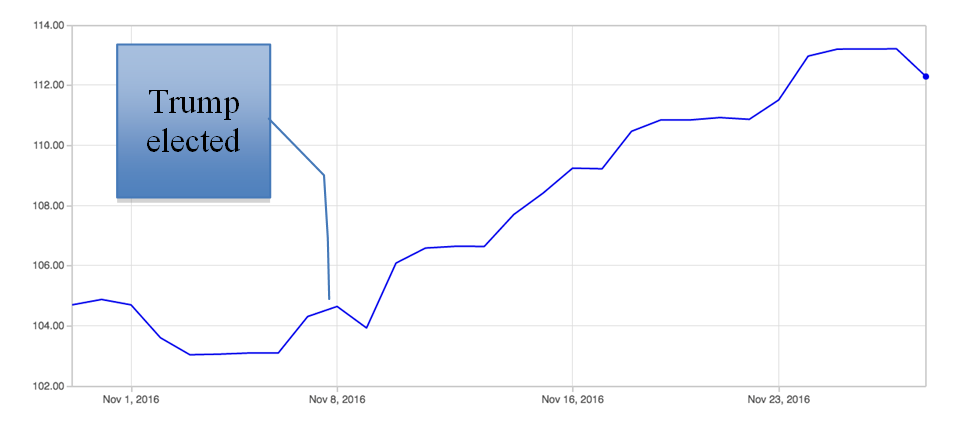

Chart 5: USD to Yen, Oanda

Bond Yields are rising – Indicating a Higher Interest Rate environment

More expected economic activity spurred by lower taxes, more infrastructure development, repatriation of funds to the US, trade barriers to bring more manufacturing and production back to the US all means a potential higher interest environment as there will be more demand for funds. As least this is what the market expects and have put their bets down, whether justified or not.

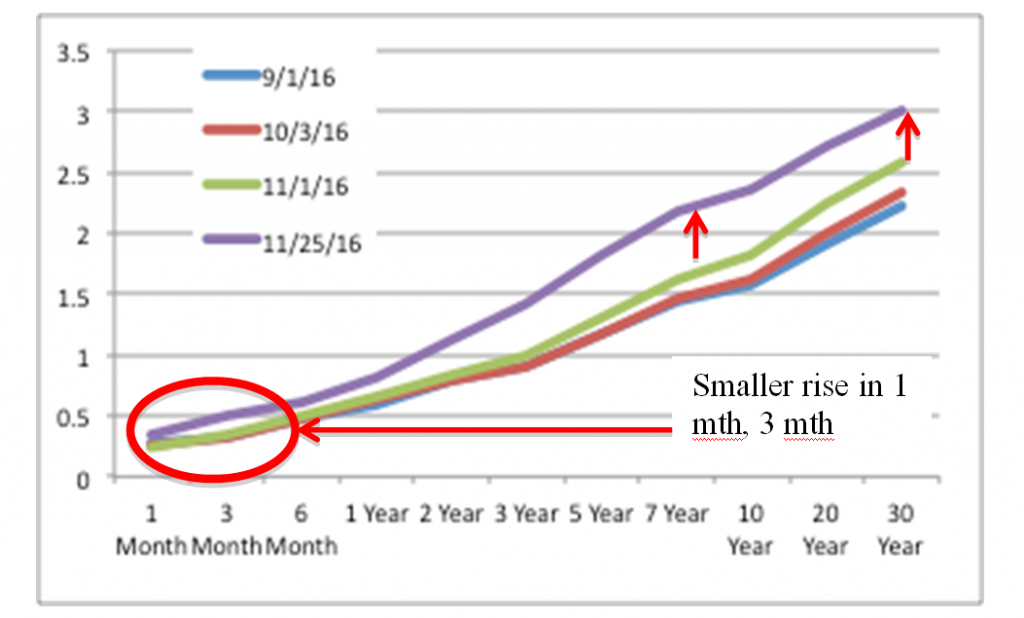

Chart 6: Treasury Bond Yield Curve, US Treasury, iCompareLoan.com

(Reference 1)

As can be seen, the yield curve on the 1st Nov 2016 is lower than that on the 25th Nov 2016. Trump’s was elected on the 8th Nov 2016. The yield curve has risen. The market thinks that there could be inflationary pressures in the years ahead and hence a possible higher interest rates.

Singapore Banks Raising Fixed Rate Home Loan

The Federal Open Market Committee (FOMC) will meet on the 13-14th Dec 2016. The market already expects the rate hikes from the Federal Reserve. It is not often that the market has reacted so strongly in anticipation.

If the US Federal Reserve raises interest rates, Singapore will have to follow suit as Sibor and US interest rates are closely correlated.

There are some banks that are still watching the FOMC meeting outcome and may not move rates for another 2 weeks.

In view of such circumstances, the time to refinance to a Fixed Rate mortgage package may be now so as to lock-in to lower rates and sit out the storm.

If rate hikes are confirmed, Singapore banks will likely remove their rates and replace these packages with higher rates.

REFERENCES

- Treasury Bond Yield Curve, US Treasury, www.iCompareLoan.com

www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldYear&year=2016