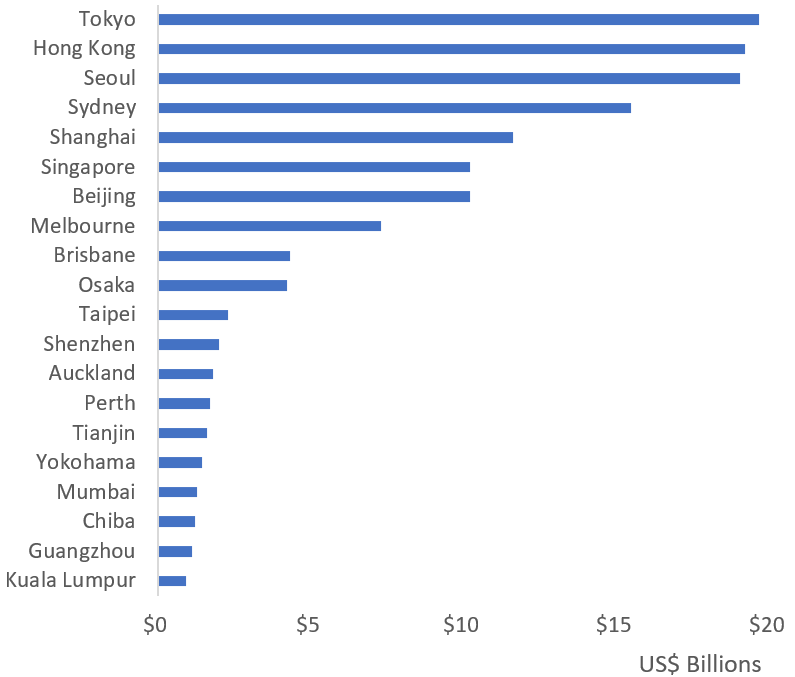

Cushman & Wakefiled’s real estate investment report places Singapore firmly at the 6th spot. The real estate investment report said that Asia Pacific is the biggest source of cross border capital for the fourth year running, led by Singapore and South Korea. The region also claims seven of the top 25 cities.

Tokyo has claimed the top spot as the highest-ranked market for real estate investment in Asia Pacific, according to Cushman & Wakefield’s ‘Winning in Growth Cities’ real estate investment report. Tokyo replaced Hong Kong, which saw a notable fall of 38% y-o-y.

Winning in Growth Cities’ is an annual real estate investment report examining global commercial real estate investment activity, assessing cities by their success at attracting capital. The report includes indexes showing the top cities for real estate investment; cross border investment; most attractive sectors; sources of international capital; and regional versus global allocation of capital.

The real estate investment report also features a section examining the impact of climate change on the real estate investment market, and the top cities for investment excludes development.

Asia Pacific claimed seven of the top 25 cities compared to five in Europe. As with North America, a number of these destinations were in growth mode and the top 25 overall again outperformed, with volumes rising 5% and their market share increasing from 53% to 56% as investors focused on the biggest and most liquid markets.

Beijing was the fastest growing major Asian city, with volumes doubling, resulting in the city moving up 11 places in the ranking to number 25.

Globally, New York strengthened its position as the number one global city for real estate investment, growing 20% year-on-year to take the top spot in the index for the eighth year running. Los Angeles took second spot, while San Francisco climbed three places to third – in the process overtaking London in fourth and Paris in fifth.

Francis Li, International Director, Head of Capital Markets, Greater China at Cushman & Wakefield, commented: “Asia Pacific remains a global growth leader and investors will continue to channel funds here to ride the region’s long-term structural dynamics. While investors will turn more selective in a late cycle environment, gateway cities with stable fundamentals will continue to lead investments. We believe the region’s diverse economic backdrop and demographically driven growth markets in India and Southeast Asia to remain compelling prospects across cycles; the current round of deleveraging in China have also unlocked opportunities across its cities.

“Tokyo’s rise up the rankings ahead of Hong Kong comes as no surprise due to its strong fundamentals, fed by a tourism boom and investment momentum in the run up to the Olympics. The city’s real estate is in an investment sweet spot: strong pre-leasing commitments and robust demand have whittled office vacancies to record lows and the lower-for-longer environment continues to fuel investments by J-REITs and foreign funds.”

Cross Border Investment

The sources of capital crossing borders into real estate grew more diverse in the past 12 months. For the fourth year running Asia Pacific – led by Singapore and South Korea – remained the biggest source region overall despite outbound volumes dropping nearly 13% and its market share easing to 38% overall. Singapore investors were the most prolific, ranking 4th globally, followed by South Korea, ranking 7th after a 50% increase in cross-border spending over the year. Japanese capital also continued to stir, rising 61%, ranking as the 13th largest source of international capital. Last year’s regional leaders, China and Hong Kong, both fell back into 11th and 8th place respectively

Investment Outlook

In Asia Pacific, growth may be set to slow further next year whether looking at consumption or employment figures, but overall will remain attractive on a global basis and more foreign capital is likely to flow towards the region. Occupier markets are mixed, with some seeing increased supply and others slowing demand, but the market offers a wide range of cities as investment options and sector-by-sector there are attractive areas for short- and medium-term returns. These may be in still demand-driven parts of the CBD office market, the largely under supplied logistics sector, or demographically driven residential markets.

Carlo Barel di Sant’Albano, Head of Global Capital Markets at Cushman & Wakefield, stated:

“Ongoing headwinds, such as geopolitical unrest, means economic growth will remain in doubt in the months ahead, but it also means quantitative easing and negative interest rates are back on the agenda. As a result, property yields will be seen to offer better value and could fall into 2020 once investors have more faith that the cycle still has some life in it. However, buyers will have to find additional opportunities if they are to allocate capital, with a particular focus on alternatives and residential/multifamily likely to be seen.”

David Hutchings, Head of Investment Strategy, EMEA Capital Markets at Cushman & Wakefield and author of the report, added: “What differentiates markets going forward will be less about growth – that will be down – but more about relative financing costs, the timing and direction of structural market shifts and, as ever, finding stock in a global market with relatively limited distress.

“We expect more M&A activity as a result but also more pressure on investors to diversity to both gain exposure to the right cities and to reduce risk. Residential will be the asset class to watch and will continue to rise as the professionally managed rental sector continues to grow and mature.

“The winning markets of 2020 will be the biggest and best across gateway and challenger cities, but increasingly those with the right mix of strong innovative governance on the one hand and appeal to talent on the other.”